Sallie Mae 2007 Annual Report Download - page 46

Download and view the complete annual report

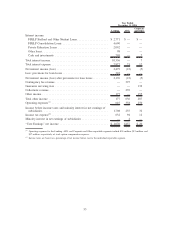

Please find page 46 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Year Ended December 31, 2007 Compared to Year Ended December 31, 2006

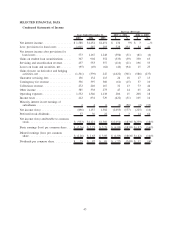

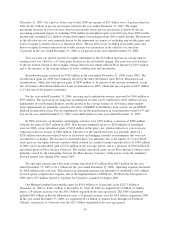

For the year ended December 31, 2007, our net loss was $896 million, or $2.26 diluted loss per share,

compared to net income of $1.2 billion, or $2.63 diluted earnings per share, in the year-ago period. The

effective tax rate in those periods was (86) percent and 42 percent, respectively. The movement in the effective

tax rate was primarily driven by the permanent tax impact of excluding non-taxable gains and losses on equity

forward contracts which are marked to market through earnings under the FASB’s SFAS No. 133. Pre-tax

income decreased by $2.5 billion versus the year ended December 31, 2006 primarily due to a $1.0 billion

increase in net losses on derivative and hedging activities, which was mostly comprised of losses on our equity

forward contracts. Losses on derivative and hedging activities were $1.4 billion for the year ended

December 31, 2007 compared to $339 million for the year ended December 31, 2006.

Pre-tax income for the year ended December 31, 2007 also decreased versus the year ended December 31,

2006 due to a $535 million decrease in gains on student loan securitizations. The securitization gain in 2007

was the result of one Private Education Loan securitization that had a pre-tax gain of $367 million or

18.4 percent of the amount securitized. In the year-ago period, there were three Private Education Loan

securitizations that had total pre-tax gains of $830 million or 16.3 percent of the amount securitized. For the

year ended December 31, 2007, servicing and securitization income was $437 million, a $116 million decrease

from the year ended December 31, 2006. This decrease was primarily due to a $97 million increase in

impairment losses which was mainly the result of FFELP Stafford Consolidation Loan activity exceeding

expectations, increased Private Education Consolidation Loan activity, increased Private Education Loan

expected default activity, and an increase in the discount rate used to value the Private Education Loan

Residual Interests (see “LIQUIDITY AND CAPITAL RESOURCES — Residual Interest in Securitized

Receivables”).

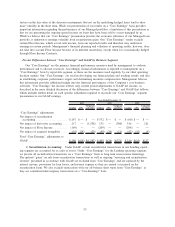

Net interest income after provisions for loan losses decreased by $594 million versus the year ended

December 31, 2006. The decrease was due to the year-over-year increase in the provisions for loan losses of

$728 million, which offset the year-over-year $134 million increase in net interest income. The increase in net

interest income was primarily due to an increase of $30.8 billion in the average balance of on-balance sheet

interest earning assets offset by a decrease in the student loan spread, including the impact of Wholesale

Consolidation Loans (see “Student Loan Spread — Student Loan Spread Analysis — On-Balance Sheet”). The

increase in provisions for loan losses relates to higher provision amounts for Private Education Loans, FFELP

loans, and mortgage loans primarily due to a weakening U.S. economy (see “LENDING BUSINESS

SEGMENT — Activity in the Allowance for Private Education Loan Losses; and — Total Provisions for Loan

Losses”).

Fee and other income and collections revenue increased $42 million from $1.11 billion for the year ended

December 31, 2006 to $1.15 billion for the year ended December 31, 2007. Operating expenses increased by

$206 million year-over-year. This increase in operating expenses was primarily due to $56 million in Merger-

related expenses and $23 million in severance costs incurred in 2007. As part of the Company’s cost reduction

efforts, these severance costs were related to the elimination of approximately 350 positions (representing three

percent of the overall employee population) across all areas of the Company. Operating expenses in 2007 also

included $93 million related to a full year of expenses for Upromise compared to $33 million incurred in 2006

subsequent to the August 2006 acquisition of this subsidiary.

Our Managed student loan portfolio grew by $21.5 billion (or 15 percent), from $142.1 billion at

December 31, 2006 to $163.6 billion at December 31, 2007. In 2007 we acquired $40.3 billion of student

loans, an 8 percent increase over the $37.4 billion acquired in the year-ago period. The 2007 acquisitions

included $9.3 billion in Private Education Loans, an 11 percent increase over the $8.4 billion acquired in

2006. In the year ended December 31, 2007, we originated $25.5 billion of student loans through our Preferred

Channel, an increase of 9 percent over the $23.4 billion originated in the year-ago period.

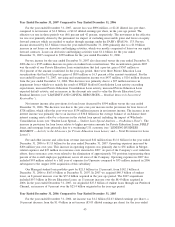

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

For the year ended December 31, 2006, net income was $1.2 billion ($2.63 diluted earnings per share), a

16 percent decrease from the $1.4 billion in net income ($3.05 diluted earnings per share) for the year ended

45