Sallie Mae 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The $28 million increase in contingency fee revenue for the year ended December 31, 2006 over 2005

can be primarily attributed to a change in the federal regulations governing the rehabilitation loan policy along

with the growth in guaranty agency collections. Under this change, the number of payments to qualify for a

rehabilitated loan was reduced to nine months from twelve months, so all loans with nine to eleven

consecutive payments at the time of change immediately qualified as a rehabilitated loan.

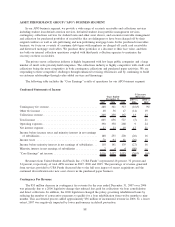

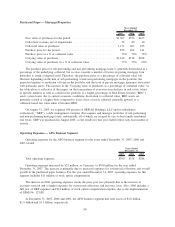

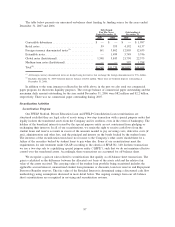

Contingency Inventory

The following table presents the outstanding inventory of receivables serviced through our APG business.

These assets are not on our balance sheet.

2007 2006 2005

Years Ended

December 31,

Contingency:

Student loans ......................................... $8,195 $6,971 $7,205

Other ............................................... 1,509 1,667 2,178

Total.................................................. $9,704 $8,638 $9,383

Purchased Paper

The consistent increase in collections revenue for the years ended December 31, 2005 to 2007 was

primarily due to the growth in purchased paper asset balances, resulting in an increase in yield income.

Declines in real estate values and the weakening U.S. economy as well as lengthening the assumed lifetime

collection period have resulted in write-downs related to the mortgage purchased paper portfolio. Specifically,

the mortgage purchased paper portfolio had impairments of $25 million and $8 million for the years ended

December 31, 2007 and 2006, respectively. General economic uncertainty has also resulted in lengthening the

assumed lifetime collection period related to our non-mortgage, purchased paper portfolio.

Our purchased paper collection business is comprised of the purchase of delinquent and charged-off

consumer receivables, primarily credit cards and the purchase of distressed mortgage receivables. Since these

businesses operate in different segments of the marketplace with the primary distinguishing factor being the

existence of collateral for the mortgage receivable, we have broken out their results separately in the

presentations below.

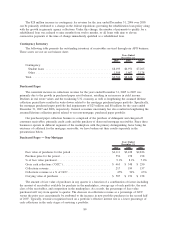

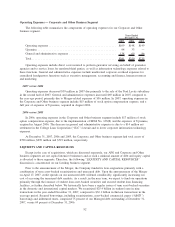

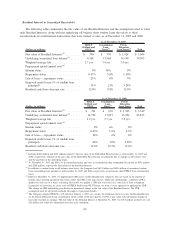

Purchased Paper — Non-Mortgage

2007 2006 2005

Years Ended

December 31,

Face value of purchases for the period ......................... $6,111 $3,438 $2,826

Purchase price for the period ................................ 556 278 198

% of face value purchased .................................. 9.1% 8.1% 7.0%

Gross cash collections (“GCC”) .............................. $ 463 $ 348 $ 250

Collections revenue ....................................... 217 199 157

Collections revenue as a % of GCC ........................... 47% 56% 63%

Carrying value of purchases ................................ $ 587 $ 274 $ 158

The amount of face value of purchases in any quarter is a function of a combination of factors including

the amount of receivables available for purchase in the marketplace, average age of each portfolio, the asset

class of the receivables, and competition in the marketplace. As a result, the percentage of face value

purchased will vary from quarter to quarter. The decrease in collections revenue as a percentage of GCC

versus the prior year can primarily be attributed to the increase in new portfolio purchases in the second half

of 2007. Typically, revenue recognition based on a portfolio’s effective interest rate is a lower percentage of

cash collections in the early stages of servicing a portfolio.

89