PNC Bank 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

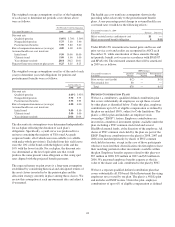

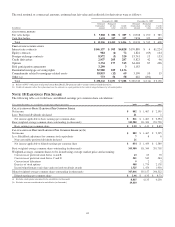

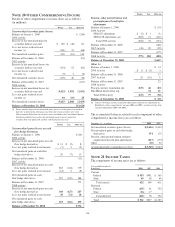

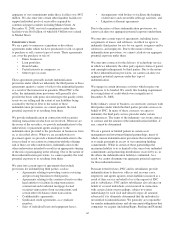

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2008 2007

Deferred tax assets

Allowance for loan and lease losses $1,564 $ 370

Net unrealized securities losses 2,121 90

Compensation and benefits 813 322

Unrealized losses on loans 1,825

Other 1,918 370

Total deferred tax assets 8,241 1,152

Deferred tax liabilities

Leasing 1,292 1,011

Goodwill and Intangibles 636 255

Mortgage servicing rights 332

BlackRock basis difference 1,265 1,234

Other 968 184

Total deferred tax liabilities 4,493 2,684

Net deferred asset (liability) $3,748 $(1,532)

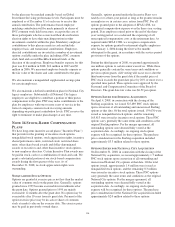

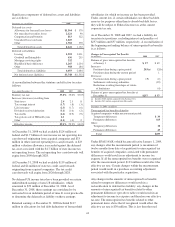

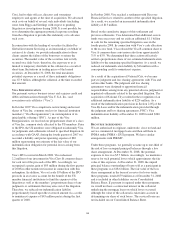

A reconciliation between the statutory and effective tax rates

follows:

Year ended December 31 2008 2007 2006

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes 2.4 2.3 .8

Tax-exempt interest (1.7) (.8) (.3)

Life insurance (2.3) (1.7) (.6)

Dividend received deduction (3.1) (1.6) (.2)

Tax credits (4.2) (2.9) (.9)

Tax gain on sale of Hilliard Lyons 4.1

Other (1.1) (.4) .2

Effective tax rate 29.1% 29.9% 34.0%

At December 31, 2008 we had available $124 million of

federal and $1.7 billion of state income tax net operating loss

carryforward originating from acquired companies and $33

million in other state net operating loss carryforwards. A $23

million valuation allowance is recorded against the deferred

tax asset associated with the $1.7 billion of state income tax

net operating losses. The net operating loss carryforwards will

expire from 2009 through 2028.

At December 31, 2008 we had available $119 million of

federal and $4 million of state tax credit carryforwards

originating from acquired companies. The tax credit

carryforwards will expire from 2026 through 2028.

No deferred US income taxes have been provided on certain

undistributed earnings of non-US subsidiaries, which

amounted to $59 million at December 31, 2008. As of

December 31, 2008, these earnings are considered to be

reinvested for an indefinite period of time. It is not practicable

to determine the deferred tax liability on these earnings.

Retained earnings at December 31, 2008 included $117

million in allocations for bad debt deductions of former thrift

subsidiaries for which no income tax has been provided.

Under current law, if certain subsidiaries use these bad debt

reserves for purposes other than to absorb bad debt losses,

they will be subject to Federal income tax at the current

corporate tax rate.

As of December 31, 2008 and 2007, we had a liability for

uncertain tax positions, excluding interest and penalties of

$257 million and $57 million, respectively. A reconciliation of

the beginning and ending balance of unrecognized tax benefits

is as follows:

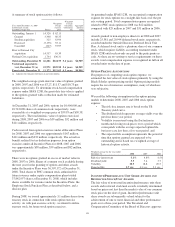

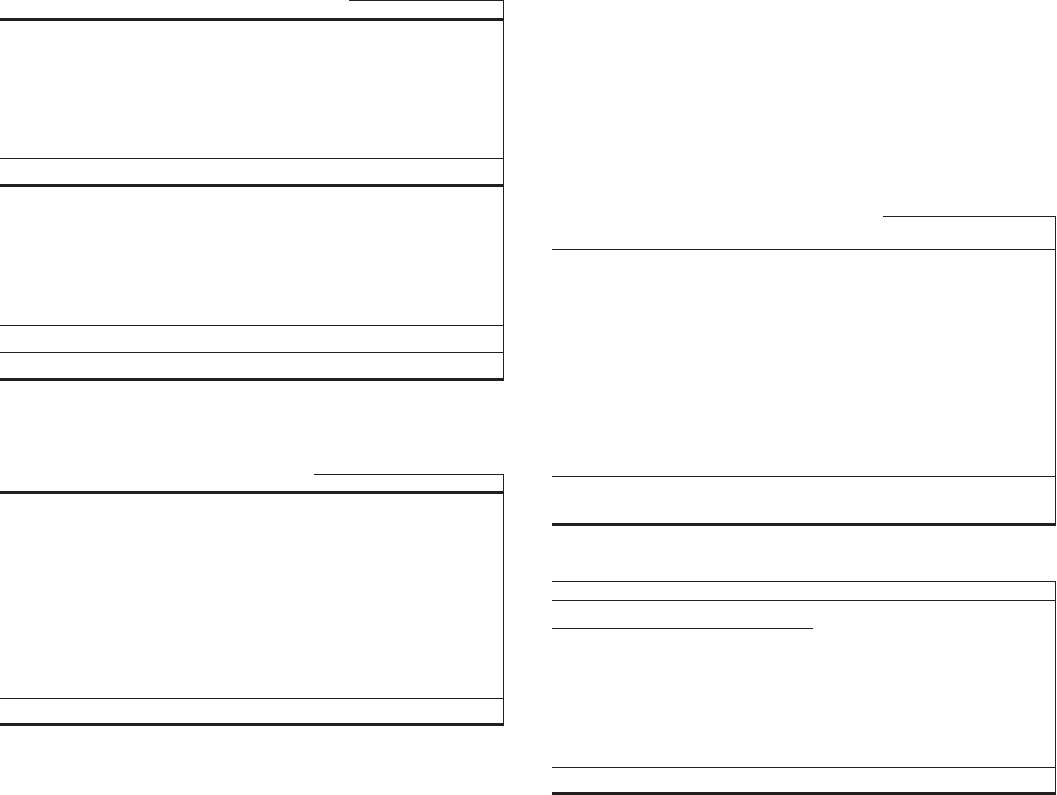

Changes in Unrecognized Tax Benefits

(in millions): 2008 2007

Balance of gross unrecognized tax benefits

at January 1 $57 $49

Increases:

Positions taken during a prior period 203(a) 52(b)

Positions taken during the current period 1

Decreases:

Positions taken during a prior period (3) (2)

Settlements with taxing authorities (39)

Reductions resulting from lapse of statute

of limitations (4)

Balance of gross unrecognized tax benefits at

December 31 $257 $ 57

(a) Includes $202 million acquired from National City.

(b) Includes $42 million acquired from Mercantile.

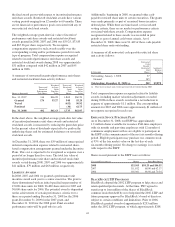

December 31, 2008 - in millions

Unrecognized tax benefits related to:

Acquired companies within measurement period:

Temporary differences $39

Permanent differences 163

Other:

Temporary differences 12

Permanent differences 43

Total $257

Under SFAS 141(R) which became effective January 1, 2009,

any changes after the measurement period (a maximum of

twelve months from date of acquisition) to unrecognized tax

benefits of acquired companies associated with permanent

differences would result in an adjustment to income tax

expense. If all the unrecognized tax benefits were recognized

after the measurement period, $133 million would affect the

effective tax rate. Certain changes within the measurement

period would result in a purchase accounting adjustment

associated with the particular acquisition.

Any changes in the amounts of unrecognized tax benefits

related to temporary differences would result in a

reclassification to deferred tax liability; any changes in the

amounts of unrecognized tax benefits related to other

permanent differences (per above table) would result in an

adjustment to income tax expense and therefore our effective

tax rate. The unrecognized tax benefits related to other

permanent items above that if recognized would affect the

effective tax rate is $30 million. This is less than the total

139