Sallie Mae 2007 Annual Report Download - page 112

Download and view the complete annual report

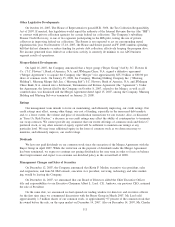

Please find page 112 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Legislative Developments

On October 10, 2007, The House of Representatives passed H.R. 3056, the Tax Collection Responsibility

Act of 2007. If enacted, this legislation would repeal the authority of the Internal Revenue Service (the “IRS”)

to contract with private collection agencies for certain federal tax collections. The Company’s subsidiary,

Pioneer Credit Recovery, is one of two agencies participating in the IRS pilot, testing the use of private

collectors in improving federal tax collections. The Senate is not expected to act on corresponding repeal

legislation this year. On December 17-18, 2007, the House and Senate passed an FY 2008 omnibus spending

bill that did not eliminate or reduce funding for private debt collection, effectively keeping the program alive.

Fee income generated from federal tax collections activity is currently de minimis to our APG business

segment results of operations.

Merger-Related Developments

On April 16, 2007, the Company announced that a buyer group (“Buyer Group”) led by J.C. Flowers &

Co. (“J.C. Flowers”), Bank of America, N.A. and JPMorgan Chase, N.A. signed a definitive agreement

(“Merger Agreement”) to acquire the Company (the “Merger”) for approximately $25.3 billion or $60.00 per

share of common stock. On January 25, 2008, the Company, Mustang Holding Company Inc. (“Mustang

Holding”), Mustang Merger Sub, Inc. (“Mustang Sub”), J.C. Flowers, Bank of America, N.A. and JPMorgan

Chase Bank, N.A. entered into a Settlement, Termination and Release Agreement (the “Agreement”). Under

the Agreement, the lawsuit filed by the Company on October 8, 2007, related to the Merger, as well as all

counterclaims, was dismissed and the Merger Agreement dated April 15, 2007, among the Company, Mustang

Holding and Mustang Sub was terminated on January 25, 2008.

Ratings

Our management team intends to focus on maintaining, and ultimately improving, our credit ratings. Our

credit ratings may affect, among other things, our cost of funding, especially in the unsecured debt markets,

and, to a lesser extent, the volume and price of securitization transactions we can execute. Also, as discussed

in “Item 1A. Risk Factors,” a decrease in our credit ratings may affect the ability of counterparties to terminate

our swap contracts. We cannot provide any assurance that our recent offerings of common stock and Series C

preferred stock, or any other amount of equity capital will be sufficient to maintain our ratings at any

particular level. We may issue additional equity in the form of common stock as we deem necessary to

maintain, and ultimately improve, our credit ratings.

Dividends

We have not paid dividends on our common stock since the execution of the Merger Agreement with the

Buyer Group in April 2007. While the restriction on the payment of dividends under the Merger Agreement

has been terminated, we expect to continue not paying dividends in the near term in order to focus on balance

sheet improvement and expect to re-examine our dividend policy in the second half of 2008.

Management Changes and Sales of Securities

On December 12, 2007, the Company announced that Kevin F. Moehn, executive vice president, sales

and originations, and June M. McCormack, executive vice president, servicing, technology and sales market-

ing, would be leaving the Company.

On December 14, 2007, we announced that our Board of Directors added the Chief Executive Officer

title and responsibilities to our Executive Chairman Albert L. Lord. C.E. Andrews, our previous CEO, assumed

the role of President.

On the same date, we announced we had opened our trading window for directors and executive officers

for the first time since we commenced discussions with the Buyer Group in March 2007. Mr. Lord sold

approximately 1.3 million shares of our common stock, or approximately 97 percent of the common stock that

he owned before the sale, on the open market on December 14, 2007. Also on December 14, 2007, Mr. Charles

111