Sallie Mae 2007 Annual Report Download - page 33

Download and view the complete annual report

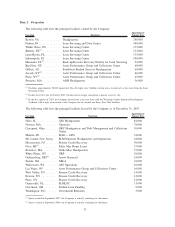

Please find page 33 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.None of the Company’s facilities is encumbered by a mortgage. The Company believes that its

headquarters, loan servicing centers data center, back-up facility and data management and collections centers

are generally adequate to meet its long-term student loan and business goals. The Company’s principal office

is currently in owned space at 12061 Bluemont Way, Reston, Virginia, 20190.

Item 3. Legal Proceedings

On April 6, 2007, the Company was served with a putative class action suit by several borrowers in

federal court in the Central District of California (Anne Chae et. al., v. SLM Corporation et. al.). The

complaint, which was amended on April 12, 2007, alleges violations of California Business & Professions

Code 17200, breach of contract, breach of covenant of good faith and fair dealing, violation of consumer legal

remedies act and unjust enrichment. The complaint challenges the Company’s FFELP billing practices as they

relate to use of the simple daily interest method for calculating interest. On June 19, 2007, the Company filed

the Company’s Motion to Dismiss the amended complaint. On September 14, 2007, the court entered an order

denying Sallie Mae’s Motion to Dismiss. The court did not comment on the merits of the allegations or the

plaintiffs’ case but instead merely determined that the allegations stated a claim sufficient under the Federal

Rules of Civil Procedure. The Company filed an answer on September 28, 2007 and on November 26, 2007

filed a motion for judgment on the pleadings. On January 4, 2008, the court entered an order denying the

Company’s motion without ruling on the merits of plaintiffs’ claims. On September 17, 2007, the court entered

a scheduling order that set July 8, 2008, as the start date for the trial. Discovery has commenced and is

scheduled to continue through May 30, 2008. The Company believes these allegations lack merit and will

continue to vigorously defend itself in this case, and notes that ED and the applicable guarantor of plaintiffs’

loans have confirmed that simple daily interest is the proper method for calculating interest under the FFELP.

On September 11, 2007, the Office of the Inspector General (“OIG”), of ED, confirmed that they planned

to conduct an audit to determine if the Company billed for special allowance payments, under the 9.5 percent

floor calculation, in compliance with the Higher Education Act, regulations and guidance issued by ED. The

audit covers the period from 2003 through 2006, and is currently confined to the Company’s Nellie Mae

subsidiaries. We ceased billing under the 9.5 percent floor calculation at the end of 2006. We believe that our

billing practices were consistent with longstanding ED guidance, but there can be no assurance that the OIG

will not advocate an interpretation that differs from the ED’s previous guidance. The OIG has audited other

industry participants who billed for 9.5 percent SAP and in certain cases ED has disagreed with the OIG’s

recommendation.

In August 2005, Rhonda Salmeron (the “Plaintiff”) filed a qui tam whistleblower case under the False

Claims Act against collection company Enterprise Recovery Systems, Inc., or ERS. In the fall of 2006, Plaintiff

amended her complaint and added USA Funds, as a defendant. On September 17, 2007, Plaintiff filed a second

amended complaint adding USA Group Guarantee Services Inc., USA Servicing Corp., Sallie Mae Servicing

L.P. and Scott J. Nicholson, an officer and employee of ERS as defendants. On February 5, 2008, Plaintiff filed

a Third Amended Complaint. Plaintiff alleges that the various defendants submitted false claims and/or created

false records to support claims in connection with collection activity on federally guaranteed student loans. The

allegations against USA Funds and Sallie Mae are that they allowed the creation of false records and the

submission of false claims by failing to take adequate measures in connection with audits of ERS. At this time,

we intend to vigorously defend the case. Plaintiff claims that the U.S. government has been damaged in an

amount greater than $12 million. The False Claims Act provides for the award of treble damages and $5,500 to

$11,000 per false claim in successful qui tam lawsuits. We intend to vigorously defend this action.

On December 17, 2007, Sasha Rodriguez and Cathelyn Gregoire filed a putative class action claim on

behalf of themselves and persons similarly situated against us in the United States District Court for the

District of Connecticut, alleging an intentional violation of civil rights laws (42 U.S.C. § 1981, 1982), the

Equal Credit Opportunity Act and the Truth in Lending Act. Plaintiffs allege that we engaged in underwriting

practices on private loans which resulted, among other things, in certain applicants being directed into

substandard and more expensive student loans on the basis of race. No amount in controversy is stated in the

complaint. We intend to vigorously defend this action.

32