Sallie Mae 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidation activity affects each estimate differently depending on whether the original loans being

consolidated were on-balance sheet or off-balance sheet and whether the resulting consolidation is retained by

us or consolidated with a third party. When we consolidate a loan that was in our portfolio, the term of that

loan is generally extended and the term of the amortization of associated student loan premiums and discounts

is likewise extended to match the new term of the loan. In that process, the unamortized premium balance

must be adjusted to reflect the new expected term of the consolidated loan as if it had been in place from

inception.

The estimate of the CPR also affects the estimate of the average life of securitized trusts and therefore

affects the valuation of the Residual Interest. Prepayments shorten the average life of the trust, and if all other

factors remain equal, will reduce the value of the Residual Interest, the securitization gain on sale and the

effective yield used to recognize interest income. Prepayments on student loans in our securitized trusts are

significantly impacted by the rate at which securitized loans are consolidated. When a loan is consolidated

from the trust either by us or a third party, the loan is treated as a prepayment. In cases where the loan is

consolidated by us, it will be recorded as an on-balance sheet asset. We discuss the effects of changes in our

CPR estimates in “LIQUIDITY AND CAPITAL RESOURCES — Securitization Activities and Liquidity Risk

and Funding Long-Term.”

The increased activity in FFELP Consolidation Loans has led to demand for the consolidation of Private

Education loans. Private Education Consolidation Loans provide an attractive refinancing opportunity to

certain borrowers because they allow borrowers to lower their monthly payments by extending the life of the

loan and/or lowering their interest rate. Consolidation of Private Education Loans from off-balance sheet

Private Education Loan trusts will increase the CPR used to value the Residual Interest.

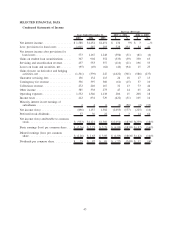

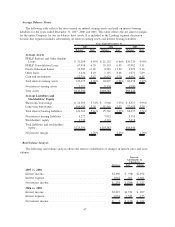

Effect of Consolidation Activity

The schedule below summarizes the impact of loan consolidation on each affected financial statement

line item.

On-Balance Sheet Student Loans

Estimate

Consolidating

Lender Effect on Estimate CPR Accounting Effect

Premium ................. Sallie Mae Term extension Decrease Estimate Adjustment

(1)

—

increase unamortized

balance of premium.

Reduced amortization

expense going forward.

Premium ................. Other lenders Loan prepaid Increase Estimate Adjustment

(1)

—

decrease unamortized

balance of premium or

accelerated amortization of

premium.

Repayment Borrower Benefits. . Sallie Mae Term extension N/A Existing Repayment

Borrower Benefits reserve

reversed into income —

new FFELP Consolidation

Loan benefit amortized

over a longer term.

(2)

Repayment Borrower Benefits. . Other lenders Loan prepaid N/A Repayment Borrower

Benefits reserve reversed

into income.

(2)

(1)

As estimates are updated, in accordance with SFAS No. 91, the premium balance must be adjusted from inception to reflect the new

expected term of the loan, as if it had been in place from inception.

(2)

Consolidation estimates also affect the estimates of borrowers who will eventually qualify for Repayment Borrower Benefits.

41