PNC Bank 2008 Annual Report Download - page 52

Download and view the complete annual report

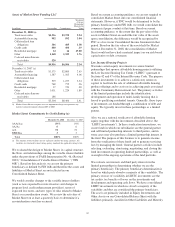

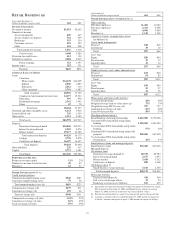

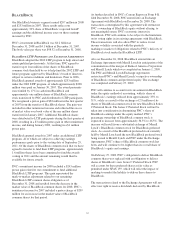

Please find page 52 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(d) Includes nonperforming loans of $605 million at December 31, 2008 and $215

million at December 31, 2007.

(e) Excludes certain satellite branches that provide limited products and service hours.

(f) Excludes brokerage account assets.

(g) Calculated as of origination date.

(h) Represents the most recent FICO scores that we have on file.

(i) The increase at December 31, 2008 compared with December 31, 2007 reflected

large customer deposit activity in the last few days of December 2008.

(j) Represents small business balances. These balances are swept into liquidity products

managed by other PNC business segments, the majority of which are off-balance

sheet.

(k) Financial consultants provide services in full service brokerage offices and PNC

traditional branches.

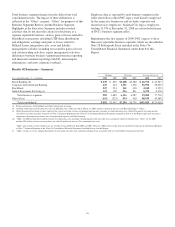

The acquisition of National City on December 31, 2008 added

1,441 branches, including 61 branches that we committed to

divest, and 2,191 ATMs to our distribution network. Including

the impact of National City, our network grew to 2,589

branches and 6,232 ATM machines, giving PNC one of the

largest distribution networks among US banks. The

acquisition also added $53 billion of assets under management

to give the combined company $110 billion in assets under

management.

All other Retail Banking business segment disclosures in this

Item 7 exclude any impact of National City.

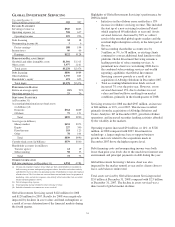

Retail Banking’s earnings were $429 million for 2008

compared with $876 million for 2007. The decline in earnings

over the prior year was primarily driven by increases in the

provision for credit losses and noninterest expense. The 2008

revenue growth was negatively impacted by a lower interest

credit attributed to deposits in the declining rate environment

and was therefore not reflective of the solid growth in

customers and deposits.

Highlights of Retail Banking’s performance during 2008

include the following:

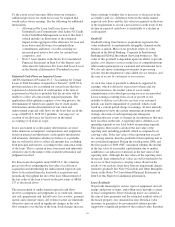

• Retail Banking expanded the number of customers it

serves and grew checking relationships. Total

checking relationships increased by a net 160,000

since December 31, 2007, which includes both the

conversion of Yardville and Sterling accounts as well

as the addition of new relationships through organic

growth. Excluding relationships added from

acquisitions, net new consumer and business

checking relationships grew by 72,000 in 2008

compared with 32,000 a year earlier.

• Average deposit balances increased $3.7 billion or

7% primarily as a result of strong money market

deposit growth and the benefits of the acquisitions.

• Our investment in online banking capabilities

continued to pay off. Since December 31, 2007, the

percentage of consumer checking households using

online bill payment increased from 33% to 41%. We

continue to seek customer growth by expanding our

use of technology, such as the recent launch of our

“Virtual Wallet” online banking product. Recently,

Virtual Wallet received a “Best of the Web” award

for 2008 from Online Banking Report.

• Retail Banking continued to invest in the branch

network. During 2008, we opened 19 new branches,

consolidated 45 branches, and acquired 65 branches

for a total of 1,148 branches at December 31, 2008.

We continue to work to optimize our network by

opening new branches in high growth areas,

relocating branches to areas of higher market

opportunity, and consolidating branches in areas of

declining opportunity. We relocated 8 branches

during 2008.

In October 2008 we announced an exclusive agreement under

which we will provide banking services in Giant Food LLC

supermarket locations across Virginia, Maryland, Delaware

and the District of Columbia. In 2009, we expect to open

approximately 40 new in-store branches and install

approximately 180 ATMs. Additional locations are expected

to open in subsequent years.

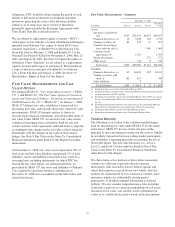

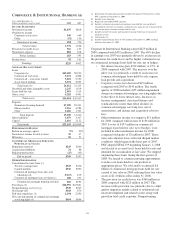

Total revenue for 2008 was $3.608 billion, a 1% increase

compared with $3.580 billion for 2007. Net interest income of

$1.992 billion decreased $70 million, or 3%, compared with

2007. This decline was primarily driven by a lower value

attributed to deposits in the declining rate environment

partially offset by benefits from earlier acquisitions.

Noninterest income increased $98 million, or 6%, compared

with 2007. This growth was attributed primarily to the

following:

• A gain of $95 million from the redemption of a

portion of our Visa Class B common shares related to

Visa’s March 2008 initial public offering,

• The Mercantile, Yardville and Sterling acquisitions,

• Increased volume-related consumer fees including

debit card, credit card, and merchant revenue, and

• Increased brokerage account activities.

These increases were partially offset by lower asset

management fees as a result of lower equity markets and by

other business gains in the prior year.

The Market Risk Management – Equity and Other Investment

Risk section of this Financial Review includes further

information regarding Visa.

The provision for credit losses for 2008 was $612 million

compared to $138 million for 2007. Net charge-offs were

$368 million for 2008 and $131 million in 2007. Asset quality

continued to migrate at an accelerated pace in the very

challenging economic and credit environment. The increases

in provision and net charge-offs were primarily a result of the

following:

• Downward credit migration of residential real estate

development and related sectors, commercial real

estate, and commercial and industrial loan portfolios,

and

• Increased levels of consumer and commercial charge-

offs given the current credit environment.

48