Sallie Mae 2007 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

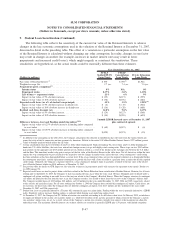

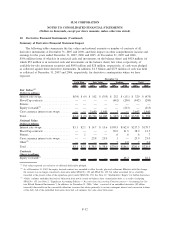

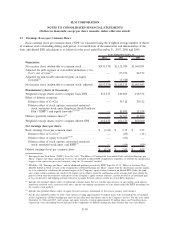

9. Student Loan Securitization (Continued)

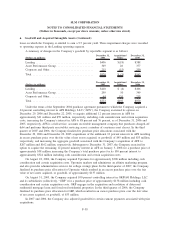

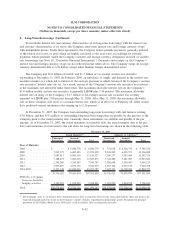

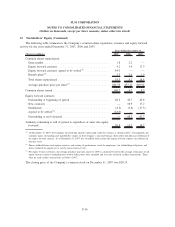

The table below shows the Company’s off-balance sheet Private Education Loan delinquency trends as of

December 31, 2007, 2006 and 2005.

(Dollars in millions) Balance % Balance % Balance %

December 31,

2007

December 31,

2006

December 31,

2005

Off-Balance Sheet Private Education Loan Delinquencies

Loans in-school/grace/deferment

(1)

............... $ 4,963 $ 5,608 $3,679

Loans in forbearance

(2)

........................ 1,417 822 614

Loans in repayment and percentage of each status:

Loans current ............................. 7,403 94.7% 6,419 94.5% 4,446 95.6%

Loans delinquent 31-60 days

(3)

................ 202 2.6 222 3.3 136 2.9

Loans delinquent 61-90 days .................. 84 1.1 60 .9 35 .7

Loans delinquent greater than 90 days ........... 130 1.6 91 1.3 36 .8

Total off-balance sheet Private Education Loans in

repayment .............................. 7,819 100% 6,792 100% 4,653 100%

Total off-balance sheet Private Education Loans,

gross ................................... $14,199 $13,222 $8,946

(1)

Loans for borrowers who still may be attending school or engaging in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2)

Loans for borrowers who have requested extension of grace period generally during employment transition or who have tempo-

rarily ceased making full payments due to hardship or other factors, consistent with the established loan program servicing poli-

cies and procedures.

(3)

The period of delinquency is based on the number of days scheduled payments are contractually past due.

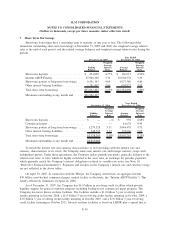

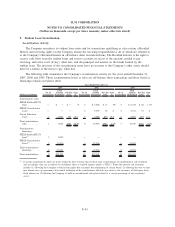

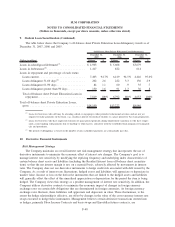

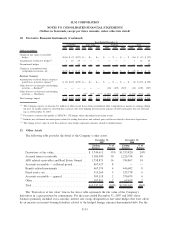

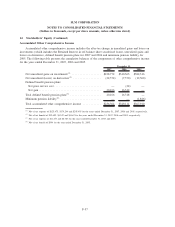

10. Derivative Financial Instruments

Risk Management Strategy

The Company maintains an overall interest rate risk management strategy that incorporates the use of

derivative instruments to minimize the economic effect of interest rate changes. The Company’s goal is to

manage interest rate sensitivity by modifying the repricing frequency and underlying index characteristics of

certain balance sheet assets and liabilities (including the Residual Interest from off-balance sheet securitiza-

tions) so that the net interest margin is not, on a material basis, adversely affected by movements in interest

rates. The Company does not use derivative instruments to hedge credit risk associated with debt issued by the

Company. As a result of interest rate fluctuations, hedged assets and liabilities will appreciate or depreciate in

market value. Income or loss on the derivative instruments that are linked to the hedged assets and liabilities

will generally offset the effect of this unrealized appreciation or depreciation for the period the item is being

hedged. The Company views this strategy as a prudent management of interest rate sensitivity. In addition, the

Company utilizes derivative contracts to minimize the economic impact of changes in foreign currency

exchange rates on certain debt obligations that are denominated in foreign currencies. As foreign currency

exchange rates fluctuate, these liabilities will appreciate and depreciate in value. These fluctuations, to the

extent the hedge relationship is effective, are offset by changes in the value of the cross-currency interest rate

swaps executed to hedge these instruments. Management believes certain derivative transactions entered into

as hedges, primarily Floor Income Contracts and basis swaps and Eurodollar futures contracts, are

F-48

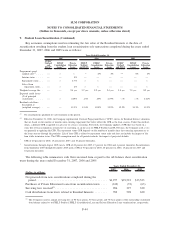

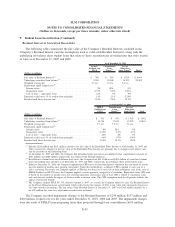

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)