Sallie Mae 2007 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

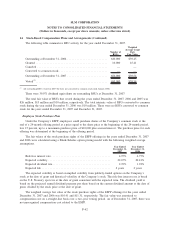

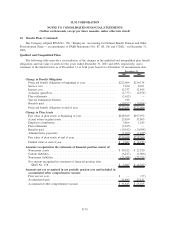

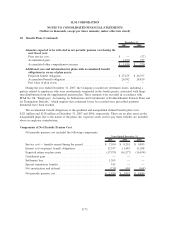

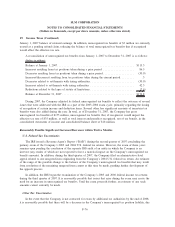

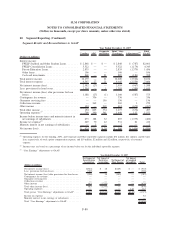

18. Benefit Plans (Continued)

2007 2006

December 31,

Amounts expected to be reflected in net periodic pension cost during the

next fiscal year:

Prior service cost ........................................... $ — (37)

Accumulated gain .......................................... 1,450 757

Accumulated other comprehensive income ........................ $ 1,450 $ 720

Additional year-end information for plans with accumulated benefit

obligations in excess of plan assets:

Projected benefit obligation ................................... $ 27,275 $ 26,757

Accumulated benefit obligation ................................ 26,592 24,819

Fair value of plan assets...................................... — —

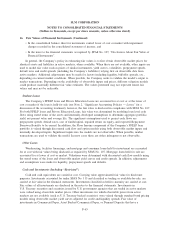

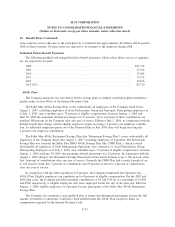

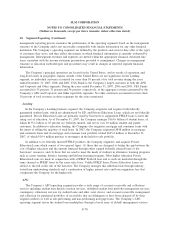

During the year ended December 31, 2007, the Company recorded net settlement losses, including a

portion related to employees who were involuntarily terminated in the fourth quarter, associated with lump-

sum distributions from the supplemental pension plan. These amounts were recorded in accordance with

SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and

for Termination Benefits,” which requires that settlement losses be recorded once prescribed payment

thresholds have been reached.

The accumulated benefit obligations of the qualified and nonqualified defined benefit plans were

$221 million and $218 million at December 31, 2007 and 2006, respectively. There are no plan assets in the

nonqualified plans due to the nature of the plans; the corporate assets used to pay these benefits are included

above in employer contributions.

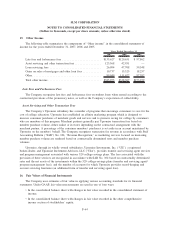

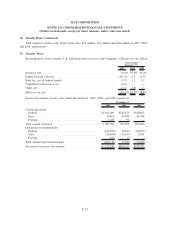

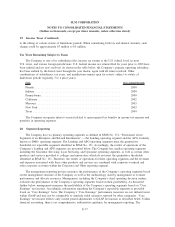

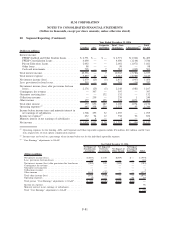

Components of Net Periodic Pension Cost

Net periodic pension cost included the following components:

2007 2006 2005

Years Ended December 31,

Service cost — benefits earned during the period ............ $ 7,100 $ 8,291 $ 9,893

Interest cost on project benefit obligations ................. 12,337 11,445 11,208

Expected return on plan assets .......................... (17,975) (16,277) (16,434)

Curtailment gain .................................... — — —

Settlement loss...................................... 1,265 — —

Special termination benefits ............................ 912 — —

Net amortization and deferral ........................... (719) 494 (168)

Net periodic pension cost .............................. $ 2,920 $ 3,953 $ 4,499

F-71

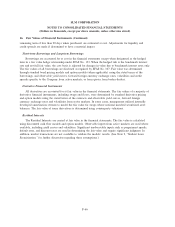

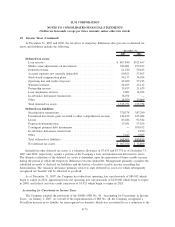

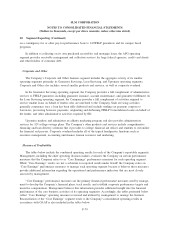

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)