PNC Bank 2008 Annual Report Download - page 98

Download and view the complete annual report

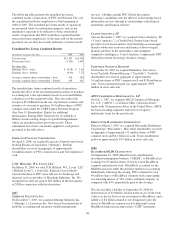

Please find page 98 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ineffectiveness is reflected in the income statement in the

same financial statement category as the hedged item.

For derivatives designated as cash flow hedges (i.e., hedging

the exposure to variability in expected future cash flows), the

effective portions of the gain or loss on derivatives are

reported as a component of accumulated other comprehensive

income (loss) and subsequently reclassified to interest income

in the same period or periods during which the hedged

transaction affects earnings. The change in fair value of any

ineffective portion of the hedging derivative is recognized

immediately in noninterest income.

We discontinue hedge accounting when it is determined that

the derivative is no longer qualifying as an effective hedge;

the derivative expires or is sold, terminated or exercised; or

the derivative is de-designated as a fair value or cash flow

hedge or, for a cash flow hedge, it is no longer probable that

the forecasted transaction will occur by the end of the

originally specified time period. If we determine that the

derivative no longer qualifies as a fair value or cash flow

hedge and hedge accounting is discontinued, the derivative

will continue to be recorded on the balance sheet at its fair

value with changes in fair value included in current earnings.

For a discontinued fair value hedge, the previously hedged

item is no longer adjusted for changes in fair value.

When hedge accounting is discontinued because it is no longer

probable that a forecasted transaction will occur, the

derivative will continue to be recorded on the balance sheet at

its fair value with changes in fair value included in current

earnings, and the gains and losses in accumulated other

comprehensive income (loss) will be recognized immediately

into earnings. When we discontinue hedge accounting because

the hedging instrument is sold, terminated or no longer

designated, the amount reported in accumulated other

comprehensive income (loss) up to the date of sale,

termination or de-designation, continues to be reported in

other comprehensive income or loss until the forecasted

transaction affects earnings. We did not terminate any cash

flow hedges in 2008, 2007 or 2006 due to a determination that

a forecasted transaction was no longer probable of occurring.

We occasionally purchase or originate financial instruments

that contain an embedded derivative. At the inception of the

transaction, we assess if the economic characteristics of the

embedded derivative are clearly and closely related to the

economic characteristics of the financial instrument (host

contract), whether the financial instrument that embodied both

the embedded derivative and the host contract are measured at

fair value with changes in fair value reported in earnings, and

whether a separate instrument with the same terms as the

embedded instrument would not meet the definition of a

derivative. If the embedded derivative does not meet these

three conditions, the embedded derivative would qualify as a

derivative and be recorded apart from the host contract and

carried at fair value with changes recorded in current earnings.

On January 1, 2006, we adopted SFAS 155, which, among

other provisions, permits a fair value election for hybrid

financial instruments requiring bifurcation on an

instrument-by-instrument basis. Beginning January 1, 2006,

we elected to account for certain previously bifurcated hybrid

instruments and certain newly acquired hybrid instruments

under this fair value election on an instrument-by-instrument

basis. As such, certain previously reported embedded

derivatives are reported with their host contracts at fair value

in loans or other borrowed funds.

We enter into commitments to make residential real estate

loans and loans whereby the interest rate on the loan is set

prior to funding (interest rate lock commitments). We also

enter into commitments to purchase or sell commercial

mortgage loans. Loan commitments and interest rate lock

commitments for loans to be classified as held for sale and

commitments to buy or sell mortgage loans are accounted for

as free-standing derivatives and are recorded at fair value in

other assets or other liabilities on the Consolidated Balance

Sheet. Any gain or loss from the change in fair value after the

inception of the commitment is recognized in noninterest

income.

I

NCOME

T

AXES

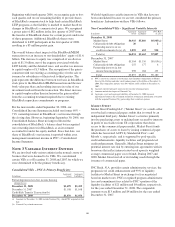

We account for income taxes under the asset and liability

method. Deferred tax assets and liabilities are determined

based on differences between the financial reporting and tax

bases of assets and liabilities and are measured using the

enacted tax rates and laws that we expect will apply at the

time when we believe the differences will reverse. The

realization of deferred tax assets requires an assessment to

determine the realization of such assets. Realization refers to

the incremental benefit achieved through the reduction in

future taxes payable or refunds receivable from the deferred

tax assets, assuming that the underlying deductible differences

and carryforwards are the last items to enter into the

determination of future taxable income. We establish a

valuation allowance for tax assets when it is more likely than

not that they will not be realized, based upon all available

positive and negative evidence.

E

ARNINGS

P

ER

C

OMMON

S

HARE

We calculate basic earnings per common share by dividing net

income adjusted for preferred stock dividends declared by the

weighted-average number of shares of common stock

outstanding.

Diluted earnings per common share are based on net income

available to common stockholders. We increase the weighted-

average number of shares of common stock outstanding by the

assumed conversion of outstanding convertible preferred stock

and debentures from the beginning of the year or date of

issuance, if later, and the number of shares of common stock

that would be issued assuming the exercise of stock options

and warrants and the issuance of incentive shares using the

treasury stock method. These adjustments to the weighted-

average number of shares of common stock outstanding are

94