PNC Bank 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

19 S

HAREHOLDERS

’E

QUITY

Preferred Stock

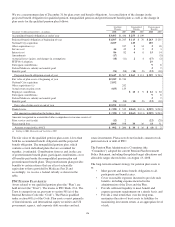

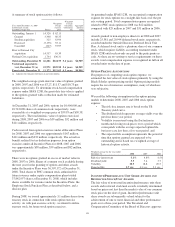

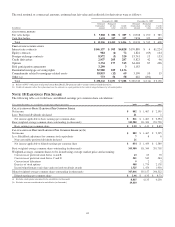

Information related to preferred stock is as follows:

Preferred Shares

December 31

Shares in thousands

Liquidation

value per

share 2008 2007

Authorized

$1 par value 16,960 16,985

Issued and outstanding

Series A $ 40 67

Series B 40 11

Series C 20 119 128

Series D 20 171 186

Series K 10,000 50

Series L 100,000 2

Series N 100,000 76

Total issued and outstanding 425 322

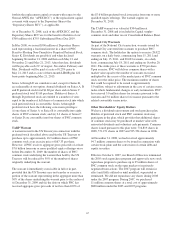

On December 31, 2008, we issued $7.6 billion of Fixed Rate

Cumulative Perpetual Preferred Stock, Series N, to the US

Treasury under the US Treasury’s Troubled Asset Relief

Program (“TARP”) Capital Purchase Program, together with a

warrant to purchase shares of common stock of PNC

described below. Series N dividends are payable on the 15th of

February, May, August and November beginning February 15,

2009. Dividends will be paid at a rate of 5.00% through

February 15, 2014 and 9.00% thereafter. This preferred stock

is redeemable at par plus accrued and unpaid dividends

subject to the approval of our primary banking regulators.

Under the TARP Capital Purchase Program, there are

restrictions on common and preferred dividends and common

share repurchases associated with the preferred stock issued to

the US Treasury. As is typical with cumulative preferred

stock, dividend payments for this preferred stock must be

current before dividends can be paid on junior shares,

including our common stock, or junior shares can be

repurchased or redeemed. Also, the US Treasury’s consent is

required for any increase in common dividends per share

above the most recent level prior to October 14, 2008 until the

third anniversary of the preferred stock issuance as long as the

US Treasury continues to hold any of the preferred stock.

Further, during that same period, the US Treasury’s consent is

required, unless the preferred stock is no longer held by the

US Treasury, for any share repurchases with limited

exceptions, most significantly purchases of common shares in

connection with any benefit plan in the ordinary course of

business consistent with past practice.

As part of the National City transaction, we issued 9.875%

Fixed-to-Floating Rate Non-Cumulative Preferred Stock,

Series L in exchange for National City’s Fixed-to-Floating

Rate Non-Cumulative Preferred Stock, Series F. Dividends are

payable if and when declared each 1st of February, May,

August and November. Dividends will be paid at a rate of

9.875% prior to February 1, 2013 and at a rate of three-month

LIBOR plus 633 basis points beginning February 1, 2013. The

Series L is redeemable at PNC’s option, subject to a

replacement capital covenant for the first ten years after

issuance and subject to Federal Reserve approval, if then

applicable, on or after February 1, 2013 at a redemption price

per share equal to the liquidation preference plus any declared

but unpaid dividends.

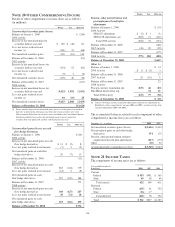

Also as part of the National City transaction, we established

the PNC Non-Cumulative Perpetual Preferred Stock, Series

M, which mirrors in all material respects the former National

City Non-Cumulative Perpetual Preferred Stock, Series E.

PNC has designated 5,751preferred shares, liquidation value

$100,000 per share, for this series. No shares have yet been

issued; however, National City issued stock purchase

contracts for 5,001 shares of its Series E Preferred Stock (now

replaced by the PNC Series M as part of the National City

transaction) to the National City Preferred Capital Trust I in

connection with the issuance by that Trust of $500 million of

12.000% Fixed-to-Floating Rate Normal Automatic Preferred

Enhanced Capital Securities (the “Normal APEX Securities”)

in January 2008 by the Trust. It is expected that the Trust will

purchase 5,001 of the Series M preferred shares pursuant to

these stock purchase contracts on December 10, 2012 or on an

earlier date and possibly as late as December 10, 2013. The

Trust has pledged the $500,100,000 principal amount of

National City 8.729% Junior Subordinated Notes due 2043

held by the Trust and their proceeds to secure this purchase

obligation.

If Series M shares are issued prior to December 10, 2012, any

dividends on such shares will be calculated at a rate per

annum equal to 12.000% until December 10, 2012, and

thereafter, at a rate per annum that will be reset quarterly and

will equal three-month LIBOR for the related dividend period

plus 8.610%. Dividends will be payable if and when declared

by the Board at the dividend rate so indicated applied to the

liquidation preference per share of the Series M Preferred

Stock. The Series M is redeemable at PNC’s option, subject to

a replacement capital covenant for the first ten years after

issuance and subject to Federal Reserve approval, if then

applicable, on or after December 10, 2012 at a redemption

price per share equal to the liquidation preference plus any

declared but unpaid dividends.

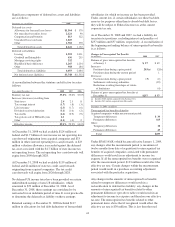

As a result of the National City transaction, we assumed

National City’s obligations under replacement capital

covenants with respect to (i) the Normal APEX Securities and

our Series M shares and (ii) National City’s 6,000,000 of

Depositary Shares (each representing 1/4000th of an interest

in a share of our 9.875% Fixed-to-Floating Rate

Non-Cumulative Preferred Stock, Series L), whereby we

agreed not to cause the redemption or repurchase of the

Normal APEX or Depositary Shares, as applicable, or the

underlying Preferred Stock and/or junior subordinated notes,

as applicable, unless such repurchases or redemptions are

made from the proceeds of the issuance of certain qualified

securities and pursuant to the other terms and conditions set

136