PNC Bank 2008 Annual Report Download - page 82

Download and view the complete annual report

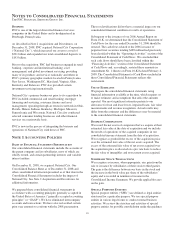

Please find page 82 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including in the Risk Factors and Risk Management sections.

Our forward-looking statements may also be subject to other

risks and uncertainties, including those discussed elsewhere in

this Report or in our other filings with the SEC.

• Our businesses and financial results are affected by

business and economic conditions, both generally and

specifically in the principal markets in which we operate.

In particular, our businesses and financial results may be

impacted by:

– Changes in interest rates and valuations in the debt,

equity and other financial markets.

– Disruptions in the liquidity and other functioning of

financial markets, including such disruptions in the

markets for real estate and other assets commonly

securing financial products.

– Actions by the Federal Reserve and other

government agencies, including those that impact

money supply and market interest rates.

– Changes in our customers’, suppliers’ and other

counterparties’ performance in general and their

creditworthiness in particular.

– Changes in customer preferences and behavior,

whether as a result of changing business and

economic conditions or other factors.

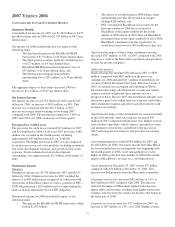

• A continuation of recent turbulence in significant

portions of the US and global financial markets,

particularly if it worsens, could impact our performance,

both directly by affecting our revenues and the value of

our assets and liabilities and indirectly by affecting our

counterparties and the economy generally.

• Our business and financial performance could be

impacted as the financial industry restructures in the

current environment, both by changes in the

creditworthiness and performance of our counterparties

and by changes in the competitive landscape.

• Given current economic and financial market conditions,

our forward-looking financial statements are subject to

the risk that these conditions will be substantially

different than we are currently expecting. These

statements are based on our current expectations that

interest rates will remain low through 2009 with

continued wide market credit spreads, and our view that

national economic trends currently point to a

continuation of severe recessionary conditions in 2009

followed by a subdued recovery.

• Legal and regulatory developments could have an impact

on our ability to operate our businesses or our financial

condition or results of operations or our competitive

position or reputation. Reputational impacts, in turn,

could affect matters such as business generation and

retention, our ability to attract and retain management,

liquidity, and funding. These legal and regulatory

developments could include:

– Changes resulting from the Emergency Economic

Stabilization Act of 2008, the American Recovery

and Reinvestment Act of 2009, and other

developments in response to the current economic

and financial industry environment, including current

and future conditions or restrictions imposed as a

result of our participation in the TARP Capital

Purchase Program.

– Legislative and regulatory reforms generally,

including changes to laws and regulations involving

tax, pension, bankruptcy, consumer protection, and

other aspects of the financial institution industry.

– Increased litigation risk from recent regulatory and

other governmental developments.

– Unfavorable resolution of legal proceedings or

regulatory and other governmental inquiries.

– The results of the regulatory examination and

supervision process, including our failure to satisfy

the requirements of agreements with governmental

agencies.

– Changes in accounting policies and principles.

• Our issuance of securities to the US Department of the

Treasury may limit our ability to return capital to our

shareholders and is dilutive to our common shares. If we

are unable previously to redeem the shares, the dividend

rate increases substantially after five years.

• Our business and operating results are affected by our

ability to identify and effectively manage risks inherent

in our businesses, including, where appropriate, through

the effective use of third-party insurance, derivatives, and

capital management techniques.

• The adequacy of our intellectual property protection, and

the extent of any costs associated with obtaining rights in

intellectual property claimed by others, can impact our

business and operating results.

• Our ability to anticipate and respond to technological

changes can have an impact on our ability to respond to

customer needs and to meet competitive demands.

• Our ability to implement our business initiatives and

strategies could affect our financial performance over the

next several years.

• Competition can have an impact on customer acquisition,

growth and retention, as well as on our credit spreads and

product pricing, which can affect market share, deposits

and revenues.

• Our business and operating results can also be affected

by widespread natural disasters, terrorist activities or

international hostilities, either as a result of the impact on

the economy and capital and other financial markets

generally or on us or on our customers, suppliers or other

counterparties specifically.

• Also, risks and uncertainties that could affect the results

anticipated in forward-looking statements or from

historical performance relating to our equity interest in

BlackRock, Inc. are discussed in more detail in

BlackRock’s filings with the SEC, including in the Risk

Factors sections of BlackRock’s reports. BlackRock’s

SEC filings are accessible on the SEC’s website and on

or through BlackRock’s website at www.blackrock.com.

78