Sallie Mae 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

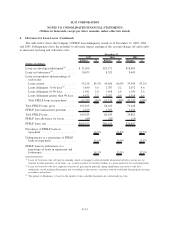

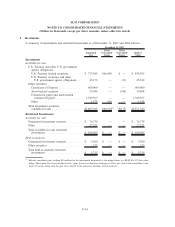

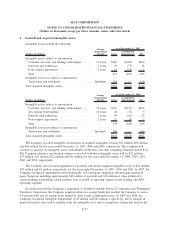

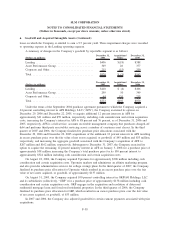

4. Allowance for Loan Losses (Continued)

Allowance for Private Education Loan Losses

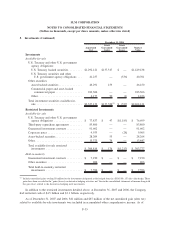

The Company’s allowance for Private Education Loan losses is an estimate of losses incurred in the

portfolio at the balance sheet date that will be charged off in subsequent periods. The maturing of the

Company’s Private Education Loan portfolios has provided more historical data on borrower default behavior

such that those portfolios can now be analyzed to determine the effects that the various stages of delinquency

have on borrower default behavior and ultimate charge-off. In 2005, the Company changed its estimate of the

allowance for loan losses to include a migration analysis of delinquent and current accounts, in addition to

other considerations. A migration analysis is a technique used to estimate the likelihood that a loan receivable

may progress through the various delinquency stages and ultimately charge off. Additionally, other factors are

considered, including external factors and forecasting data, which can result in adjustments to the formula-

based migration analysis. Prior to 2005, the Company calculated its allowance for Private Education Loan

losses by estimating the probable losses in the portfolio based primarily on loan characteristics and where

pools of loans were in their life with less emphasis on current delinquency status of the loan. Also, in the prior

methodology for calculating the allowance, some loss rates were based on proxies and extrapolations of

FFELP loan loss data.

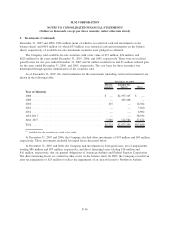

Also in 2005, the Company transitioned to a migration analysis to revise its estimates pertaining to its

non-accrual policy for interest income. Under this methodology, the amount of uncollectible accrued interest

on Private Education Loans is estimated and written off against current period interest income. Under the

Company’s prior methodology, Private Education Loans continued to accrue interest, including in periods of

forbearance, until they were charged off, at which time, the loans were placed on non-accrual status and all

previously accrued interest was reversed against income in the month of charge-off. The allowance for loan

losses provided for a portion of the probable losses in accrued interest receivable prior to charge-off.

F-28

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)