Sallie Mae 2007 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

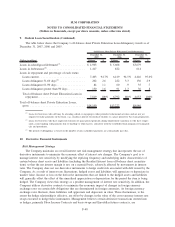

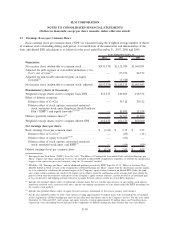

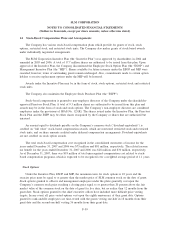

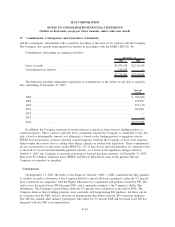

13. Earnings (Loss) per Common Share

Basic earnings (loss) per common share (“EPS”) is calculated using the weighted average number of shares

of common stock outstanding during each period. A reconciliation of the numerators and denominators of the

basic and diluted EPS calculations is as follows for the years ended December 31, 2007, 2006 and 2005:

2007 2006 2005

Years Ended December 31,

Numerator:

Net income (loss) attributable to common stock ......... $(933,539) $1,121,389 $1,360,381

Adjusted for debt expense of convertible debentures (“Co-

Cos”), net of taxes

(1)

........................... — 67,274 44,572

Adjusted for non-taxable unrealized gains on equity

forwards

(2)

................................... — (3,528) —

Net income (loss) attributable to common stock, adjusted . . $(933,539) $1,185,135 $1,404,953

Denominator (shares in thousands):

Weighted average shares used to compute basic EPS ..... 412,233 410,805 418,374

Effect of dilutive securities:

Dilutive effect of Co-Cos ........................ — 30,312 30,312

Dilutive effect of stock options, nonvested restricted

stock, restricted stock units, Employee Stock Purchase

Plan (“ESPP”) and equity forwards

(2)(3)(4)

.......... — 10,053 11,574

Dilutive potential common shares

(5)

.................. — 40,365 41,886

Weighted average shares used to compute diluted EPS .... 412,233 451,170 460,260

Net earnings (loss) per share:

Basic earnings (loss) per common share ............... $ (2.26) $ 2.73 $ 3.25

Dilutive effect of Co-Cos

(1)

...................... — (.03) (.11)

Dilutive effect of equity forwards

(2)(4)

............... — (.01) —

Dilutive effect of stock options, nonvested restricted

stock, restricted stock units, and ESPP

(3)

........... — (.06) (.09)

Diluted earnings (loss) per common share ............. $ (2.26) $ 2.63 $ 3.05

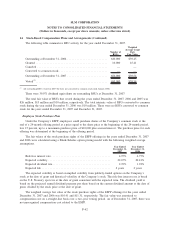

(1)

Emerging Issues Task Force (“EITF”) Issue No. 04-8, “The Effect of Contingently Convertible Debt on Diluted Earnings per

Share,” requires the shares underlying Co-Cos to be included in diluted EPS computations regardless of whether the market price

trigger or the conversion price has been met, using the “if-converted” method.

(2)

SFAS No. 128, “Earnings per Share,” and the additional guidance provided by EITF Topic No. D-72, “Effect of Contracts That

May Be Settled in Stock or Cash on the Computation of Diluted Earnings per Share,” require both the denominator and the numera-

tor to be adjusted in calculating the potential impact of the Company’s equity forward contracts on diluted EPS. Under this guid-

ance, when certain conditions are satisfied, the impact can be dilutive when the combination of the average share price during the

period is lower than the respective strike prices on the Company’s equity forward contracts, and the reversal of an unrealized gain

or loss on derivative and hedging activities related to its equity forward contracts results in a lower EPS calculation.

(3)

Includes the potential dilutive effect of additional common shares that are issuable upon exercise of outstanding stock options,

nonvested restricted stock, restricted stock units, and the outstanding commitment to issue shares under the ESPP, determined by

the treasury stock method.

(4)

Includes the potential dilutive effect of equity forward contracts, determined by the reverse treasury stock method.

(5)

For the year ended December 31, 2007, stock options covering approximately 37 million shares were outstanding but not included

in the computation of diluted earnings per share because they were anti-dilutive due to the Company’s net loss. For the years ended

December 31, 2006 and 2005, stock options and equity forwards covering approximately 57 million shares and 30 million shares,

respectively, were outstanding but not included in the computation of diluted earnings per share because they were anti-dilutive.

F-58

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)