Sallie Mae 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

Accounting for Uncertainty in Income Taxes

The Company adopted the provisions of the FASB’s FIN No. 48, “Accounting for Uncertainty in Income

Taxes,” on January 1, 2007.

FIN No. 48, amends SFAS No. 109, “Accounting for Income Taxes,” and includes the following

interpretations:

• Changes historical methods of recording the impact to the financial statements of uncertain tax

positions from a model based upon probable liabilities to be owed, to a model based upon the tax

benefit most likely to be sustained.

• Prescribes a threshold for the financial statement recognition of tax positions taken or expected to be

taken in a tax return, based upon whether it is more likely than not that a tax position will be sustained

upon examination.

• Provides rules on the measurement in the financial statements of tax positions that meet this recognition

threshold, requiring that the largest amount of benefit that is greater than 50 percent likely of being

realized upon ultimate settlement to be recorded.

• Requires new disclosures regarding uncertain tax positions.

Minority Interest in Subsidiaries

At December 31, 2007 and 2006, minority interest in subsidiaries represents interests held by minority

shareholders in AFS Holdings, LLC, of approximately 12 percent for both years.

Earnings (Loss) per Common Share

The Company computes earnings (loss) per common share (“EPS”) in accordance with SFAS No. 128,

“Earnings per Share.” See Note 13, “Earnings (Loss) per Common Share,” for further discussion.

Foreign Currency Transactions

The Company has financial services operations in foreign countries. The financial statements of these

foreign businesses have been translated into U.S. dollars in accordance with U.S. GAAP. The net investments

of the parent in the foreign subsidiary are translated at the current exchange rate at each period-end through

the “other comprehensive income” component of stockholders’ equity for net investments deemed to be long-

term in nature or through net income if the net investment is short-term in nature. Income statement items are

translated at the average exchange rate for the period through income. Transaction gains and losses resulting

from exchange rate changes on transactions denominated in currencies other than the entity’s functional

currency are included in other operating income.

Statement of Cash Flows

Included in the Company’s financial statements is the consolidated statement of cash flows. It is the

policy of the Company to include all derivative net settlements, irrespective of whether the derivative is a

qualifying hedge, in the same section of the Statement of Cash Flows that the derivative is economically

hedging.

As discussed in the Restricted Cash and Investments section of this note, the Company’s restricted cash

balances primarily relate to on-balance sheet securitizations. This balance is primarily the result of timing

F-21

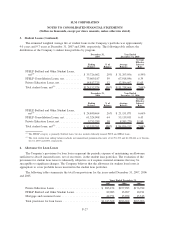

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)