PNC Bank 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based upon the current environment and the acquisition of

National City, we believe the provision and nonperforming

assets will continue to increase in 2009 versus 2008 levels.

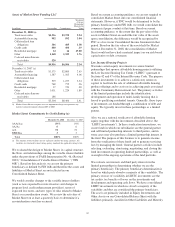

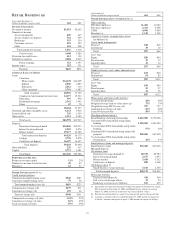

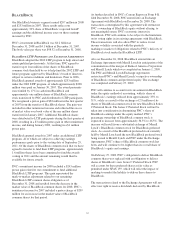

Noninterest expense for 2008 totaled $2.284 billion, an

increase of $239 million compared with 2007. Approximately

76% of this increase was attributable to acquisitions and

continued investments in the business such as the branch

network and innovation.

Full-time employees at December 31, 2008 totaled 11,481, an

increase of 459 over the prior year. Part-time employees have

increased by 65 since December 31, 2007. The increase in

full-time and part-time employees was primarily the result of

the Yardville and Sterling acquisitions.

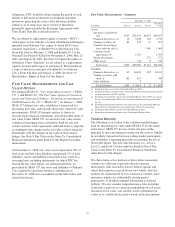

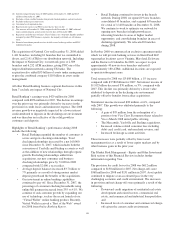

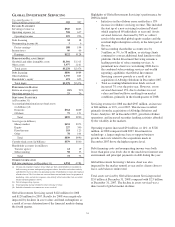

Growing core checking deposits as a lower-cost funding

source and as the cornerstone product to build customer

relationships is the primary objective of our deposit strategy.

Furthermore, core checking accounts are critical to our

strategy of expanding our payments business. Average total

deposits increased $3.7 billion, or 7%, compared with 2007.

• Average money market deposits increased $2.9

billion, and average certificates of deposits declined

$.2 billion. Money market deposits experienced core

growth and both deposit categories benefited from

the acquisitions. The decline in certificates of

deposits was a result of a focus on relationship

customers rather than pursuing higher-rate single

service customers. The deposit strategy of Retail

Banking is to remain disciplined on pricing, target

specific products and markets for growth, and focus

on the retention and growth of balances for

relationship customers.

• Average demand deposit growth of $1.1 billion, or

5%, was primarily driven by acquisitions as organic

growth was impacted by current economic

conditions, such as lower average balances per

account.

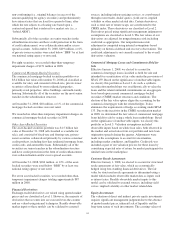

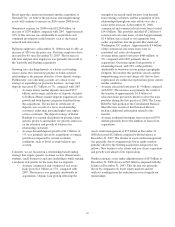

Currently, we are focused on a relationship-based lending

strategy that targets specific customer sectors (homeowners,

students, small businesses and auto dealerships) while seeking

a moderate risk profile for the loans that we originate.

• Average commercial and commercial real estate

loans grew $2.1 billion, or 17%, compared with

2007. The increase was primarily attributable to

acquisitions. Organic loan growth reflecting the

strength of increased small business loan demand

from existing customers and the acquisition of new

relationships through our sales efforts was also a

factor in the increase. At December 31, 2008,

commercial and commercial real estate loans totaled

$14.6 billion. This portfolio included $3.2 billion of

commercial real estate loans, of which approximately

$2.4 billion were related to our expansion from

earlier acquisitions into the greater Maryland and

Washington, DC markets. Approximately $.4 billion

of the commercial real estate loans were in

residential real estate development.

• Average home equity loans grew $469 million, or

3%, compared with 2007 primarily due to

acquisitions. Our home equity loan portfolio is

relationship based, with 93% of the portfolio

attributable to borrowers in our primary geographic

footprint. We monitor this portfolio closely and the

nonperforming assets and charge-offs that we have

experienced are within our expectations given current

market conditions.

• Average education loans grew $1.9 billion compared

with 2007. The increase was primarily the result of

the transfer of approximately $1.8 billion of

education loans previously held for sale to the loan

portfolio during the first quarter of 2008. The Loans

Held For Sale portion of the Consolidated Balance

Sheet Review section of this Financial Review

includes additional information related to this

transfer.

• Average residential mortgage loans increased $370

million primarily due to the addition of loans from

acquisitions.

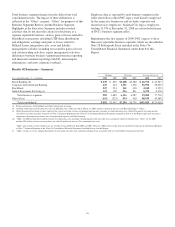

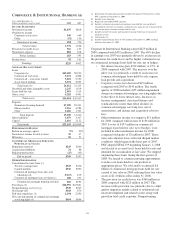

Assets under management of $57 billion at December 31,

2008 decreased $12 billion compared with the balance at

December 31, 2007. The decline in assets under management

was primarily due to comparatively lower equity markets

partially offset by the Sterling acquisition and positive net

inflows. New business sales efforts and new client acquisition

and growth were ahead of our expectations.

Nondiscretionary assets under administration of $87 billion at

December 31, 2008 decreased $25 billion compared with the

balance at December 31, 2007. This decline was primarily

driven by comparatively lower equity markets and net

outflows resulting from the reduction in several significant

relationships.

49