Sallie Mae 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.payment for these services includes a contractually agreed upon set percentage of the account maintenance

fees that the guarantors receive from ED.

The Company’s guarantee services agreement with USA Funds has a five-year term that will be

automatically increased by an additional year on October 1 of each year unless a prior notice is given by

either party.

Our primary non-profit competitors in guarantor servicing are state and non-profit guarantee agencies that

provide third-party outsourcing to other guarantors.

(See APPENDIX A, “FEDERAL FAMILY EDUCATION LOAN PROGRAM — Guarantor Funding” for

details of the fees paid to guarantors.)

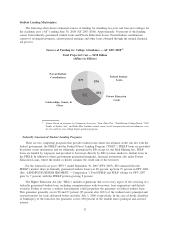

Upromise

Upromise has a number of programs that encourage consumers to save for the cost of college education.

Upromise has established an affinity marketing program which is designed to increase consumer purchases of

merchant goods and services and to promote saving for college by consumers who are members of this

program. Merchant partners generally pay Upromise transaction fees based on member purchase volume,

either online or in stores depending on the contractual arrangement with the merchant partner. A percentage of

the consumer members’ purchases is set aside in an account maintained by Upromise on the members’ behalf.

Upromise, through its wholly owned subsidiaries, Upromise Investments, Inc. (“UII”), a registered

broker-dealer, and Upromise Investment Advisors, LLC (“UIA”), provides transfer and servicing agent services

and program management associated with various 529 college-savings plans. Upromise manages $19 billion in

529 college-savings plans.

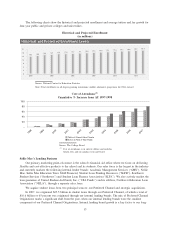

REGULATION

Like other participants in the FFELP, the Company is subject to the HEA and, from time to time, to

review of its student loan operations by ED and guarantee agencies. ED is authorized under its regulations to

limit, suspend or terminate lenders from participating in the FFELP, as well as impose civil penalties if lenders

violate program regulations. The laws relating to the FFELP are subject to revision. In addition, Sallie Mae,

Inc., as a servicer of federal student loans, is subject to certain ED regulations regarding financial responsibil-

ity and administrative capability that govern all third-party servicers of insured student loans. Failure to satisfy

such standards may result in the loss of the government guarantee of the payment of principal and accrued

interest on defaulted FFELP loans. Also, in connection with our guarantor servicing operations, the Company

must comply with, on behalf of its guarantor servicing customers, certain ED regulations that govern guarantor

activities as well as agreements for reimbursement between the Secretary of Education and the Company’s

guarantor servicing customers. Failure to comply with these regulations or the provisions of these agreements

may result in the termination of the Secretary of Education’s reimbursement obligation.

The Company’s originating or servicing of federal and private student loans also subjects it to federal and

state consumer protection, privacy and related laws and regulations. Some of the more significant federal laws

and regulations that are applicable to our student loan business include:

• the Truth-In-Lending Act;

• the Fair Credit Reporting Act;

• the Equal Credit Opportunity Act;

• the Gramm-Leach Bliley Act; and

• the U.S. Bankruptcy Code.

20