Sallie Mae 2007 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

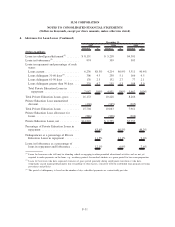

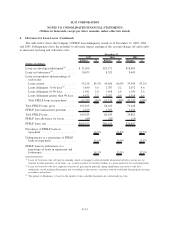

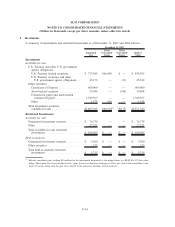

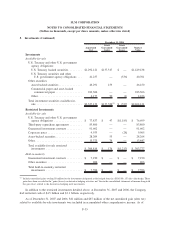

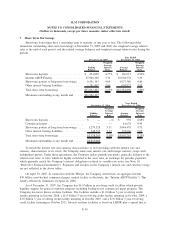

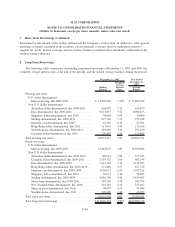

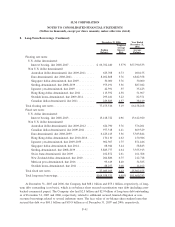

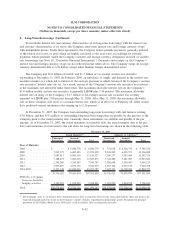

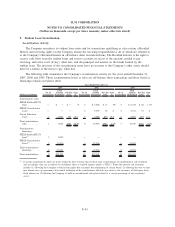

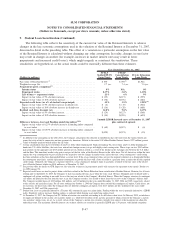

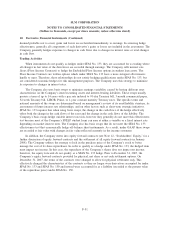

8. Long-Term Borrowings (Continued)

Ending

Balance

Weighted

Average

Interest

Rate

Average

Balance

Year Ended

December 31,

2006

December 31, 2006

Floating rate notes:

U.S. dollar denominated:

Interest bearing, due 2008-2047 ................ $ 66,762,440 5.37% $57,790,533

Non U.S. dollar denominated:

Australian dollar-denominated, due 2009-2011 ..... 625,708 6.73 400,155

Euro-denominated, due 2008-2041 .............. 8,402,868 3.76 6,842,358

Singapore dollar-denominated, due 2009.......... 30,000 3.76 30,000

Sterling-denominated, due 2008-2039 ............ 975,191 5.36 887,042

Japanese yen-denominated, due 2009 ............ 42,391 .55 35,423

Hong Kong dollar-denominated, due 2011 ........ 113,592 4.38 51,967

Swedish krona-denominated, due 2009-2011 ....... 293,441 3.22 82,371

Canadian dollar-denominated, due 2011 .......... 229,885 4.57 38,419

Total floating rate notes.......................... 77,475,516 5.19 66,158,268

Fixed rate notes:

U.S. dollar denominated:

Interest bearing, due 2008-2043 ................ 13,418,722 4.96 13,612,920

Non U.S. dollar denominated:

Australian dollar-denominated, due 2009-2012 ..... 624,790 5.76 576,201

Canadian dollar-denominated, due 2009-2011 ...... 977,318 4.41 869,329

Euro-denominated, due 2008-2039 .............. 6,425,413 3.36 5,383,844

Hong Kong dollar-denominated, due 2010-2016 .... 170,110 4.62 150,946

Japanese yen-denominated, due 2009-2035 ........ 962,307 1.75 871,446

Singapore dollar-denominated, due 2014.......... 68,944 3.44 58,843

Sterling-denominated, due 2008-2039 ............ 3,883,777 4.64 3,355,913

Swiss franc-denominated, due 2009 ............. 162,872 2.61 161,568

New Zealand dollar-denominated, due 2010 ....... 204,886 6.75 212,718

Mexican peso-denominated, due 2016 ........... 95,619 8.40 34,585

Swedish krona-denominated, due 2011 ........... 88,257 3.08 14,162

Total fixed rate notes............................ 27,083,015 4.42 25,302,475

Total long-term borrowings ....................... $104,558,531 4.99% $91,460,743

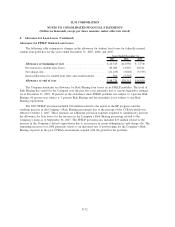

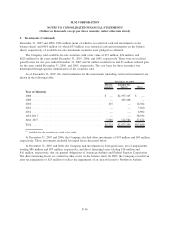

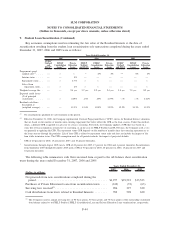

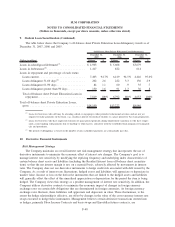

At December 31, 2007 and 2006, the Company had $68.1 billion and $55.1 billion, respectively, of long-

term debt outstanding (cost basis), which is on-balance sheet secured securitization trust debt (including asset-

backed commercial paper). The Company also had $2.5 billion and $2.9 billion of long-term debt outstanding

as of December 31, 2007 and 2006, respectively, related to additional secured, limited obligation or non-

recourse borrowings related to several indenture trusts. The face value of on-balance sheet student loans that

secured this debt was $68.1 billion and $55.9 billion as of December 31, 2007 and 2006, respectively.

F-41

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)