Sallie Mae 2007 Annual Report Download - page 106

Download and view the complete annual report

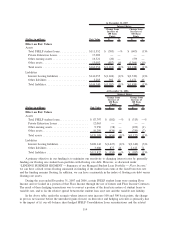

Please find page 106 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.available consumer credit scoring system, FICO. Because our borrowers often have limited repayment history

on other loan products and the addition of our loans increases the debt burden of our borrowers, the origination

of our loans generally results in an initial decrease in borrowers’ FICO scores. After this initial decrease,

borrowers’ FICO scores will generally improve over time as the financial positions of our borrowers become

more established and their repayment history on all loans becomes more seasoned. Additionally, for borrowers

who do not meet our lending requirements or who desire more favorable terms, we generally require credit-

worthy cosigners. Our higher education Private Education Loans to students attending Title IV schools are not

dischargeable in bankruptcy, except in certain limited circumstances.

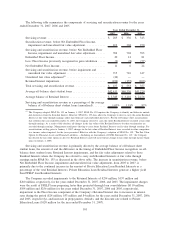

We have defined underwriting and collection policies, and ongoing risk monitoring and review processes

for all Private Education Loans. Potential credit losses are considered in our risk-based pricing model. The

performance of the Private Education Loan portfolio may be affected by the economy, and a prolonged

economic downturn may have an adverse effect on its credit performance. Management believes that it has

provided sufficient allowances to cover the incurred losses estimated to be inherent in both the federally

guaranteed and Private Education Loan portfolio. In addition, losses may be incurred for student borrowers

who have not completed their education as a result of a drop-out or a school closing, and who may have

deferred repayment on all or on part of their loans. We have provided for these potential losses in our

allowance for loan losses. There is, however, no guarantee that such allowances are sufficient enough to

account for actual losses. (See “LENDING BUSINESS SEGMENT — Private Education Loans — Activity in

the Allowance for Private Education Loan Losses.”)

In limited instances in our Private Education Loan portfolio, we have third-party guarantors or have

entered into arrangements with schools whereby they bear a portion of the student loan default exposure. In

these instances, we are exposed to credit risk related to these third parties. We perform financial performance

reviews of these third parties upon entering agreements and monitor their financial performance on an ongoing

basis.

FFELP loans are guaranteed by state agencies or non-profit companies called guarantors, with ED

providing reinsurance to the guarantor. This guarantee generally covers 98 and 97 percent of the student loan’s

principal and accrued interest for loans disbursed before and after July 1, 2006, respectively. As a result, we

have credit exposure on FFELP loans for the remaining non-guaranteed portion which is referred to as the

Risk Sharing component. The performance of the FFELP loan portfolio may be affected by the economy, and

a prolonged economic downturn may have an adverse effect on its payment performance. Management

believes that it has provided sufficient allowances to cover the incurred losses estimated to be inherent in the

FFELP loan portfolio. There is, however, no guarantee that such allowances are sufficient enough to account

for actual losses. (See “LENDING BUSINESS SEGMENT — FFELP Loans.”)

We have credit risk exposure to the various counterparties with whom we have entered into derivative

contracts. We review the credit standing of these companies. Our credit policies place limits on the amount of

exposure we may take with any one party and in most cases, require collateral to secure the position. The

credit risk associated with derivatives is measured based on the replacement cost should the counterparties

with contracts in a gain position to the Company fail to perform under the terms of the contract.

Credit risk in our investment portfolio is minimized by only investing in paper with highly rated issuers.

Additionally, limits per issuer are determined by our internal credit and investment guidelines to limit our

exposure to any one issuer. We also have credit risk with one commercial airline and Federal Express

Corporation related to our portfolio of leveraged leases.

Consolidation Loan Refinancing Risk

The process of consolidating FFELP Stafford loans into FFELP Consolidation loans can have detrimental

effects. Student loans in our portfolio can be consolidated away from us by other lenders at par. Additionally,

FFELP Consolidation Loans have lower net yields than the FFELP Stafford loans they replace, which is

somewhat offset by the longer average lives of FFELP Consolidation Loans.

When FFELP Stafford loans in our securitization trusts consolidate, they are a prepayment for the trust.

In periods of high consolidation activity, the prepayments can be greater than we have anticipated which can

result in an impairment of our on-balance sheet Retained Interest in those trusts due to its shorter life. See

105