Sallie Mae 2007 Annual Report Download - page 144

Download and view the complete annual report

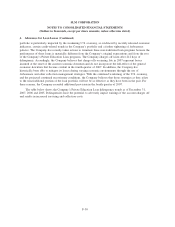

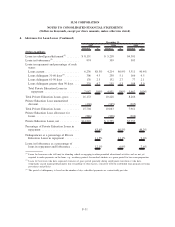

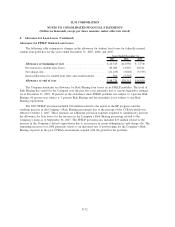

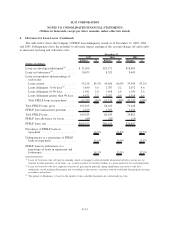

Please find page 144 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

Accounting for Certain Hybrid Financial Instruments

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instru-

ments,” which amends SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” and

SFAS No. 140. This statement was effective for the Company beginning January 1, 2007.

This statement:

• Requires that all interests in securitized financial assets be evaluated to determine if the interests are

free standing derivatives or if the interests contain an embedded derivative;

• Clarifies which interest-only strips and principal-only strips are exempt from the requirements of

SFAS No. 133;

• Clarifies that the concentrations of credit risk in the form of subordination are not an embedded

derivative;

• Allows a hybrid financial instrument containing an embedded derivative that would have required

bifurcation under SFAS No. 133 to be measured at fair value as one instrument on a case by case

basis; and

• Amends SFAS Statement No. 140 to eliminate the prohibition of a qualifying special purpose entity

from holding a derivative financial instrument that pertains to beneficial interests other than another

derivative financial instrument.

In January 2007, the FASB issued SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” Implementation Issues No. B39, “Embedded Derivatives: Application of Paragraph 13(b) to Call

Options That Are Exercisable Only by the Debtor (Amended),” and No. B40, “Embedded Derivatives:

Application of Paragraph 13(b) to Securitized Interests in Prepayable Financial Assets.” The guidance clarifies

various aspects of SFAS No. 155 and will require the Company to either (1) separately record embedded

derivatives that may reside in the Company’s Residual Interest and on-balance sheet securitization debt, or

(2) if embedded derivatives exist that require bifurcation, record the entire Residual Interest at fair value with

changes in the fair value of the Company’s Residual Interest and on-balance sheet securitization debt in their

entirety. This standard is prospectively applied in 2007 for new securitizations and does not apply to the

Company’s existing Residual Interest or on-balance sheet securitization debt that settled prior to 2007.

In the first quarter of 2007, the Company elected this option related to the Private Education Loan

securitization which settled in the first quarter of 2007 and as a result, has recorded related unrealized gains/

losses through earnings that, prior to the adoption of SFAS No. 155, would have been recorded through other

comprehensive income (except for any impairment required to be recognized).

The Company has concluded, based on its current securitization deal structures, that its on-balance sheet

securitization debt will not be materially impacted upon the adoption of SFAS No. 155 as embedded

derivatives will not have a material value. Accordingly, there was no impact for the year ended December 31,

2007, as it relates to on-balance sheet securitization debt.

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements.” This statement is

effective for financial statements issued for fiscal years beginning after November 15, 2007. This statement

defines fair value, establishes a framework for measuring fair value within GAAP, and expands disclosures

about fair value measurements. This statement applies to other accounting pronouncements that require or

F-23

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)