Sallie Mae 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

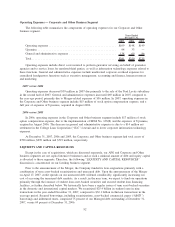

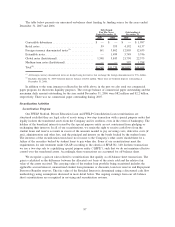

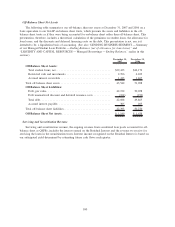

Operating Expenses — Corporate and Other Business Segment

The following table summarizes the components of operating expenses for our Corporate and Other

business segment.

2007 2006 2005

Years Ended

December 31,

Operating expenses ........................................... $109 $148 $149

Upromise .................................................. 94 33 —

General and administrative expenses .............................. 138 69 86

Total ...................................................... $341 $250 $235

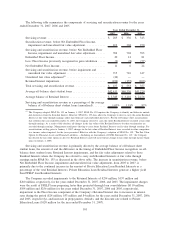

Operating expenses include direct costs incurred to perform guarantor servicing on behalf of guarantor

agencies and to service loans for unrelated third parties, as well as information technology expenses related to

these functions. General and administrative expenses include unallocated corporate overhead expenses for

centralized headquarters functions such as executive management, accounting and finance, human resources

and marketing.

2007 versus 2006

Operating expenses decreased $39 million in 2007 due primarily to the sale of the Noel Levitz subsidiary

in the second half of 2007. General and administrative expenses increased $69 million in 2007 compared to

the year-ago period, primarily due to Merger-related expenses of $56 million. In 2007, operating expenses in

the Corporate and Other business segment include $15 million of stock option compensation expense, and a

full year of expenses of Upromise, acquired in August 2006.

2006 versus 2005

In 2006, operating expenses in the Corporate and Other business segment include $17 million of stock

option compensation expense, due to the implementation of SFAS No. 123(R) and the expenses of Upromise,

acquired in August 2006. The decrease in general and administrative expenses is due to a $14 million net

settlement in the College Loan Corporation (“CLC”) lawsuit and to lower corporate information technology

expenses.

At December 31, 2007, 2006 and 2005, the Corporate and Other business segment had total assets of

$780 million, $999 million and $719 million, respectively.

LIQUIDITY AND CAPITAL RESOURCES

Except in the case of acquisitions, which are discussed separately, our APG and Corporate and Other

business segments are not capital intensive businesses and as such a minimal amount of debt and equity capital

is allocated to these segments. Therefore, the following “LIQUIDITY AND CAPITAL RESOURCES”

discussion is concentrated on our Lending business segment.

Prior to the announcement of the Merger, the Company funded its loan originations primarily with a

combination of term asset-backed securitizations and unsecured debt. Upon the announcement of the Merger

on April 17, 2007, credit spreads on our unsecured debt widened considerably, significantly increasing our

cost of accessing the unsecured debt markets. As a result, in the near term, we expect to fund our operations

primarily through the issuance of student loan asset-backed securities and secured student loan financing

facilities, as further described below. We historically have been a regular issuer of term asset-backed securities

in the domestic and international capital markets. We securitized $25.4 billion in student loans in nine

transactions in the year ended December 31, 2007, compared to $32.1 billion in thirteen transactions in the

year-ago period. Secured borrowings, including securitizations, asset-backed commercial paper (“ABCP”)

borrowings and indentured trusts, comprised 75 percent of our Managed debt outstanding at December 31,

2007, versus 69 percent at December 31, 2006.

92