Sallie Mae 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

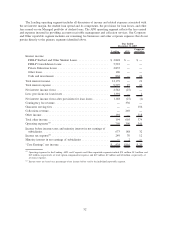

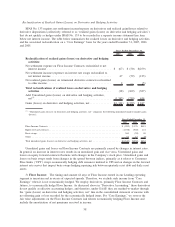

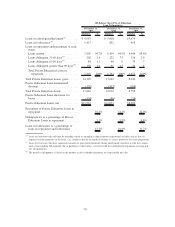

Average Balances:

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans Total FFELP

Private

Education

Loans Total

Year Ended December 31, 2007

On-balance sheet ............ $31,294 $67,918 $ 99,212 $12,507 $111,719

Off-balance sheet ............ 11,533 17,195 28,728 13,683 42,411

Total Managed .............. $42,827 $85,113 $127,940 $26,190 $154,130

% of on-balance sheet FFELP . . . 32% 68% 100%

% of Managed FFELP ........ 33% 67% 100%

% of total ................. 28% 55% 83% 17% 100%

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans Total FFELP

Private

Education

Loans Total

Year Ended December 31, 2006

On-balance sheet ............ $21,152 $55,119 $ 76,271 $ 8,585 $ 84,856

Off-balance sheet ............ 19,546 15,652 35,198 11,138 46,336

Total Managed .............. $40,698 $70,771 $111,469 $19,723 $131,192

% of on-balance sheet FFELP . . . 28% 72% 100%

% of Managed FFELP ........ 37% 63% 100%

% of total ................. 31% 54% 85% 15% 100%

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans Total FFELP

Private

Education

Loans Total

Year Ended December 31, 2005

On-balance sheet ............ $20,720 $47,082 $ 67,802 $ 6,922 $ 74,724

Off-balance sheet ............ 24,182 9,800 33,982 7,238 41,220

Total Managed .............. $44,902 $56,882 $101,784 $14,160 $115,944

% of on-balance sheet FFELP . . . 31% 69% 100%

% of Managed FFELP ........ 44% 56% 100%

% of total ................. 39% 49% 88% 12% 100%

(1)

FFELP category is primarily Stafford loans and also includes federally insured PLUS and HEAL loans.

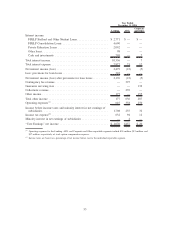

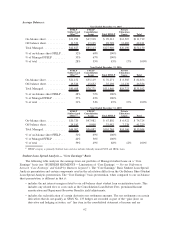

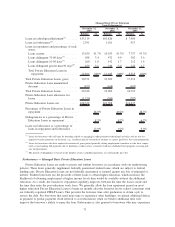

Student Loan Spread Analysis — “Core Earnings” Basis

The following table analyzes the earnings from our portfolio of Managed student loans on a “Core

Earnings” basis (see “BUSINESS SEGMENTS — Limitations of ‘Core Earnings’ — Pre-tax Differences

between ‘Core Earnings’ and GAAP by Business Segment”). The “Core Earnings” Basis Student Loan Spread

Analysis presentation and certain components used in the calculation differ from the On-Balance Sheet Student

Loan Spread Analysis presentation. The “Core Earnings” basis presentation, when compared to our on-balance

sheet presentation, is different in that it:

• includes the net interest margin related to our off-balance sheet student loan securitization trusts. This

includes any related fees or costs such as the Consolidation Loan Rebate Fees, premium/discount

amortization and Repayment Borrower Benefits yield adjustments;

• includes the reclassification of certain derivative net settlement amounts. The net settlements on certain

derivatives that do not qualify as SFAS No. 133 hedges are recorded as part of the “gain (loss) on

derivative and hedging activities, net” line item in the consolidated statement of income and are

62