PNC Bank 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

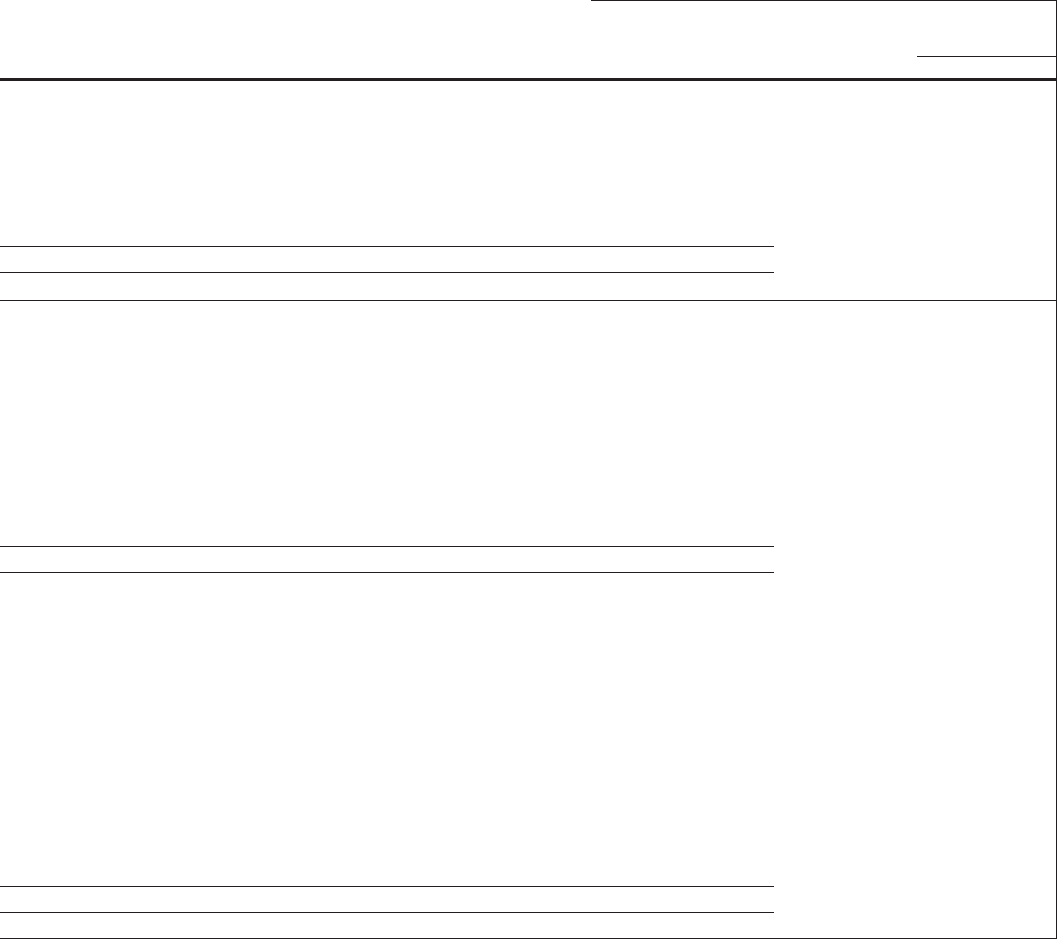

Not all elements of interest rate, market and credit risk are addressed through the use of financial or other derivatives, and such

instruments may be ineffective for their intended purposes due to unanticipated market characteristics, among other reasons.

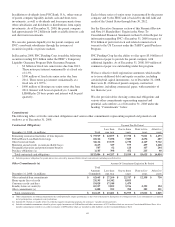

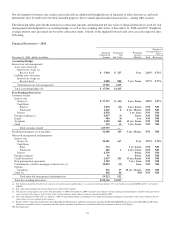

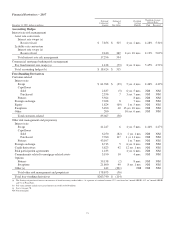

The following tables provide the notional or contractual amounts and estimated net fair value of financial derivatives used for risk

management and designated as accounting hedges as well as free-standing derivatives at December 31, 2008 and 2007. Weighted-

average interest rates presented are based on contractual terms, if fixed, or the implied forward yield curve at each respective date,

if floating.

Financial Derivatives – 2008

December 31, 2008 - dollars in millions

Notional/

Contractual

Amount

Estimated

Net

Fair Value

Weighted

Average

Maturity

Weighted-

Average Interest

Rates

Paid Received

Accounting Hedges

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed $ 5,618 $ 527 3 yrs. 2.18% 4.76%

Liability rate conversion

Interest rate swaps (a)

Receive fixed 9,888 888 3 yrs. 7 mos. 2.27% 4.73%

Total interest rate risk management 15,506 1,415

Total accounting hedges (b) $ 15,506 $1,415

Free-Standing Derivatives

Customer-related

Interest rate

Swaps (c) $ 97,337 $ (161) 4 yrs. 9 mos. 3.08% 3.07%

Caps/floors

Sold (c) 3,878 (12) 4 yrs. 4 mos. NM NM

Purchased 2,410 8 2 yrs. 10 mos. NM NM

Futures 8,878 1 yr. 1 mo. NM NM

Foreign exchange (c) 8,877 (3) 5 mos. NM NM

Equity 984 (4) 1 yr. NM NM

Swaptions 3,058 160 13 yrs. 2 mos. NM NM

Other 335 12 3 yrs. 3 mos. NM NM

Total customer-related 125,757 —

Residential mortgage servicing rights 52,980 109 5 yrs. 10 mos. NM NM

Other risk management and proprietary

Interest rate

Swaps (d) 24,481 667 3 yrs. 3.93% 2.70%

Caps/floors

Sold 514 1 yr. 4 mos. NM NM

Purchased 280 1 4 yrs. 7 mos. NM NM

Futures 8,359 8 mos. NM NM

Foreign exchange 95 4 mos. NM NM

Credit derivatives 2,937 205 13 yrs. 8 mos. NM NM

Risk participation agreements 3,290 3 yrs. 1 mo. NM NM

Commitments related to mortgage-related assets (c) 18,853 (12) 1 mo. NM NM

Options

Swaptions 276 17 10 yrs. 11 mos. NM NM

Other (e) 438 44 NM NM NM

Total other risk management and proprietary 59,523 922

Total free-standing derivatives $238,260 $1,031

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional amount, 55% were based on 1-month LIBOR and 45% on 3-month

LIBOR.

(b) Fair value amount includes net accrued interest receivable of $147 million.

(c) The increases in the negative fair values from December 31, 2007 to December 31, 2008 for interest rate contracts, foreign exchange and commitments related to mortgage-related

assets were due to the changes in fair values of the existing contracts along with new contracts entered into during 2008.

(d) Due to the adoption of SFAS 159 as of January 1, 2008, we discontinued hedge accounting for our commercial mortgage banking pay-fixed interest rate swaps; therefore, the fair

value of these are now reported in this category.

(e) Relates to PNC’s obligation to help fund certain BlackRock LTIP programs. Additional information regarding the BlackRock/MLIM transaction and our BlackRock LTIP shares

obligation is included in Note 2 Acquisitions and Divestitures included in the Notes to Consolidated Financial Statements in Item 8 of this Report.

NM Not meaningful

70