PNC Bank 2008 Annual Report Download - page 33

Download and view the complete annual report

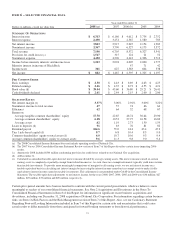

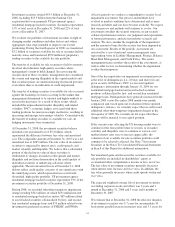

Please find page 33 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment assets at December 31, 2008, compared with $990

billion and $500 billion, respectively, at December 31, 2007.

The decrease in assets serviced was due to declines in asset

values and fund outflows resulting primarily from market

conditions in the second half of 2008.

Asset management fees totaled $686 million in 2008, a

decline of $98 million compared with 2007. The effect on fees

of lower equity earnings from BlackRock, a $12 billion

decrease in assets managed due to equity values related to

wealth management, and the Hilliard Lyons divestiture were

reflected in the decline compared with 2007. Excluding $53

billion of assets acquired on December 31, 2008 resulting

from our acquisition of National City, assets managed at

December 31, 2008 totaled $57 billion compared with $74

billion at December 31, 2007. The Hilliard Lyons sale and the

impact of comparatively lower equity markets in 2008 drove

the decline in assets managed. The Retail Banking section of

the Business Segments Review section of this Item 7 includes

further discussion of assets under management.

Consumer services fees declined $69 million, to $623 million,

for 2008 compared with 2007. The sale of Hilliard Lyons

more than offset the benefits of increased volume-related fees,

including debit card, credit card, bank brokerage and merchant

revenues.

Corporate services revenue totaled $704 million in 2008

compared with $713 million in 2007. Higher revenue from

treasury management and other fees were more than offset by

lower merger and acquisition advisory fees and commercial

mortgage servicing fees, net of amortization.

Service charges on deposits grew $24 million, to $372 million,

in 2008 compared with 2007. The impact of our expansion

into new markets contributed to the increase during 2008.

Net securities losses totaled $206 million in 2008 compared

with net securities losses of $5 million in 2007. Losses for

2008 included other-than-temporary impairment charges of

$312 million, including $74 million on our investment in

preferred stock of FHLMC and FNMA that were partially

offset by securities gains.

Other noninterest income totaled $284 million for 2008

compared with $423 million for 2007. Other noninterest

income for 2008 included gains of $246 million related to our

BlackRock LTIP shares adjustment, the $114 million gain

from the sale of Hilliard Lyons, the $95 million gain from the

redemption of a portion of our investment in Visa related to its

March 2008 initial public offering, and the $61 million

reversal of a legal contingency reserve referred to above. The

impact of these items was partially offset by losses related to

our commercial mortgage loans held for sale of $197 million,

net of hedges, trading losses of $55 million and equity

management losses of $24 million.

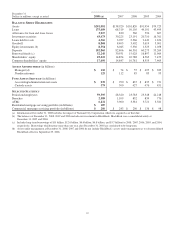

Other noninterest income for 2007 included a net loss related

to our BlackRock investment of $127 million (the net of the

two items described within the Summary section above),

trading income of $104 million, equity management gains of

$102 million and gains related to our commercial mortgage

loans held for sale, net of hedges, of $3 million.

See the BlackRock portion of the Business Segments Review

section of Item 7 of this Report for further information

regarding LTIP. Additional information regarding our

transactions related to Visa is included in Note 25

Commitments And Guarantees in the Notes To Consolidated

Financial Statements included in Item 8 of this Report. Further

details regarding our trading activities are included in the

Market Risk Management – Trading Risk portion of the Risk

Management section of this Item 7 and information regarding

equity management are included in the Market Risk

Management-Equity and Other Investment Risk section.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed.

We expect noninterest income in 2009 to reflect customer

growth, offset by softening consumer fees and by ongoing

volatility of the more market-related categories.

P

RODUCT

R

EVENUE

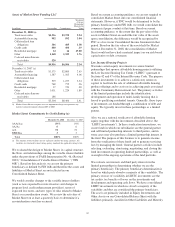

In addition to credit and deposit products for commercial

customers, Corporate & Institutional Banking offers other

services, including treasury management and capital markets-

related products and services and commercial mortgage loan

servicing, that are marketed by several businesses to

commercial and retail customers across PNC.

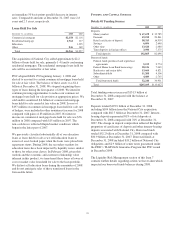

Treasury management revenue, which includes fees as well as

net interest income from customer deposit balances, increased

14% to $545 million in 2008 compared with $476 million in

2007. The increase was primarily related to the impact of our

expansion into new markets and strong growth in commercial

payment card services and in cash and liquidity management

products.

Revenue from capital markets-related products and services

totaled $336 million in 2008 compared with $290 million in

2007. This increase was primarily driven by strong customer

interest rate derivative and foreign exchange activity partially

offset by a decline in merger and acquisition advisory fees.

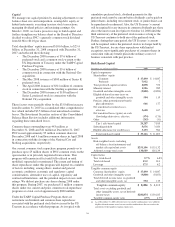

Commercial mortgage banking activities include revenue

derived from loan originations, commercial mortgage

servicing (including net interest income and noninterest

income from loan servicing and ancillary services), gains from

loan sales, valuation adjustments, net interest income on loans

held for sale, and related commitments and hedges.

29