Sallie Mae 2007 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

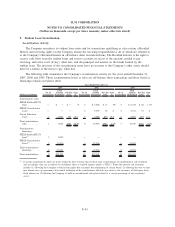

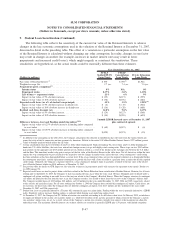

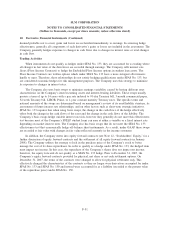

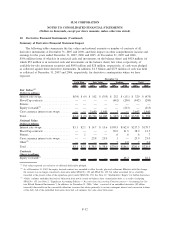

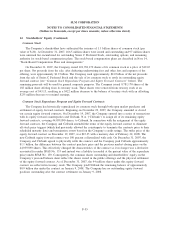

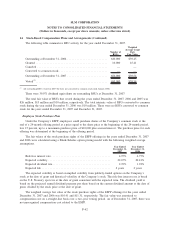

10. Derivative Financial Instruments (Continued)

2007 2006 2005 2007 2006 2005 2007 2006 2005 2007 2006 2005

Cash Flow Fair Value Trading Total

Years Ended December 31,

(Dollars in millions)

Change in fair value of cash flow

hedges . . .................... $(16) $ (7) $(27) $— $— $— $ — $ — $ — $ (16) $ (7) $ (27)

Amortization of effective hedges

(1)

...... 1 12 25 — — — — — — 1 12 25

Discontinued hedges ............... — — 15 — — — — — — — — 15

Change in accumulated other

comprehensive income, net ......... $(15) $ 5 $ 13 $— $— $— $ — $ — $ — $ (15) $ 5 $ 13

Earnings Summary

Amortization of closed futures contracts’

gains/losses in interest expense

(2)

..... $ (2) $(19) $(39) $— $— $— $ — $ — $ — $ (2) $ (19) $ (39)

Gains (losses) on derivative and hedging

activities — Realized

(3)

............ — — — — — — (18) (109) (387) (18) (109) (387)

Gains (losses) on derivative and hedging

activities — Unrealized . . .......... — — — 60

(4)

13

(4)

(3)

(4)

(1,403) (243) 637 (1,343) (230) 634

Total earnings impact .............. $ (2) $(19) $(39) $60 $13 $ (3) $(1,421) $(352) $ 250 $(1,363) $(358) $ 208

(1)

The Company expects to amortize $.1 million of after-tax net losses from accumulated other comprehensive income to earnings during

the next 12 months related to closed futures contracts that were hedging the forecasted issuance of debt instruments that are outstand-

ing as of December 31, 2007.

(2)

For futures contracts that qualify as SFAS No. 133 hedges where the hedged transaction occurs.

(3)

Includes net settlement income/expense related to trading derivatives and realized gains and losses related to derivative dispositions.

(4)

The change in fair value of cash flow and fair value hedges represents amounts related to ineffectiveness.

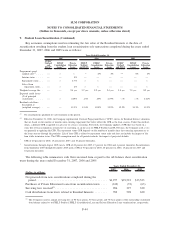

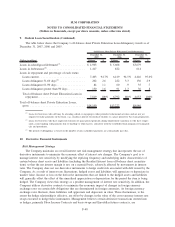

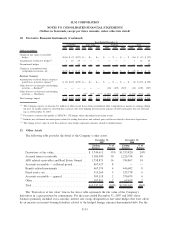

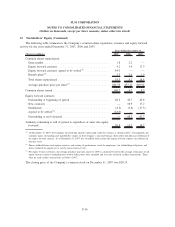

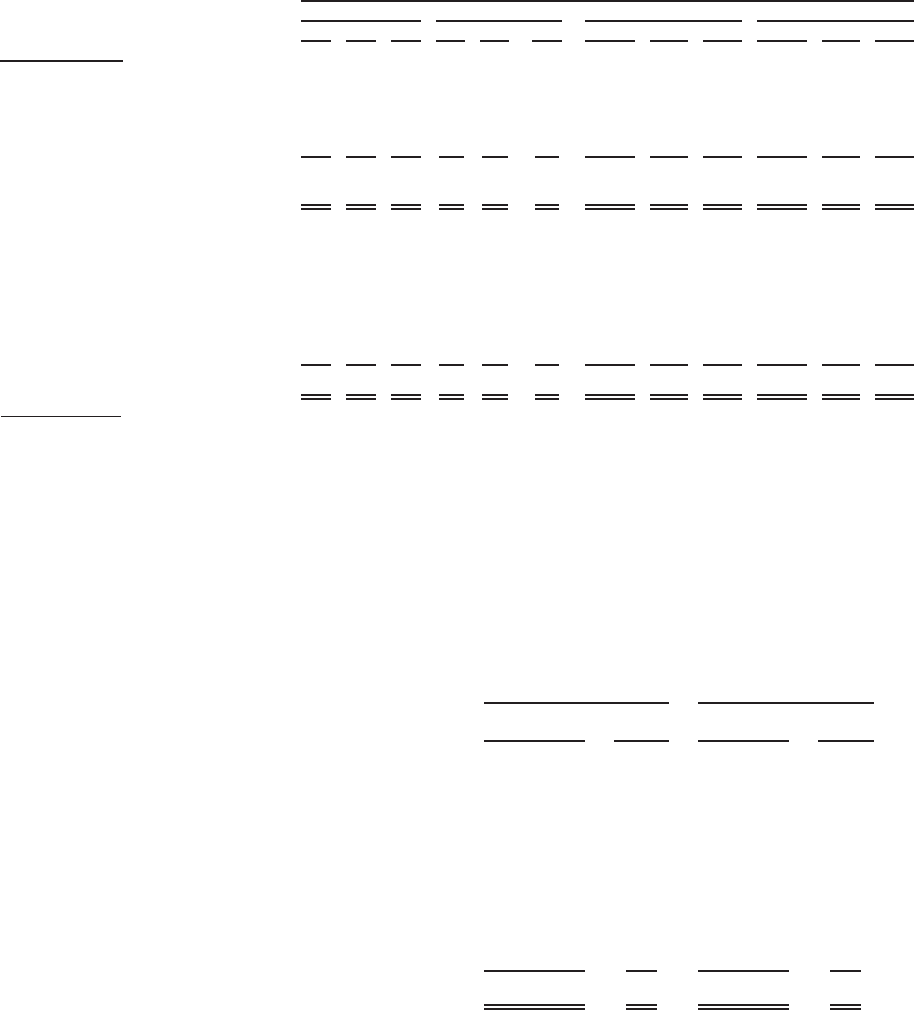

11. Other Assets

The following table provides the detail of the Company’s other assets.

Ending

Balance

%of

Balance

Ending

Balance

%of

Balance

December 31,

2007

December 31,

2006

Derivatives at fair value ..................... $ 3,744,611 35% $1,353,820 24%

Accrued interest receivable .................. 3,180,590 30 2,226,758 40

APG related receivables and Real Estate Owned . . 1,758,871 16 794,867 14

Accounts receivable — collateral posted ......... 867,427 8 — —

Benefit-related investments .................. 467,379 4 446,602 8

Fixed assets, net .......................... 315,260 3 323,778 6

Accounts receivable — general ............... 305,118 2 370,679 6

Other .................................. 107,851 2 69,439 2

Total ................................... $10,747,107 100% $5,585,943 100%

The “Derivatives at fair value” line in the above table represents the fair value of the Company’s

derivatives in a gain position by counterparty. For the years ended December 31, 2007 and 2006, these

balances primarily included cross-currency interest rate swaps designated as fair value hedges that were offset

by an increase in interest-bearing liabilities related to the hedged foreign currency-denominated debt. For the

F-53

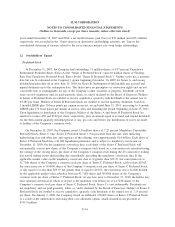

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)