PNC Bank 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

2A

CQUISITIONS AND

D

IVESTITURES

2008

N

ATIONAL

C

ITY

C

ORPORATION

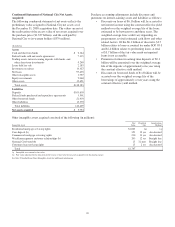

On December 31, 2008, we acquired National City for

approximately $6.1 billion. The total consideration included

approximately $5.6 billion of common stock, representing

approximately 95 million shares, $150 million of preferred

stock and cash of $379 million paid to warrant holders by

National City. The transaction requires no future contingent

consideration payments.

National City, based in Cleveland, Ohio, was one of the

nation’s largest financial services companies. At

December 31, 2008, prior to our acquisition, National City had

total assets of approximately $153 billion and total deposits of

approximately $101 billion. National City operates through an

extensive network in Ohio, Florida, Illinois, Indiana,

Kentucky, Michigan, Missouri, Pennsylvania and Wisconsin

and also conducts selected consumer lending businesses and

other financial services on a nationwide basis. Its primary

businesses include commercial and retail banking, mortgage

financing and servicing, consumer finance and asset

management. The primary reasons for the merger with

National City were to enhance shareholder value, to improve

PNC’s competitive position in the financial services industry

and to further expand PNC’s existing branch network in states

where it currently operates as well as expanding into new

markets.

This acquisition was accounted for under the purchase method

of accounting. The purchase price was allocated to the

National City assets acquired and liabilities assumed using

their estimated fair values as of the acquisition date,

December 31, 2008. Since the acquisition occurred at year

end, no results of operations of National City are included in

the Consolidated Income Statement. The summary

computation of the purchase price and the allocation of the

purchase price to the net assets of National City are presented

below. The allocation of the purchase price may be modified

through 2009 as more information, such as appraisals,

contracts, reviews of legal documentation, and selected key

borrower data, is obtained about the fair value of assets

acquired and liabilities assumed and may result in goodwill.

We also have not yet finalized our plans to exit National City

facilities or identified employee terminations. Completion of

these plans will likely result in additional liabilities in future

periods.

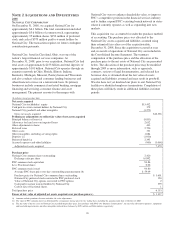

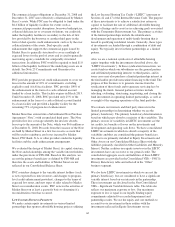

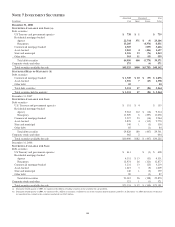

(In millions, except per share data)

Net assets acquired

National City stockholders’ equity $13,432

Cash paid to certain warrant holders by National City 379

National City goodwill and other intangibles (3,275)

Gross net assets acquired $10,536

Preliminary adjustments to reflect fair value of net assets acquired

Principal balance of loans (a) (9,831)

Allowance for loan losses on impaired loans 2,632

Other adjustments to loans 433

Deferred taxes 2,720

Other assets 331

Other intangibles, including servicing rights 1,084

Deposits (a) (1,930)

Borrowed funds (a) 2,395

Accrued expenses and other liabilities (900) (3,066)

Adjusted net assets acquired 7,470

Purchase price

National City common shares outstanding 2,420

Exchange ratio per share 0.0392

PNC common stock equivalent 94.86

Less: Fractional shares 0.06

PNC common stock issued 94.80

Average PNC share price over days surrounding announcement (b) $ 59.09

Purchase price for National City common shares outstanding $ 5,601

National City preferred stock converted to PNC preferred stock 150

Value of National City options converted to PNC options 2

Cash paid to certain warrant holders by National City 379

Cash in lieu of fractional shares 1

Total purchase price 6,133

Excess of fair value of adjusted net assets acquired over purchase price (c) $ 1,337

(a) Amounts include premium, discount and other fair value adjustments.

(b) The value of PNC common stock was determined by averaging its closing price for five trading days, including the announcement date of October 24, 2008.

(c) The fair value of the net assets of National City exceeded the purchase price. In accordance with SFAS 141 “Business Combinations”, the fair value allocated to premises, equipment

and leasehold improvements and other intangibles reduced these balances by $891 million and $446 million, respectively.

98