Sallie Mae 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219

|

|

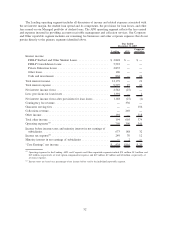

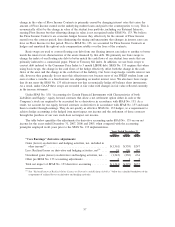

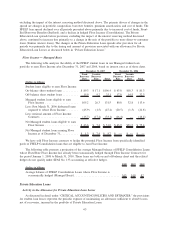

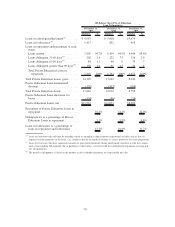

The following table includes the “Core Earnings” results of operations for our Lending business segment.

2007 2006 2005 2007 vs. 2006 2006 vs. 2005

Years Ended December 31, % Increase (Decrease)

“Core Earnings” interest income:

FFELP Stafford and Other Student

Loans ..................... $ 2,848 $ 2,771 $2,298 3% 21%

FFELP Consolidation Loans ...... 5,522 4,690 3,014 18 56

Private Education Loans ......... 2,835 2,092 1,160 36 80

Other loans ................... 106 98 85 8 15

Cash and investments ........... 868 705 396 23 78

Total “Core Earnings” interest

income ...................... 12,179 10,356 6,953 18 49

Total “Core Earnings” interest

expense...................... 9,597 7,877 4,798 22 64

Net “Core Earnings” interest income . . 2,582 2,479 2,155 4 15

Less: provisions for loan losses ...... 1,394 303 138 360 120

Net “Core Earnings” interest income

after provisions for loan losses..... 1,188 2,176 2,017 45 8

Other income ................... 194 177 111 10 59

Operating expenses ............... 709 645 547 10 18

Income before income taxes and

minority interest in net earnings of

subsidiaries ................... 673 1,708 1,581 (61) 8

Income taxes ................... 249 632 586 (61) 8

Income before minority interest in net

earnings of subsidiaries .......... 424 1,076 995 (61) 8

Minority interest in net earnings of

subsidiaries ................... — — 2 — (100)

“Core Earnings” net income ....... $ 424 $ 1,076 $ 993 (61)% 8%

The changes in net interest income are primarily due to fluctuations in the student loan spread discussed

below, as well as the growth in our student loan portfolio and the level of cash and investments we may hold

on our balance sheet for liquidity purposes. In connection with the Merger Agreement, we increased our

liquidity portfolio to higher than historical levels. The liquidity portfolio has a negative net interest margin,

and as a result, the increase in this portfolio reduced net interest income by $18 million for the year ended

December 31, 2007.

60