Sallie Mae 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

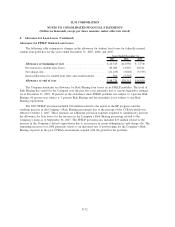

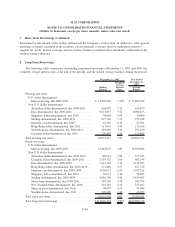

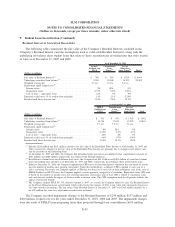

8. Long-Term Borrowings (Continued)

To match the interest rate and currency characteristics of its long-term borrowings with the interest rate

and currency characteristics of its assets, the Company enters into interest rate and foreign currency swaps

with independent parties. Under these agreements, the Company makes periodic payments, generally indexed

to the related asset rates, or rates which are highly correlated to the asset rates, in exchange for periodic

payments which generally match the Company’s interest and foreign currency obligations on fixed or variable

rate borrowings (see Note 10, “Derivative Financial Instruments”). Payments and receipts on the Company’s

interest rate and foreign currency swaps are not reflected in the tables above. The Company swaps all foreign

currency denominated debt to U.S dollars except when funding foreign denominated assets.

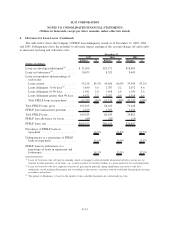

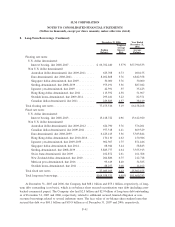

The Company had $1.0 billion of taxable and $1.7 billion of tax-exempt auction rate securities

outstanding at December 31, 2007. In February 2008, an imbalance of supply and demand in the auction rate

securities market as a whole led to failures of the auctions pursuant to which certain of the Company’s auction

rate securities’ interest rates are set. As a result, certain of the Company’s auction rate securities bear interest

at the maximum rate allowable under their terms. The maximum allowable interest rate on the Company’s

$1.0 billion taxable auction rate securities is generally LIBOR plus 1.50 percent. The maximum allowable

interest rate on many of the Company’s $1.7 billion of tax-exempt auction rate securities was recently

amended to LIBOR plus 2.00 percent through May 31, 2008. After May 31, 2008, the maximum allowable

rate on these securities will revert to a formula driven rate, which, if in effect as of February 28, 2008, would

have produced various maximum rates ranging up to 5.26 percent.

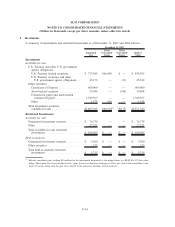

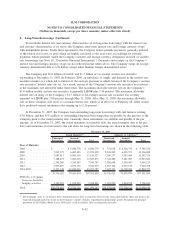

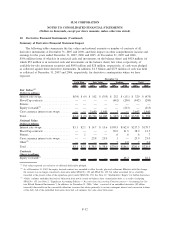

At December 31, 2007, the Company had outstanding long-term borrowings with call features totaling

$3.8 billion, and had $131 million of outstanding long-term borrowings that are putable by the investor to the

Company prior to the stated maturity date. Generally, these instruments are callable and putable at the par

amount. As of December 31, 2007, the stated maturities (for putable debt, the stated maturity date is the put

date) and maturities if accelerated to the call dates for long-term borrowings are shown in the following table:

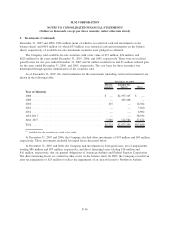

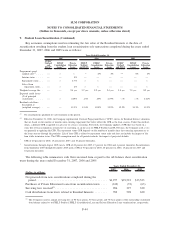

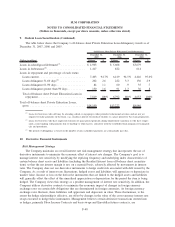

Unsecured

Borrowings

Secured

Borrowings Total

Unsecured

Borrowings

Secured

Borrowings Total

Stated Maturity

(1)

Maturity to Call Date

(1)

December 31, 2007

Year of Maturity

2008 . . . . . . . . . . . . . . . . $ — $ 6,840,770 $ 6,840,770 $ 774,038 $ 8,566,332 $ 9,340,370

2009 . . . . . . . . . . . . . . . . 7,952,375 6,007,623 13,959,998 8,503,235 6,003,573 14,506,808

2010 . . . . . . . . . . . . . . . . 7,087,011 6,043,316 13,130,327 7,200,277 5,943,449 13,143,726

2011 . . . . . . . . . . . . . . . . 7,188,472 5,681,403 12,869,875 7,342,286 5,681,403 13,023,689

2012 . . . . . . . . . . . . . . . . 2,341,200 5,249,587 7,590,787 2,386,648 5,249,587 7,636,235

2013 . . . . . . . . . . . . . . . . 2,993,819 4,953,136 7,946,955 2,967,162 4,953,136 7,920,298

2014-2047 . . . . . . . . . . . . 9,233,148 35,820,039 45,053,187 7,622,379 34,198,394 41,820,773

36,796,025 70,595,874 107,391,899 36,796,025 70,595,874 107,391,899

SFAS No. 133 (gains)

losses on derivative

hedging activities . . . . . 1,781,993 1,924,252 3,706,245 1,781,993 1,924,252 3,706,245

Total . . . . . . . . . . . . . . . . $38,578,018 $72,520,126 $111,098,144 $38,578,018 $72,520,126 $111,098,144

(1)

The Company views its on-balance sheet securitization trust debt as long-term based on the contractual maturity dates and projects the

expected principal paydowns based on the Company’s current estimates regarding loan prepayment speeds. The projected principal

paydowns of $6.8 billion shown in year 2008 relate to the on-balance sheet securitization trust debt.

F-42

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)