Sallie Mae 2007 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

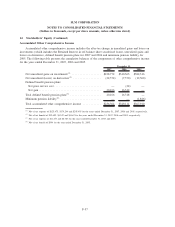

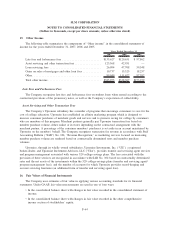

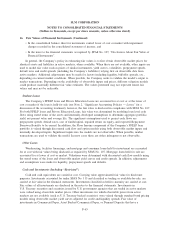

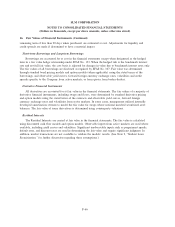

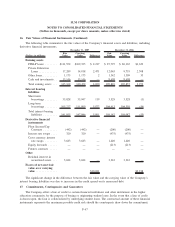

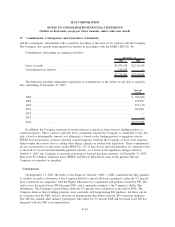

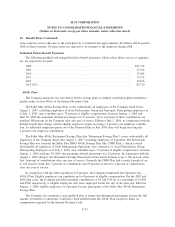

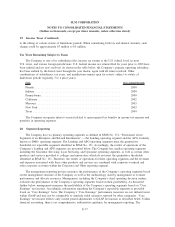

16. Fair Values of Financial Instruments (Continued)

The following table summarizes the fair values of the Company’s financial assets and liabilities, including

derivative financial instruments.

(Dollars in millions)

Fair

Value

Carrying

Value Difference

Fair

Value

Carrying

Value Difference

December 31, 2007 December 31, 2006

Earning assets

FFELP loans ........ $111,552 $109,335 $ 2,217 $ 87,797 $ 86,165 $1,632

Private Education

Loans ............ 17,289 14,818 2,471 12,063 9,755 2,308

Other loans.......... 1,175 1,173 2 1,342 1,309 33

Cash and investments . . 15,146 15,146 — 8,608 8,608 —

Total earning assets . . . 145,162 140,472 4,690 109,810 105,837 3,973

Interest bearing

liabilities

Short-term

borrowings ........ 35,828 35,947 119 3,529 3,528 (1)

Long-term

borrowings ........ 105,227 111,099 5,872 104,613 104,559 (54)

Total interest bearing

liabilities ......... 141,055 147,046 5,991 108,142 108,087 (55)

Derivative financial

instruments

Floor Income/Cap

Contracts ......... (442) (442) — (200) (200) —

Interest rate swaps .... 320 320 — (475) (475) —

Cross currency interest

rate swaps......... 3,643 3,643 — 1,440 1,440 —

Equity forwards ...... — — — (213) (213) —

Futures contracts ..... — — — — — —

Other

Residual interest in

securitized assets.... 3,044 3,044 — 3,342 3,342 —

Excess of net asset fair

value over carrying

value .............. $10,681 $3,918

The significant change in the difference between the fair value and the carrying value of the Company’s

interest bearing liabilities was due to increases in the credit spread on its unsecured debt.

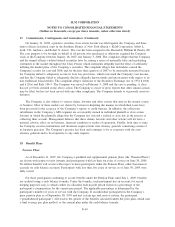

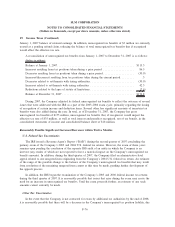

17. Commitments, Contingencies and Guarantees

The Company offers a line of credit to certain financial institutions and other institutions in the higher

education community for the purpose of buying or originating student loans. In the event that a line of credit

is drawn upon, the loan is collateralized by underlying student loans. The contractual amount of these financial

instruments represents the maximum possible credit risk should the counterparty draw down the commitment,

F-67

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)