PNC Bank 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We approve counterparty credit lines for all of our trading

activities, including CDSs. Counterparty credit lines are

approved based on a review of credit quality in accordance

with our traditional credit quality standards and credit policies.

The credit risk of our counterparties is monitored in the

normal course of business. In addition, all counterparty credit

lines are subject to collateral thresholds and exposures above

these thresholds are secured.

Credit default swaps are included in the Free-Standing

Derivatives table in the Financial Derivatives section of this

Risk Management discussion. Net gains from credit default

swaps for proprietary trading positions, reflected in other

noninterest income in our Consolidated Income Statement,

totaled $45 million for 2008 and $38 million for 2007.

O

PERATIONAL

R

ISK

M

ANAGEMENT

Operational risk is defined as the risk of financial loss or other

damage to us resulting from inadequate or failed internal

processes or systems, human factors, or from external events.

Operational risk may occur in any of our business activities

and manifests itself in various ways, including but not limited

to the following:

• Errors related to transaction processing and systems,

• Breaches of the system of internal controls and

compliance requirements, and

• Business interruptions and execution of unauthorized

transactions and fraud by employees or third parties.

Operational losses may arise from legal actions due to

operating deficiencies or noncompliance with contracts, laws

or regulations.

To monitor and control operational risk, we maintain a

comprehensive framework including policies and a system of

internal controls that is designed to manage risk and to

provide management with timely and accurate information

about the operations of PNC. Management at each business

unit is primarily responsible for its operational risk

management program, given that operational risk management

is integral to direct business management and most easily

effected at the business unit level. Corporate Operational Risk

Management oversees day-to-day operational risk

management activities.

Technology Risk

The technology risk management program is a significant

component of the operational risk framework. We have an

integrated security and technology risk management

framework designed to help ensure a secure, sound, and

compliant infrastructure for information management. The

technology risk management process is aligned with the

strategic direction of the businesses and is integrated into the

technology management culture, structure and practices. The

application of this framework across the enterprise helps to

support comprehensive and reliable internal controls.

Our business resiliency program manages the organization’s

capabilities to provide services in the case of an event that

results in material disruption of business activities.

Prioritization of investments in people, processes, technology

and facilities is based on different types of events, business

risk and criticality. Comprehensive testing validates our

resiliency capabilities on an ongoing basis, and an integrated

governance model is designed to help assure transparent

management reporting.

Insurance

As a component of our risk management practices, we

purchase insurance designed to protect us against accidental

loss or losses which, in the aggregate, may significantly affect

personnel, property, financial objectives, or our ability to

continue to meet our responsibilities to our various

stakeholder groups.

PNC, through subsidiary companies, Alpine Indemnity

Limited and Advent Guaranty Corporation, provides insurance

coverage for its general liability, automobile liability,

management liability, fidelity, employment practices liability,

special crime, workers’ compensation, property and terrorism

programs. PNC’s risks associated with its participation as an

insurer for these programs are mitigated through policy limits

and annual aggregate limits. Risks in excess of Alpine and

Advent policy limits and annual aggregates are mitigated

through the purchase of direct coverage provided by various

insurers up to limits established by PNC’s Corporate

Insurance Committee.

L

IQUIDITY

R

ISK

M

ANAGEMENT

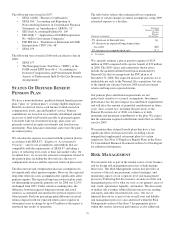

Liquidity risk is the risk of potential loss if we were unable to

meet our funding requirements at a reasonable cost. We

manage liquidity risk to help ensure that we can obtain cost-

effective funding to meet current and future obligations under

both normal “business as usual” and stressful circumstances.

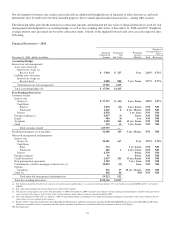

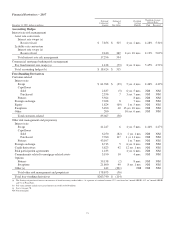

Our largest source of liquidity on a consolidated basis is the

deposit base that comes from our retail and corporate and

institutional banking activities. Other borrowed funds come

from a diverse mix of short and long-term funding sources.

Liquid assets and unused borrowing capacity from a number

of sources are also available to maintain our liquidity position.

Liquid assets consist of short-term investments (federal funds

sold, resale agreements, trading securities, interest-earning

deposits with banks, and other short-term investments) and

securities available for sale. At December 31, 2008, our liquid

assets totaled $59.6 billion, with $22.5 billion pledged as

collateral for borrowings, trust, and other commitments.

Bank Level Liquidity

PNC Bank, N.A. and National City Bank can borrow from the

Federal Reserve Bank of Cleveland’s (“Federal Reserve

Bank”) discount window to meet short-term liquidity

requirements. These borrowings are secured by securities and

63