Sallie Mae 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FFELP student loans are guaranteed by state agencies or non-profit companies called guarantors, with ED

providing reinsurance to the guarantor. Guarantors are responsible for performing certain functions necessary

to ensure the program’s soundness and accountability. These functions include reviewing loan application data

to detect and prevent fraud and abuse and to assist lenders in preventing default by providing counseling to

borrowers. Generally, the guarantor is responsible for ensuring that loans are being serviced in compliance

with the requirements of the HEA. When a borrower defaults on a FFELP loan, we submit a claim to the

guarantor who reimburses us for principal and accrued interest subject to the Risk Sharing (See APPENDIX A,

“FEDERAL FAMILY EDUCATION LOAN PROGRAM,” to this document for a more complete description

of the role of guarantors.)

Private Education Loan Products

In addition to federal loan programs, which have statutory limits on annual and total borrowing, we

sponsor a variety of Private Education Loan programs and purchase loans made under such programs to bridge

the gap between the cost of education and a student’s resources. The majority of our higher education Private

Education Loans are made in conjunction with a FFELP Stafford loan, and are marketed to schools through

the same marketing channels — and by the same sales force — as FFELP loans. In 2004, we expanded our

direct-to-consumer loan marketing channel with our Tuition Answer

SM

loan program under which we originate

and purchase loans outside of the traditional financial aid process. We also originate and purchase Private

Education Loans marketed by our SLM Financial subsidiary to career training, technical and trade schools,

tutorial and learning centers, and private kindergarten through secondary education schools. These loans are

primarily made at schools not eligible for Title IV loans. Private Education Loans are discussed in more detail

below.

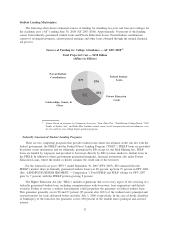

Drivers of Growth in the Student Loan Industry

The growth in our Managed student loan portfolio is driven by the growth in the overall student loan

marketplace, as well as by our own market share gains. Rising enrollment and college costs have resulted in

the size of the federally insured student loan market more than doubling over the last 10 years. Federally

insured student loan originations grew from $29.0 billion in FFY 1997 to $64.3 billion in FFY 2007.

According to the College Board, tuition and fees at four-year public institutions and four-year private

institutions have increased 54 percent and 33 percent, respectively, in constant, inflation-adjusted dollars, since

AY 1997-1998. Under the FFELP, there are limits to the amount students can borrow each academic year. The

first loan limit increases since 1992 were implemented July 1, 2007 when freshman and sophomore limits

were increased to $3,500 and $4,500 from $2,625 and $3,500, respectively. The fact that guaranteed student

loan limits have not kept pace with tuition increases has driven more students and parents to Private Education

Loans to meet an increasing portion of their education financing needs. Loans — both federal and private — as

a percentage of total student aid were 53 percent of total student aid in AY 1996-1997 and 52 percent in AY

2006-2007. Private Education Loans accounted for 24 percent of total student loans — both federally

guaranteed and Private Education Loans — in AY 2006-2007, compared to 7 percent in AY 1997-1998.

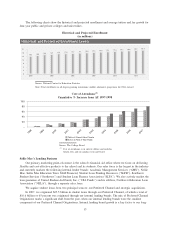

The National Center for Education Statistics predicts that the college-age population will increase

approximately 14 percent from 2007 to 2016. Demand for education credit will also increase due to the rise in

students not attending college directly from high school and adult education.

12