Sallie Mae 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

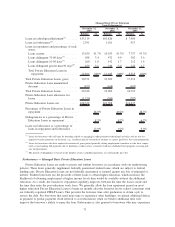

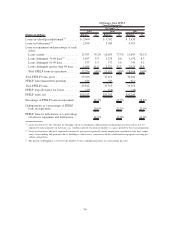

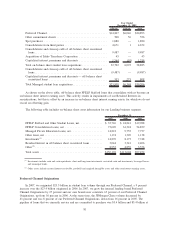

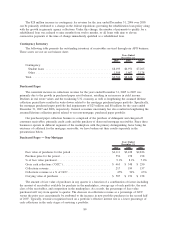

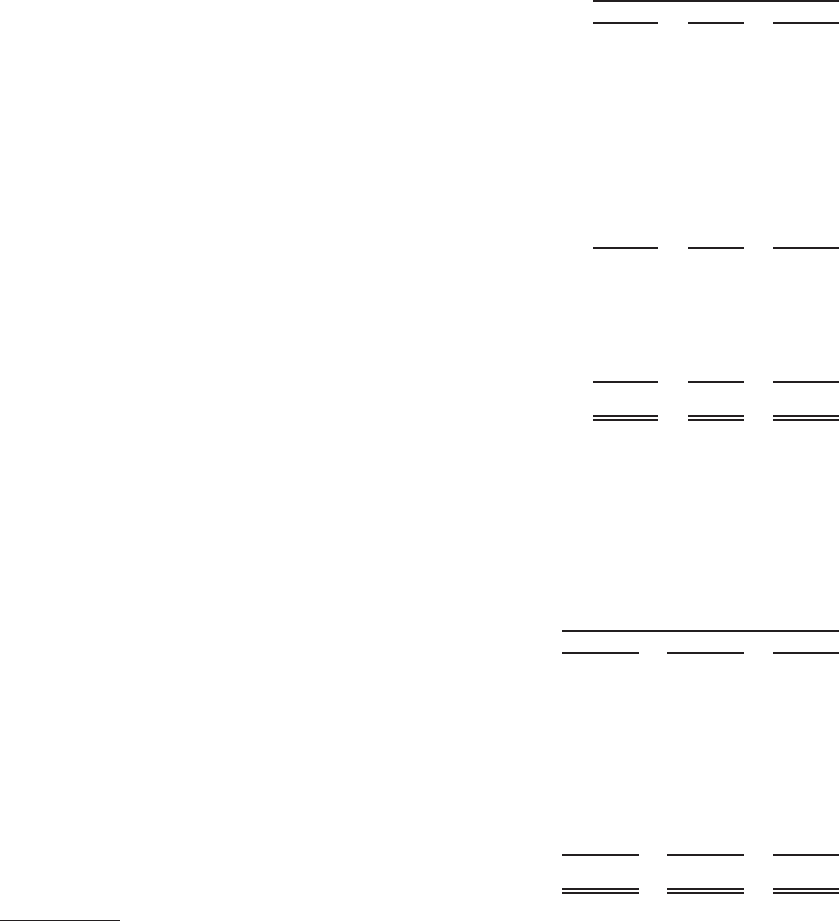

FFELP Private Total

Year Ended

December 31, 2005

Preferred Channel ...................................... $14,847 $6,046 $20,893

Other commitment clients ................................ 500 56 556

Spot purchases ........................................ 1,880 — 1,880

Consolidations from third parties ........................... 4,671 1 4,672

Consolidations and clean-up calls of off-balance sheet securitized

loans .............................................. 9,487 — 9,487

Acquisition of Idaho Transferee Corporation .................. 43 — 43

Capitalized interest, premiums and discounts .................. 1,364 (10) 1,354

Total on-balance sheet student loan acquisitions ................ 32,792 6,093 38,885

Consolidations and clean-up calls of off-balance sheet securitized

loans .............................................. (9,487) — (9,487)

Capitalized interest, premiums and discounts — off-balance sheet

securitized loans ..................................... 533 275 808

Total Managed student loan acquisitions...................... $23,838 $6,368 $30,206

As shown on the above table, off-balance sheet FFELP Stafford loans that consolidate with us become an

on-balance sheet interest earning asset. This activity results in impairments of our Retained Interests in

securitizations, but this is offset by an increase in on-balance sheet interest earning assets, for which we do not

record an offsetting gain.

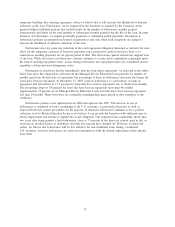

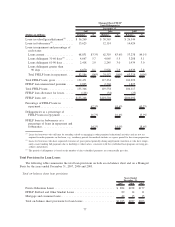

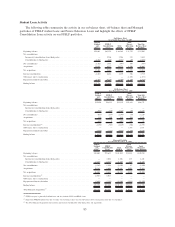

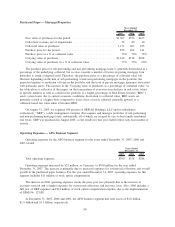

The following table includes on-balance sheet asset information for our Lending business segment.

2007 2006 2005

December 31,

FFELP Stafford and Other Student Loans, net ............... $ 35,726 $ 24,841 $19,988

FFELP Consolidation Loans, net ........................ 73,609 61,324 54,859

Managed Private Education Loans, net . ................... 14,818 9,755 7,757

Other loans, net ..................................... 1,174 1,309 1,138

Investments

(1)

...................................... 14,870 8,175 7,748

Residual Interest in off-balance sheet securitized loans ........ 3,044 3,341 2,406

Other

(2)

........................................... 8,953 4,859 3,576

Total assets ........................................ $152,194 $113,604 $97,472

(1)

Investments include cash and cash equivalents, short and long-term investments, restricted cash and investments, leveraged leases,

and municipal bonds.

(2)

Other assets include accrued interest receivable, goodwill and acquired intangible assets and other non-interest earning assets.

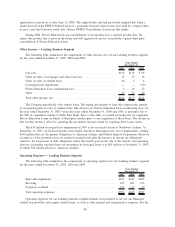

Preferred Channel Originations

In 2007, we originated $25.5 billion in student loan volume through our Preferred Channel, a 9 percent

increase over the $23.4 billion originated in 2006. In 2007, we grew the internal lending brand Preferred

Channel Originations by 27 percent and our own brands now constitute 65 percent of our Preferred Channel

Originations, up from 56 percent in 2006. At the same time, the JPMorgan Chase volume decreased by

41 percent and was 8 percent of our Preferred Channel Originations, down from 16 percent in 2005. The

pipeline of loans that we currently service and are committed to purchase was $5.4 billion and $5.4 billion at

81