Sallie Mae 2007 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

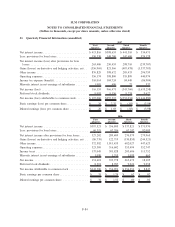

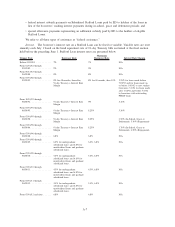

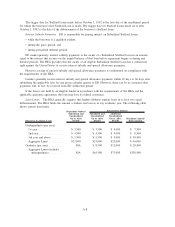

The following chart shows historic loan limits:

Borrower’s Academic Level Base

Amount Subsidized and Unsubsidized

On or After 10/1/93

Subsidized

On or After

1/1/87

All Students

Subsidized and

Unsubsidized On

or After 10/1/93

Additional

Unsubsidized

Only On or

After 7/1/94

Maximum Annual

Total Amount

Independent Students

Undergraduate (per year):

1st year .................... $ 2,625 $ 2,625* $ 4,000 $ 6,625

2nd year ................... $ 2,625 $ 3,500* $ 4,000 $ 7,500

3rd year and above ........... $ 4,000 $ 5,500 $ 5,000** $ 10,500

Graduate (per year) . ............ $ 7,500 $ 8,500 $10,000* $ 18,500

Aggregate Limit:

Undergraduate . . . ............ $17,250 $23,000 $23,000 $ 46,000

Graduate (including

undergraduate) . ............ $54,750 $65,500 $73,000 $138,500

For the purposes of the tables above:

• The loan limits include both FFELP and FDLP loans.

• The amounts in the columns labeled “Subsidized and Unsubsidized” represent the combined maximum

loan amount per year for Subsidized and Unsubsidized Stafford Loans. Accordingly, the maximum

amount that a student may borrow under an Unsubsidized Stafford Loan is the difference between the

combined maximum loan amount and the amount the student received in the form of a Subsidized

Stafford Loan.

Independent undergraduate students, graduate students and professional students may borrow the

additional amounts shown in the next to last columns in the charts above. Dependent undergraduate students

may also receive these additional loan amounts if their parents are unable to provide the family contribution

amount and it is unlikely that they will qualify for a PLUS Loan.

• Students attending certain medical schools are eligible for higher annual and aggregate loan limits.

• The annual loan limits are sometimes reduced when the student is enrolled in a program of less than

one academic year or has less than a full academic year remaining in his program.

Repayment. Repayment of a Stafford Loan begins 6 months after the student ceases to be enrolled at

least half time. In general, each loan must be scheduled for repayment over a period of not more than 10 years

after repayment begins. New borrowers on or after October 7, 1998 who accumulate outstanding loans under

the FFELP totaling more than $30,000 are entitled to extend repayment for up to 25 years, subject to

minimum repayment amounts and FFELP Consolidation Loan borrowers may be scheduled for repayment up

to 30 years depending on the borrower’s indebtedness. The HEA currently requires minimum annual payments

of $600, unless the borrower and the lender agree to lower payments, except that negative amortization is not

allowed. The Act and related regulations require lenders to offer the choice of a standard, graduated, income-

sensitive and extended repayment schedule, if applicable, to all borrowers entering repayment. The 2007

legislation introduces an income-based repayment plan on July 1, 2009 that a student borrower may elect

during a period of partial financial hardship and have annual payments that do not exceed 15% of the amount

by which adjusted gross income exceeds 150% of the poverty line. The Secretary repays or cancels any

outstanding principal and interest under certain criteria after 25 years.

Grace Periods, Deferral Periods and Forbearance Periods. After the borrower stops pursuing at least a

half-time course of study, he must begin to repay principal of a Stafford Loan following the grace period.

However, no principal repayments need be made, subject to some conditions, during deferment and

forbearance periods.

A-9