Sallie Mae 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

at the option of the holder. On January 9, 2008, we closed a second public offering of our 7.25 percent

mandatory convertible preferred stock, Series C, as a result of the underwriters exercising their overallotment

option. We sold 150,000 shares of the preferred stock related to this overallotment and the closing resulted in

net proceeds of $145.5 million. We used approximately $2.0 billion of the net proceeds of the December 31,

2007 closings to settle our outstanding equity forward contract with Citibank and repurchase the

44,039,890 shares of common stock deliverable to us under the contract. On December 31, 2007, the Company

and Citibank agreed to physically settle the contract and the Company paid Citibank approximately

$1.1 billion, the difference between the contract purchase price and the previous market closing price on the

44 million shares. Consequently, the common shares outstanding and shareholders’ equity on the Company’s

year-end balance sheet reflect the shares issued in the public offerings and the physical settlement of the

equity forward contract. As of December 31, 2007, the 44 million shares under this equity forward contract

are reflected in treasury stock. The Company paid Citibank the remaining balance of approximately $0.9 billion

due under the contract on January 9, 2008. The Company now has no outstanding equity forward positions.

The remaining proceeds from the public offerings were used for general corporate purposes.

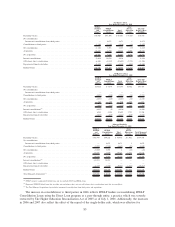

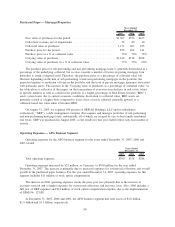

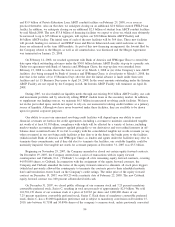

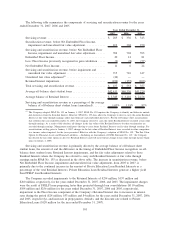

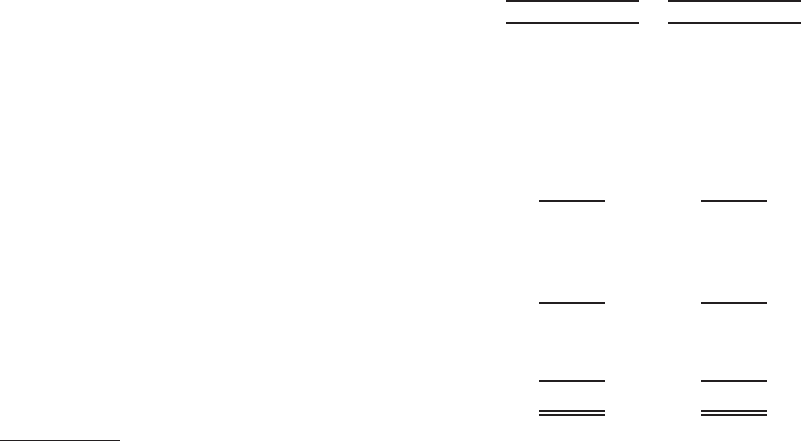

The following table details our primary sources of liquidity and the available capacity at December 31,

2007 and December 31, 2006.

Available Capacity Available Capacity

December 31, 2007 December 31, 2006

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Cash and cash equivalents ....................... $ 7,582 $ 2,621

U.S. Treasury-backed securities ................... 643 1,098

Commercial paper and asset-backed commercial paper . . 1,349 943

Certificates of deposit .......................... 600 —

Other ...................................... 83 58

Total unrestricted cash and liquid investments

(1)

......... 10,257 4,720

Unused commercial paper and bank lines of credit....... 6,500 6,500

ABCP borrowing capacity ......................... 5,933 1,047

Interim ABCP Facility borrowing capacity . . ........... 4,040 —

Total sources of primary liquidity ................... 26,730 12,267

Sources of stand-by liquidity:

Unencumbered FFELP loans ..................... 18,731 28,070

Total sources of primary and stand-by liquidity ......... $45,461 $40,337

(1)

Excludes $196 million and $365 million of investments pledged as collateral related to certain derivative positions and $93 million and

$99 million of other non-liquid investments classified at December 31, 2007 and December 31, 2006, respectively, as cash and invest-

ments on our balance sheet in accordance with GAAP.

We believe our unencumbered FFELP loan portfolio provides a viable source of potential or stand-by

liquidity because of the well-developed market for securitizations and whole loan sales of government

guaranteed student loans. In addition to the assets listed in the table above, we hold on-balance sheet a number

of other unencumbered assets, consisting primarily of Private Education Loans, Retained Interests and other

assets. At December 31, 2007, we had a total of $51.7 billion of unencumbered assets, including goodwill and

acquired intangibles.

In addition to liquidity, a major objective when financing our business is to minimize interest rate risk by

aligning the interest rate and reset characteristics of our Managed assets and liabilities, generally on a pooled

basis, to the extent practicable. In this process we use derivative financial instruments extensively to reduce

our interest rate and foreign currency exposure. This interest rate risk management helps us to stabilize our

student loan spread in various and changing interest rate environments. (See also “RISKS — Interest Rate Risk

Management” below.)

95