PNC Bank 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

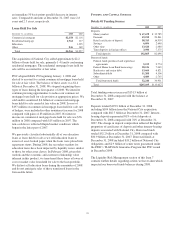

obligations, PNC would be subject during the period of such

default or deferral to restrictions on dividends and other

provisions protecting the status of the debenture holders

similar to or in some ways more restrictive than those

potentially imposed under the Exchange Agreements with

Trust II and Trust III, as described above.

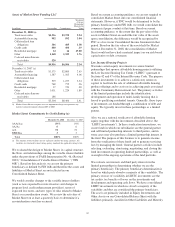

We are subject to replacement capital covenants (“RCCs”)

with respect to four tranches of junior subordinated debentures

inherited from National City, copies of which RCCs were

attached, respectively, as Exhibit 99.2 to the National City

Form 8-K filed on February 4, 2008 and Exhibit 99.1 to the

National City Forms 8-K filed on November 9, 2006, May 25,

2007 and August 30, 2007. See Note 14 Capital Securities of

Subsidiary Trusts. Similarly, we are subject to a replacement

capital covenant with respect to our Series L Preferred Stock,

a copy of which was attached as Exhibit 99.1 to National

City’s Form 8-K filed on February 4, 2008. See Note 19

Shareholders’ Equity in Item 8 of this Report.

F

AIR

V

ALUE

M

EASUREMENTS AND

F

AIR

V

ALUE

O

PTION

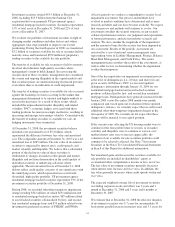

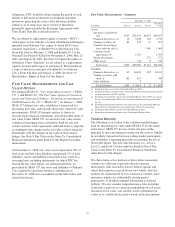

We adopted SFAS 157, “Fair Value Measurements” (“SFAS

157”), and SFAS 159, “The Fair Value Option for Financial

Assets and Financial Liabilities – Including an amendment of

FASB Statement No. 115” (“SFAS 159”), on January 1, 2008.

SFAS 157 defines fair value, establishes a framework for

measuring fair value, and expands disclosures about fair value

measurements. SFAS 159 permits entities to choose to

measure many financial instruments and certain other items at

fair value. Under SFAS 159, we elected to fair value certain

commercial mortgage loans classified as held for sale and

certain customer resale agreements and bank notes to align the

accounting for the changes in the fair value of these financial

instruments with the changes in the value of their related

hedges. See Note 8 Fair Value in the Notes To Consolidated

Financial Statements under Item 8 of this Report for further

information.

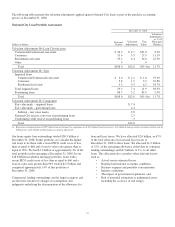

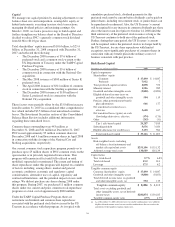

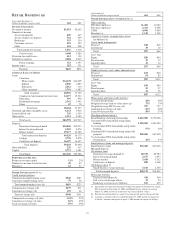

At December 31, 2008, fair value assets represented 13% of

total assets and fair value liabilities represented 2% of total

liabilities. Assets and liabilities measured at fair value on a

recurring basis, including instruments for which PNC has

elected the fair value option, are summarized below. As

prescribed by SFAS 157, the assets and liabilities of National

City acquired in a purchase business combination on

December 31, 2008 were excluded from the table below and

related disclosures.

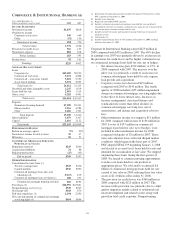

Fair Value Measurements – Summary

In millions

December 31, 2008

Level 1 Level 2 Level 3

Total Fair

Value

Assets

Securities available for

sale $347 $21,633 $4,837 $26,817

Financial derivatives (a) 16 5,582 125 5,723

Trading securities (b) 89 529 73 691

Commercial mortgage

loans held for sale (c) 1,400 1,400

Customer resale

agreements (d) 1,072 1,072

Equity investments 571 571

Other assets 144 6 150

Total assets $452 $28,960 $7,012 $36,424

Liabilities

Financial derivatives (e) $2 $4,387 $22 $4,411

Trading securities sold

short (f) 182 207 389

Other liabilities 9 9

Total liabilities $184 $ 4,603 $ 22 $ 4,809

(a) Included in other assets on the Consolidated Balance Sheet.

(b) Included in trading securities on the Consolidated Balance Sheet. Fair value includes

net unrealized losses of $27.5 million.

(c) Included in loans held for sale on the Consolidated Balance Sheet. PNC has elected

the fair value option under SFAS 159 for certain commercial mortgage loans held

for sale.

(d) Included in federal funds sold and resale agreements on the Consolidated Balance

Sheet. PNC has elected the fair value option under SFAS 159 for this item.

(e) Included in other liabilities on the Consolidated Balance Sheet.

(f) Included in other borrowed funds on the Consolidated Balance Sheet.

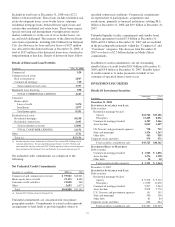

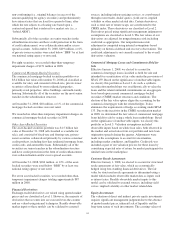

Valuation Hierarchy

The following is an outline of the valuation methodologies

used for measuring fair value under SFAS 157 for the major

items above. SFAS 157 focuses on the exit price in the

principal or most advantageous market for the asset or liability

in an orderly transaction between willing market participants

and establishes a reporting hierarchy to maximize the use of

observable inputs. The fair value hierarchy (i.e., Level 1,

Level 2, and Level 3) is described in detail in Note 8 Fair

Value in the Notes To Consolidated Financial Statements

under Item 8 of this Report.

We characterize active markets as those where transaction

volumes are sufficient to provide objective pricing

information, with reasonably narrow bid/ask spreads and

where dealer quotes received do not vary widely. Inactive

markets are characterized by low transaction volumes, price

quotations which vary substantially among market

participants, or in which minimal information is released

publicly. We also consider nonperformance risks including

credit risk as part of our valuation methodology for all assets

measured at fair value. Any models used to determine fair

values or to validate dealer quotes based on the descriptions

42