Sallie Mae 2007 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

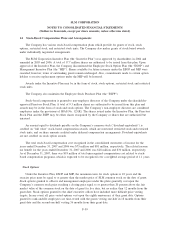

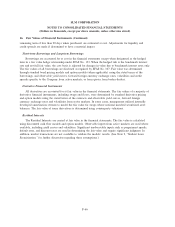

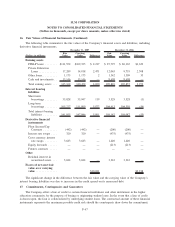

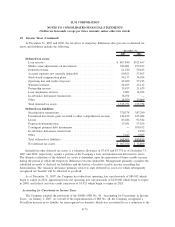

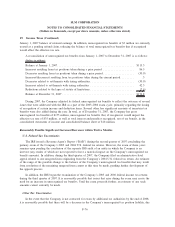

16. Fair Values of Financial Instruments (Continued)

remaining term of less than 90 days when purchased, are estimated at cost. Adjustments for liquidity and

credit spreads are made if determined to have a material impact.

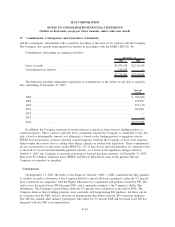

Short-term Borrowings and Long-term Borrowings

Borrowings are accounted for at cost in the financial statements except when designated as the hedged

item in a fair value hedge relationship under SFAS No. 133. When the hedged risk is the benchmark interest

rate and not full fair value, the cost basis is adjusted for changes in value due to benchmark interest rates only.

The fair values of all borrowings are disclosed as required by SFAS No. 107. Fair value was determined

through standard bond pricing models and option models (when applicable) using the stated terms of the

borrowings, and observable yield curves, forward foreign currency exchange rates, volatilities and credit

spreads specific to the Company from active markets; or from quotes from broker-dealers.

Derivative Financial Instruments

All derivatives are accounted for at fair value in the financial statements. The fair values of a majority of

derivative financial instruments, including swaps and floors, were determined by standard derivative pricing

and option models using the stated terms of the contracts and observable yield curves, forward foreign

currency exchange rates and volatilities from active markets. In some cases, management utilized internally

developed amortization streams to model the fair value for swaps whose notional matched securitized asset

balances. The fair value of some derivatives is determined using counterparty valuations.

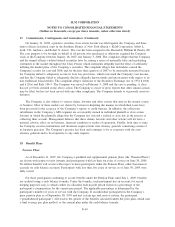

Residual Interests

The Residual Interests are carried at fair value in the financial statements. The fair value is calculated

using discounted cash flow models and option models. Observable inputs from active markets are used where

available, including yield curves and volatilities. Significant unobservable inputs such as prepayment speeds,

default rates, and discount rates are used in determining the fair value and require significant judgment. In

addition, market transactions are not available to validate the models’ results. (See Note 9, “Student Loan

Securitization,” for further discussion regarding these assumptions.)

F-66

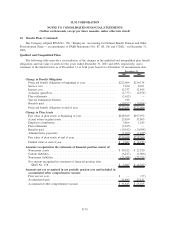

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)