Sallie Mae 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

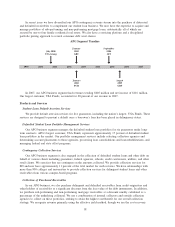

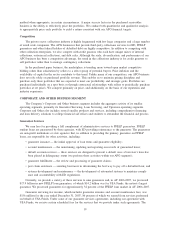

table provides a timeline of strategic acquisitions that have played a major role in the growth of our Lending

business.

Lending Segment Timeline

July

1999

Nellie

Mae

July 2000

SLFR

1999 2000 2001 2002 2003 2004 2005 20072006

November

2003

AMS

December

2004

SLFA

July 2000

USA Group

October

2004

Southwest

Financing

Prior to the announcement of the Merger, the Company funded its loan originations primarily with a

combination of term asset-backed securitizations and unsecured debt. Upon the announcement of the Merger

on April 17, 2007, credit spreads on our unsecured debt widened considerably, significantly increasing our

cost of accessing the unsecured debt markets. As a result, in the near term, we expect to fund our operations

primarily through the issuance of student loan asset-backed securities and borrowings under secured student

loan financing facilities, as further described below. We historically have been a regular issuer of term asset-

backed securities in the domestic and international capital markets. (See also “MANAGEMENT’S DISCUS-

SION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS — LIQUIDITY

AND CAPITAL RESOURCES.”) For the reasons described above, securitization is currently and is likely to

continue to be our principal source of cost-effective financing. We expect approximately 90 percent or more of

our funding needs in 2008 will be satisfied through asset-backed securitizations.

The Company has engaged J.P. Morgan Securities, Inc. (“JPMorgan”) and Banc of America Securities,

LLC (“BAS”) as Lead Arrangers and Joint Bookrunners along with Barclays Capital, The Royal Bank of

Scotland, plc and Deutsche Bank Securities, Inc. as Co-Lead Arrangers and Credit Suisse, New York Branch,

as Arranger to underwrite and arrange up to $28.0 billion of secured FFELP loan facilities and a $7.0 billion

secured private credit student loans facility (together, the “Facilities”).

As of February 28, 2008, we anticipate closing on $23.4 billion of FFELP student loan ABCP conduit

facilities and $5.9 billion of Private Education Loan ABCP conduit facilities on February 29, 2008, or as soon

as practical thereafter. Also on that date, we anticipate closing on an additional $2.0 billion secured FFELP

loan facility. In addition, we anticipate closing on an additional $2.5 billion of student loan ABCP conduit

facilities by mid March 2008. The new $33.8 billion of financing facilities we expect to close on, which may

ultimately be increased to up to $35 billion in aggregate, will replace our $30 billion Interim ABCP Facility

and $6 billion ABCP facility. The initial term of each of the new facilities will be 364 days. These new

facilities will provide funding for certain of our FFELP loans and Private Education Loans until such time as

these loans are refinanced in the term ABS markets. In the event amounts outstanding under the Interim ABCP

Facility are not repaid by the Company in full, the Interim ABCP Facility will terminate on April 24, 2008.

In connection with our financing programs, we undertake regular investor development efforts intended to

continually expand and diversify our pool of investors.

One of our major objectives when financing our business is to minimize interest rate risk by matching the

interest rate and term characteristics of our Managed assets with our Managed liabilities, generally on a pooled

16