Sallie Mae 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

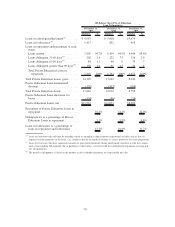

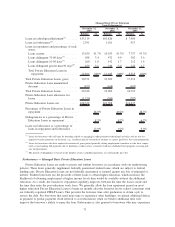

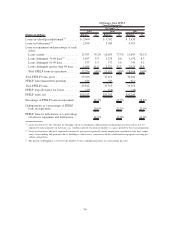

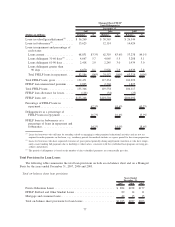

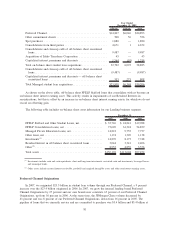

Balance % Balance % Balance %

December 31,

2007

December 31,

2006

December 31,

2005

Managed Basis Private Education

Loan Delinquencies

Loans in-school/grace/deferment

(1)

....... $13,114 $10,826 $ 7,980

Loans in forbearance

(2)

................ 2,391 1,181 917

Loans in repayment and percentage of each

status:

Loans current ..................... 13,639 91.7% 10,633 91.3% 7,757 93.3%

Loans delinquent 31-60 days

(3)

........ 508 3.4 472 4.0 302 3.6

Loans delinquent 61-90 days

(3)

........ 260 1.8 192 1.7 112 1.4

Loans delinquent greater than 90 days

(3)

. . 459 3.1 346 3.0 144 1.7

Total Private Education Loans in

repayment...................... 14,866 100% 11,643 100% 8,315 100%

Total Private Education Loans, gross...... 30,371 23,650 17,212

Private Education Loan unamortized

discount ......................... (823) (668) (493)

Total Private Education Loans .......... 29,548 22,982 16,719

Private Education Loan allowance for

losses ........................... (1,220) (394) (282)

Private Education Loans, net ........... $28,328 $22,588 $16,437

Percentage of Private Education Loans in

repayment ....................... 48.9% 49.2% 48.3%

Delinquencies as a percentage of Private

Education Loans in repayment ........ 8.3% 8.7% 6.7%

Loans in forbearance as a percentage of

loans in repayment and forbearance .... 13.9% 9.2% 9.9%

(1)

Loans for borrowers who still may be attending school or engaging in other permitted educational activities and are not yet

required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation.

(2)

Loans for borrowers who have requested extension of grace period generally during employment transition or who have tempo-

rarily ceased making full payments due to hardship or other factors, consistent with the established loan program servicing poli-

cies and procedures.

(3)

The period of delinquency is based on the number of days scheduled payments are contractually past due.

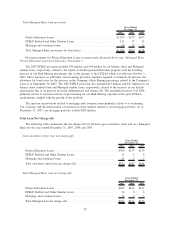

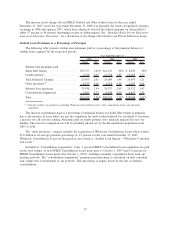

Forbearance — Managed Basis Private Education Loans

Private Education Loans are made to parent and student borrowers in accordance with our underwriting

policies. These loans generally supplement federally guaranteed student loans, which are subject to federal

lending caps. Private Education Loans are not federally guaranteed or insured against any loss of principal or

interest. Student borrowers use the proceeds of these loans to obtain higher education, which increases the

likelihood of obtaining employment at higher income levels than would be available without the additional

education. As a result, the borrowers’ repayment capability improves between the time the loan is made and

the time they enter the post-education work force. We generally allow the loan repayment period on most

higher education Private Education Loans to begin six months after the borrower leaves school (consistent with

our federally regulated FFELP loans). This provides the borrower time after graduation to obtain a job to

service the debt. For borrowers that need more time or experience other hardships, we permit additional delays

in payment or partial payments (both referred to as forbearances) when we believe additional time will

improve the borrower’s ability to repay the loan. Forbearance is also granted to borrowers who may experience

71