Sallie Mae 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

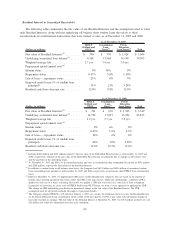

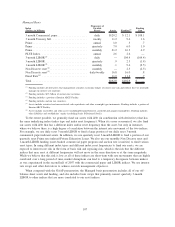

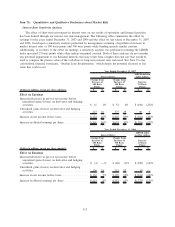

Weighted Average Life

The following table reflects the weighted average life for our Managed earning assets and liabilities at

December 31, 2007.

(Averages in Years)

On-Balance

Sheet

Off-Balance

Sheet Managed

Earning assets

Student loans...................................... 9.0 6.0 8.9

Other loans ....................................... 5.0 — 5.0

Cash and investments................................ .2 .1 .2

Total earning assets ................................. 8.0 5.6 8.0

Borrowings

Short-term borrowings ............................... .2 — .2

Long-term borrowings ............................... 6.6 6.0 6.4

Total borrowings ................................... 5.0 6.0 5.2

Long-term debt issuances likely to be called by us or putable by the investor have been categorized

according to their call or put dates rather than their maturity dates.

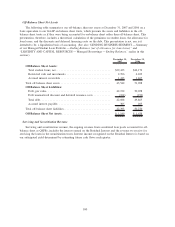

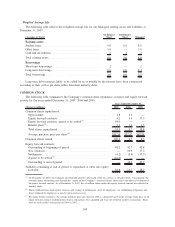

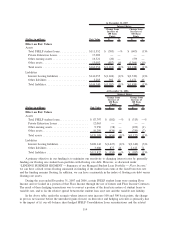

COMMON STOCK

The following table summarizes the Company’s common share repurchase, issuance and equity forward

activity for the years ended December 31, 2007, 2006 and 2005.

(Shares in millions) 2007 2006 2005

Years Ended December 31,

Common shares repurchased:

Open market .......................................... 1.8 2.2 —

Equity forward contracts ................................. 4.2 5.4 17.3

Equity forward contracts agreed to be settled

(1)

................ 44.0 — —

Benefit plans

(2)

........................................ 3.3 1.6 1.5

Total shares repurchased ................................. 53.3 9.2 18.8

Average purchase price per share

(3)

......................... $44.59 $52.41 $49.94

Common shares issued .................................... 109.2 6.7 8.3

Equity forward contracts:

Outstanding at beginning of period ......................... 48.2 42.7 42.8

New contracts ......................................... — 10.9 17.2

Settlements ........................................... (4.2) (5.4) (17.3)

Agreed to be settled

(1)

................................... (44.0) — —

Outstanding at end of period .............................. — 48.2 42.7

Authority remaining at end of period to repurchase or enter into equity

forwards ............................................. 38.8 15.7 18.7

(1)

On December 31, 2007, the Company and Citibank agreed to physically settle the contract as detailed below. Consequently, the

common shares outstanding and shareholders’ equity on the Company’s year-end balance sheet reflect the physical settlement of

the equity forward contract. As of December 31, 2007, the 44 million shares under this equity forward contract are reflected in

treasury stock.

(2)

Shares withheld from stock option exercises and vesting of performance stock for employees’ tax withholding obligations and

shares tendered by employees to satisfy option exercise costs.

(3)

For equity forward contracts, the average purchase price per share for 2005 is calculated based on the average strike price of all

equity forward contracts including those whose strike prices were amended and were net settled in cashless transactions. There

were no such cashless transactions in 2006 or 2007.

108