PNC Bank 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

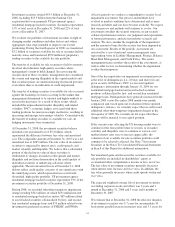

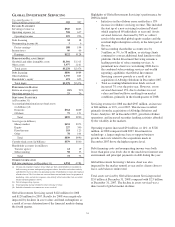

non-conforming (i.e., original balances in excess of the

amount qualifying for agency securities) and predominately

have interest rates that are fixed for a period of time, after

which the rate adjusts to a floating rate based upon a

contractual spread that is indexed to a market rate (i.e., a

“hybrid ARM”).

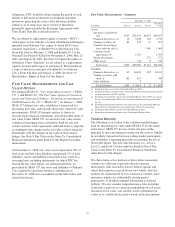

Substantially all of the securities are senior tranches in the

subordination structure and have credit protection in the form

of credit enhancement, over-collateralization and/or excess

spread accounts. At December 31, 2008, $419 million, or 6%,

of private-issuer securities were rated below “BBB” by at least

one national rating agency or not rated.

For eight securities, we recorded other-than-temporary

impairment charges of $151 million in 2008.

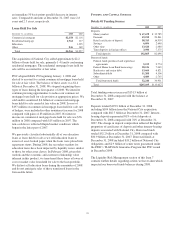

Commercial Mortgage-Backed Securities

The commercial mortgage-backed securities portfolio was

$3.4 billion fair value at December 31, 2008 (all classified as

available for sale), and consisted of fixed-rate, private-issuer

securities collateralized by non-residential properties,

primarily retail properties, office buildings, and multi-family

housing. Substantially all of the securities are the most senior

tranches in the subordination structure.

At December 31, 2008, $18 million, or 1%, of the commercial

mortgage-backed securities were not rated.

We recorded no other-than-temporary impairment charges on

commercial mortgage-backed securities in 2008.

Other Asset-Backed Securities

The asset-backed securities portfolio was $1.5 billion fair

value at December 31, 2008 (all classified as available for

sale), and consisted of fixed-rate and floating-rate, private-

issuer securities collateralized primarily by various consumer

credit products, including first-lien residential mortgage loans,

credit cards, and automobile loans. Substantially all of the

securities are senior tranches in the subordination structure

and have credit protection in the form of credit enhancement,

over-collateralization and/or excess spread accounts.

At December 31, 2008, $184 million, or 12%, of the asset-

backed securities were rated below “BBB” by at least one

national rating agency or not rated.

For seven asset-backed securities, we recorded other-than-

temporary impairment charges totaling approximately $87

million in 2008.

Financial Derivatives

Exchange-traded derivatives are valued using quoted market

prices and are classified as Level 1. However, the majority of

derivatives that we enter into are executed over-the-counter

and are valued using internal techniques. Readily observable

market inputs to these models can be validated to external

sources, including industry pricing services, or corroborated

through recent trades, dealer quotes, yield curves, implied

volatility or other market related data. Certain derivatives,

such as total rate of return swaps, are corroborated to the

CMBX index. These derivatives are classified as Level 2.

Derivatives priced using significant management judgment or

assumptions are classified as Level 3. The fair values of our

derivatives are adjusted for nonperformance risk including

credit risk as appropriate. Our nonperformance risk

adjustment is computed using internal assumptions based

primarily on historical default and recovery observations. The

credit risk adjustment is not currently material to the overall

derivatives valuation.

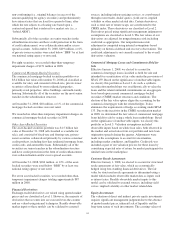

Commercial Mortgage Loans and Commitments Held for

Sale

Effective January 1, 2008, we elected to account for

commercial mortgage loans classified as held for sale and

intended for securitization at fair value under the provisions of

SFAS 159. Based on the significance of unobservable inputs,

we classify this portfolio as Level 3. As such, a synthetic

securitization methodology was used historically to value the

loans and the related unfunded commitments on an aggregate

basis based upon current commercial mortgage-backed

securities (CMBS) market structures and conditions. The

election of the fair value option aligns the accounting for the

commercial mortgages with the related hedges. It also

eliminates the requirements of hedge accounting under SFAS

133. Due to the inactivity in the CMBS securitization market

in 2008, we determined the fair value of commercial mortgage

loans held for sale by using a whole loan methodology. Based

on the significance of unobservable inputs, we classify this

portfolio as Level 3. Valuation assumptions included

observable inputs based on whole loan sales, both observed in

the market and actual sales from our portfolio and new loan

origination spreads during the quarter. Adjustments were

made to the assumptions to account for uncertainties,

including market conditions, and liquidity. Credit risk was

included as part of our valuation process for these loans by

considering expected rates of return for market participants for

similar loans in the marketplace.

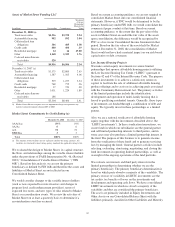

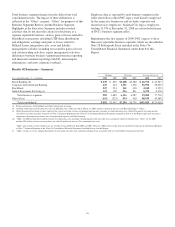

Customer Resale Agreements

Effective January 1, 2008, we elected to account for structured

resale agreements at fair value, which are economically

hedged using free-standing financial derivatives. The fair

value for structured resale agreements is determined using a

model which includes observable market data as inputs such

as interest rates. Readily observable market inputs to this

model can be validated to external sources, including yield

curves, implied volatility or other market related data.

Equity Investments

The valuation of direct and indirect private equity investments

requires significant management judgment due to the absence

of quoted market prices, inherent lack of liquidity and the

long-term nature of such investments. The carrying values of

44