Sallie Mae 2007 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2007 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

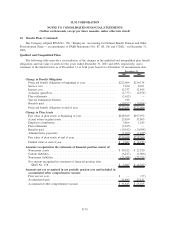

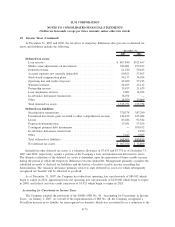

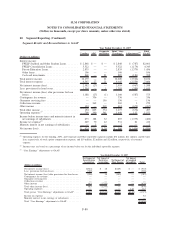

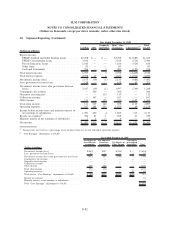

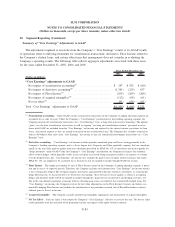

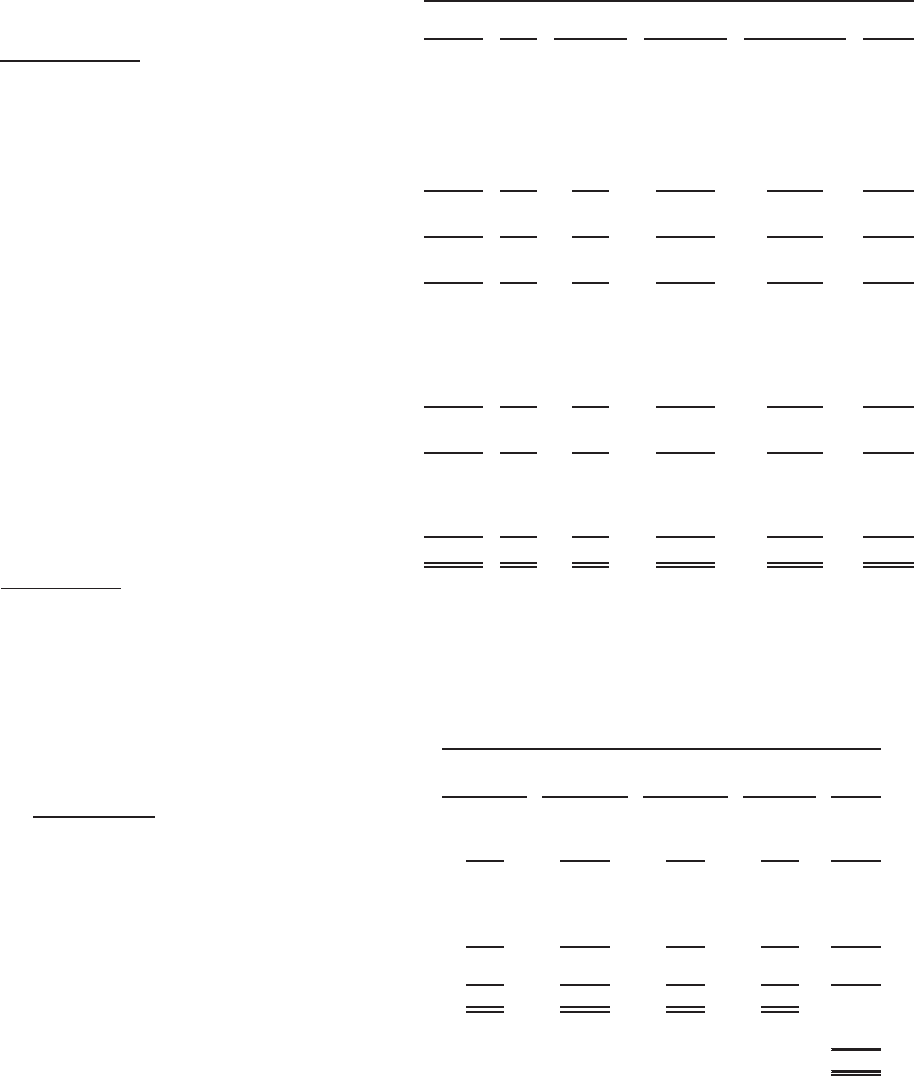

20. Segment Reporting (Continued)

Segment Results and Reconciliations to GAAP

Lending APG

Corporate

and Other

Total “Core

Earnings” Adjustments

(3)

Total

GAAP

Year Ended December 31, 2007

(Dollars in millions)

Interest income:

FFELP Stafford and Other Student Loans . . . . . . . . $ 2,848 $ — $ — $ 2,848 $ (787) $2,061

FFELP Consolidation Loans . . . . . . . . . . . . . . . . . 5,522 — — 5,522 (1,179) 4,343

Private Education Loans . . . . . . . . . . . . . . . . . . . . 2,835 — — 2,835 (1,379) 1,456

Otherloans............................. 106 — — 106 — 106

Cash and investments . . . . . . . . . . . . . . . . . . . . . . 868 — 21 889 (181) 708

Total interest income . . . . . . . . . . . . . . . . . . . . . . . . 12,179 — 21 12,200 (3,526) 8,674

Total interest expense . . . . . . . . . . . . . . . . . . . . . . . 9,597 27 21 9,645 (2,559) 7,086

Net interest income (loss). . . . . . . . . . . . . . . . . . . . . 2,582 (27) — 2,555 (967) 1,588

Less: provisions for loan losses. . . . . . . . . . . . . . . . . 1,394 — 1 1,395 (380) 1,015

Net interest income (loss) after provisions for loan

losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,188 (27) (1) 1,160 (587) 573

Contingency fee revenue . . . . . . . . . . . . . . . . . . . . . — 336 — 336 — 336

Guarantor servicing fees . . . . . . . . . . . . . . . . . . . . . — — 156 156 — 156

Collections revenue . . . . . . . . . . . . . . . . . . . . . . . . . — 269 — 269 3 272

Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 194 — 218 412 (679) (267)

Total other income . . . . . . . . . . . . . . . . . . . . . . . . . 194 605 374 1,173 (676) 497

Operating expenses

(1)

. . . . . . . . . . . . . . . . . . . . . . . 709 390 341 1,440 112 1,552

Income before income taxes and minority interest in

net earnings of subsidiaries . . . . . . . . . . . . . . . . . . 673 188 32 893 (1,375) (482)

Income tax expense

(2)

....................... 249 70 12 331 81 412

Minority interest in net earnings of subsidiaries . . . . . — 2 — 2 — 2

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 424 $116 $ 20 $ 560 $(1,456) $ (896)

(1)

Operating expenses for the Lending, APG, and Corporate and Other reportable segments include $31 million, $11 million, and $15 mil-

lion, respectively, of stock option compensation expense, and $19 million, $2 million and $2 million, respectively, of severance

expense.

(2)

Income taxes are based on a percentage of net income before tax for the individual reportable segment.

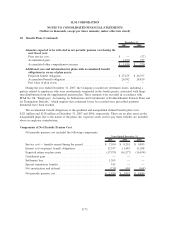

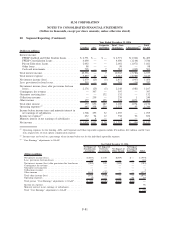

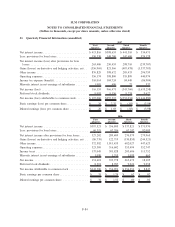

(3)

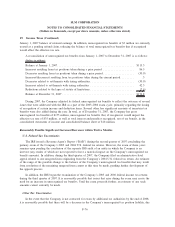

“Core Earnings” adjustments to GAAP:

Net Impact of

Securitization

Accounting

Net Impact of

Derivative

Accounting

Net Impact of

Floor Income

Net Impact

of Acquired

Intangibles Total

Year Ended December 31, 2007

(Dollars in millions)

Net interest income (loss) . . .................... $(816) $ 18 $(169) $ — $ (967)

Less: provisions for loan losses ................... (380) — — — (380)

Net interest income (loss) after provisions for loan losses . . (436) 18 (169) — (587)

Contingency fee revenue . . . .................... — — — — —

Guarantor servicing fees . . . .................... — — — — —

Collections revenue . ......................... — — — — —

Other income .............................. 683 (1,359) — — (676)

Total other income (loss) . . . .................... 683 (1,359) — — (676)

Operating expenses . . ......................... — — — 112 112

Total pre-tax “Core Earnings” adjustments to GAAP . . . . . $ 247 $(1,341) $(169) $(112) (1,375)

Income tax expense . ......................... 81

Minority interest in net earnings of subsidiaries . . . ..... —

Total “Core Earnings” adjustments to GAAP . . ........ $(1,456)

F-80

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share amounts, unless otherwise stated)