Sallie Mae 2007 Annual Report Download - page 68

Download and view the complete annual report

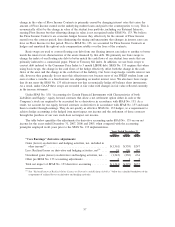

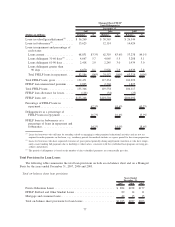

Please find page 68 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are reversed and the full amount is charged-off at day 212. We do not hold the contingent call option for any

trusts settled after September 30, 2005.

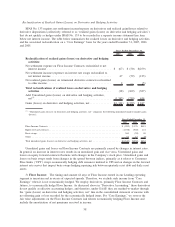

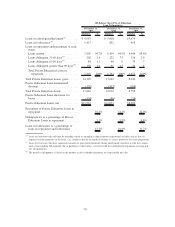

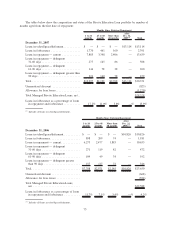

When measured as a percentage of ending loans in repayment, the off-balance sheet allowance is lower

than the on-balance sheet percentage because of the different mix of loans on-balance sheet and off-balance

sheet, as described above.

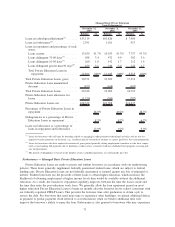

Managed Basis Private Education Loan Loss Allowance Discussion

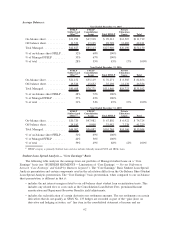

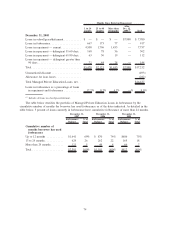

As the Private Education Loan portfolio seasons and due to shifts in its mix and certain economic factors,

we expected and have seen charge-off rates increase from the historically low levels experienced in prior

years. Additionally, this increase was significantly impacted by other factors. Toward the end of 2006 and

through mid-2007, we experienced lower pre-default collections, resulting in increased levels of charge-off

activity in our Private Education Loan portfolio. In the second half of 2006, we relocated responsibility for

certain Private Education Loan collections from our Nevada call center to a new call center in Indiana. This

transfer presented us with unexpected operational challenges that resulted in lower collections that have

negatively impacted the Private Education Loan portfolio. In addition, in late 2006, we revised certain

procedures, including our use of forbearance, to better optimize our long-term collection strategies. These

developments resulted in lower pre-default collections, increased later stage delinquency levels and higher

charge-offs. Due to the remedial actions in place, we anticipate the negative trends caused by the operational

difficulties will improve in 2008.

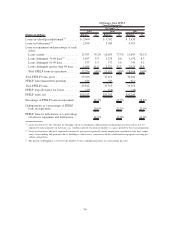

In the fourth quarter of 2007 the Company recorded provision expense of $667 million related to the

Managed Private Education Loan portfolio. This significant increase in provision primarily relates to the non-

traditional portion of our loan portfolio (education loans made to certain borrowers that have or are expected

to have a high default rate) which the Company had been expanding over the past few years. The non-

traditional portfolio is particularly impacted by the weakening U.S. economy, as evidenced by recently

released economic indicators, certain credit-related trends in the Company’s portfolio and a further tightening

of forbearance practices. The Company has recently taken actions to terminate these non-traditional loan

programs because the performance of these loans is materially different from our original expectations and

from the rest of the Company’s Private Education Loan programs. The Company charges off loans after

212 days of delinquency. Accordingly, the Company believes that charge-offs occurring late in 2007 represent

losses incurred at the onset of the current economic downturn and do not incorporate the full-effect of the

general economic downturn that became evident in the fourth quarter of 2007. In addition, the Company has

historically been able to mitigate its losses during varying economic environments through the use of

forbearance and other collection management strategies. With the continued weakening of the U.S. economy,

and the projected continued recessionary conditions, the Company believes that those strategies as they relate

to the non-traditional portion of the loan portfolio will not be as effective as they have been in the past. For

these reasons, the Company recorded additional provision in the fourth quarter of 2007.

67