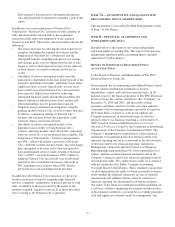

PNC Bank 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

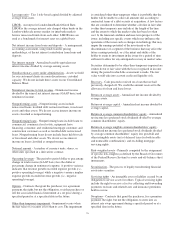

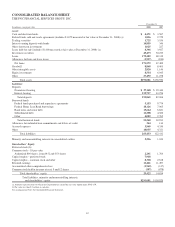

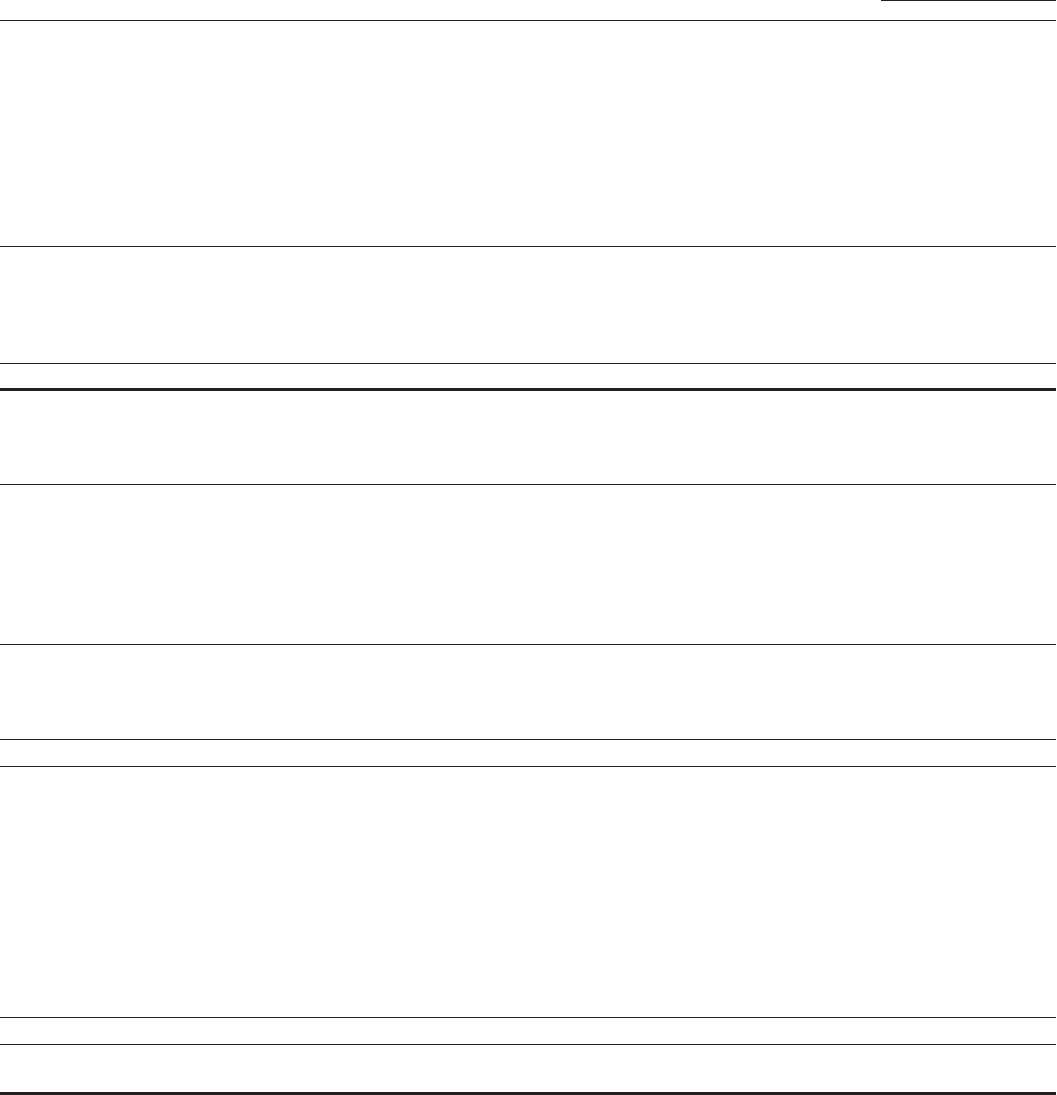

CONSOLIDATED BALANCE SHEET

THE PNC FINANCIAL SERVICES GROUP, INC.

December 31

In millions, except par value 2008 2007

Assets

Cash and due from banks $ 4,471 $ 3,567

Federal funds sold and resale agreements (includes $1,072 measured at fair value at December 31, 2008) (a) 1,856 2,729

Trading securities 1,725 3,556

Interest-earning deposits with banks 14,859 346

Other short-term investments 1,025 227

Loans held for sale (includes $1,400 measured at fair value at December 31, 2008) (a) 4,366 3,927

Investment securities 43,473 30,225

Loans 175,489 68,319

Allowance for loan and lease losses (3,917) (830)

Net loans 171,572 67,489

Goodwill 8,868 8,405

Other intangible assets 2,820 1,146

Equity investments 8,554 6,045

Other 27,492 11,258

Total assets $291,081 $138,920

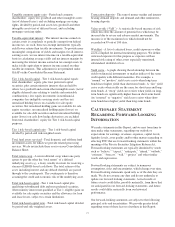

Liabilities

Deposits

Noninterest-bearing $ 37,148 $ 19,440

Interest-bearing 155,717 63,256

Total deposits 192,865 82,696

Borrowed funds

Federal funds purchased and repurchase agreements 5,153 9,774

Federal Home Loan Bank borrowings 18,126 7,065

Bank notes and senior debt 13,664 6,821

Subordinated debt 11,208 4,506

Other 4,089 2,765

Total borrowed funds 52,240 30,931

Allowance for unfunded loan commitments and letters of credit 344 134

Accrued expenses 3,949 4,330

Other 14,035 4,321

Total liabilities 263,433 122,412

Minority and noncontrolling interests in consolidated entities 2,226 1,654

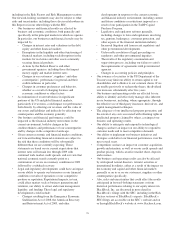

Shareholders’ Equity

Preferred stock (b)

Common stock – $5 par value

Authorized 800 shares, issued 452 and 353 shares 2,261 1,764

Capital surplus – preferred stock 7,918

Capital surplus – common stock and other 8,328 2,618

Retained earnings 11,461 11,497

Accumulated other comprehensive loss (3,949) (147)

Common stock held in treasury at cost: 9 and 12 shares (597) (878)

Total shareholders’ equity 25,422 14,854

Total liabilities, minority and noncontrolling interests,

and shareholders’ equity $291,081 $138,920

(a) Amounts represent items for which the Corporation has elected the fair value option under SFAS 159.

(b) Par value less than $.5 million at each date.

See accompanying Notes To Consolidated Financial Statements.

82