PNC Bank 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Policy area provides independent oversight to the

measurement, monitoring and reporting of our credit risk and

reports to the Chief Administrative Officer. Corporate Audit

also provides an independent assessment of the effectiveness

of the credit risk management process.

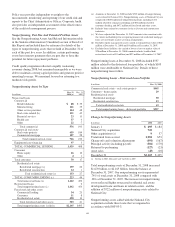

Nonperforming, Past Due And Potential Problem Assets

See the Nonperforming Assets And Related Information table

in the Statistical Information (Unaudited) section of Item 8 of

this Report and included here by reference for details of the

types of nonperforming assets that we held at December 31 of

each of the past five years. In addition, certain performing

assets have interest payments that are past due or have the

potential for future repayment problems.

Credit quality migration reflected a rapidly weakening

economy during 2008, but remained manageable as we were

able to maintain a strong capital position and generate positive

operating leverage. We remained focused on returning to a

moderate risk profile.

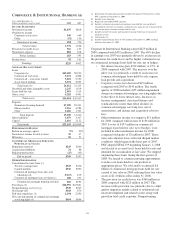

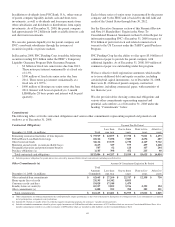

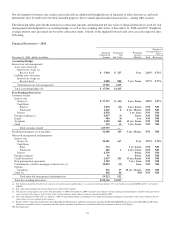

Nonperforming Assets by Type

In millions

Dec. 31

2008 (a)

Dec. 31

2007

Nonaccrual loans

Commercial

Retail/wholesale $88$39

Manufacturing 141 35

Other service providers 114 48

Real estate related (b) 151 45

Financial services 23 15

Health care 37 4

Other 22 7

Total commercial 576 193

Commercial real estate

Real estate projects 659 184

Commercial mortgage 107 28

Total commercial real estate 766 212

Equipment lease financing 97 3

TOTAL COMMERCIAL LENDING 1,439 408

Consumer

Home equity 66 16

Other 41

Total consumer 70 17

Residential real estate

Residential mortgage (c) 139 26

Residential construction 14 1

Total residential real estate (c) 153 27

TOTAL CONSUMER LENDING (c) 223 44

Total nonaccrual loans (c) 1,662 452

Restructured loans 2

Total nonperforming loans (c) 1,662 454

Foreclosed and other assets

Commercial lending 34 23

Consumer 11 8

Residential real estate 458 10

Total foreclosed and other assets 503 41

Total nonperforming assets (c)(d)(e) $2,165 $495

(a) Amounts at December 31, 2008 include $722 million of nonperforming

assets related to National City. Nonperforming assets of National City are

comprised of $250 million of nonperforming loans, including $154

million related to commercial lending and $96 million related to

consumer lending, and $472 million of foreclosed and other assets.

(b) Includes loans related to customers in the real estate and construction

industries.

(c) We have adjusted the December 31, 2007 amounts to be consistent with

the current methodology for recognizing nonaccrual residential mortgage

loans serviced under master servicing arrangements.

(d) Excludes equity management assets carried at estimated fair value of $42

million at December 31, 2008 and $4 million at December 31, 2007.

(e) Excludes loans held for sale carried at lower of cost or market value of

$78 million at December 31, 2008 (amount includes troubled debt

restructured assets of $5 million) and $25 million at December 31, 2007.

Nonperforming loans at December 31, 2008 included $537

million related to the distressed loan portfolio, of which $103

million were attributable to National City. Details of these

nonperforming loans follow.

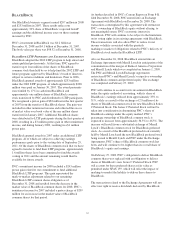

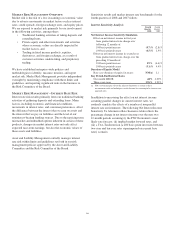

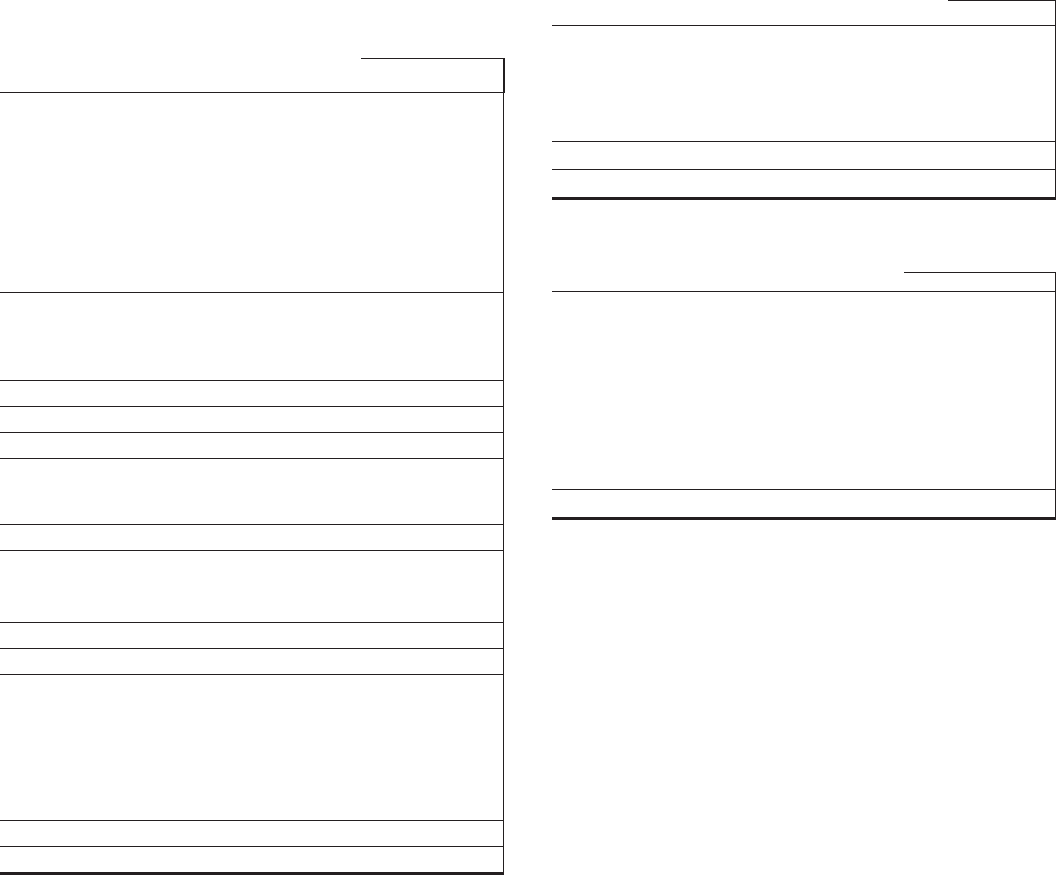

Nonperforming Loans - Distressed Loan Portfolio

In millions Dec. 31, 2008

Commercial real estate – real estate projects $445

Consumer – home equity 29

Residential real estate

Residential mortgage 50

Residential construction 13

Total residential real estate 63

Total nonperforming loans – distressed portfolio $537

Change In Nonperforming Assets

In millions 2008 2007

January 1 $ 495 $ 184

National City acquisition 722

Other acquisitions (a) 937

Transferred from accrual 1,981 653

Charge-offs and valuation adjustments (491) (167)

Principal activity including payoffs (381) (179)

Returned to performing (127) (23)

Asset sales (43) (10)

December 31 $2,165 $ 495

(a) Sterling in 2008; Mercantile and Yardville in 2007.

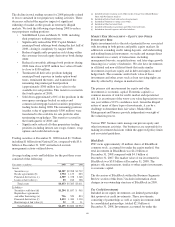

Total nonperforming assets at December 31, 2008 increased

$1.670 billion, to $2.165 billion, from the balance at

December 31, 2007. Our nonperforming assets represented

.74% of total assets at December 31, 2008 compared with

.36% at December 31, 2007. The increase in nonperforming

assets reflected higher nonaccrual residential real estate

development loans and loans in related sectors, and the

addition of $722 million of nonperforming assets related to

National City.

Nonperforming assets added with the National City

acquisition exclude those loans that we impaired in

accordance with SOP 03-3.

60