PNC Bank 2008 Annual Report Download - page 107

Download and view the complete annual report

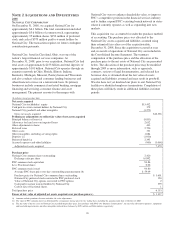

Please find page 107 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Balance Sheet. In addition, we increase our

recognized investments and recognize a liability for all legally

binding unfunded equity commitments. These liabilities are

reflected in Other Liabilities on our Consolidated Balance

Sheet.

C

REDIT

R

ISK

T

RANSFER

T

RANSACTION

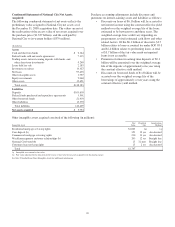

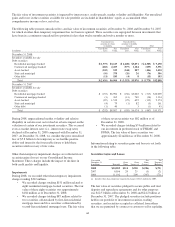

National City Bank (“NCB”) sponsored a special purpose

entity (“SPE”) trust and concurrently entered into a credit risk

transfer agreement with an independent third party to mitigate

credit losses on a pool of nonconforming mortgage loans

originated by its former First Franklin business unit. The SPE

was formed with a small contribution from NCB and was

structured as a bankruptcy-remote entity so that its creditors

have no recourse to NCB. In exchange for a perfected security

interest in the cash flows of the nonconforming mortgage

loans, the SPE issued to NCB asset-backed securities in the

form of senior, mezzanine, and subordinated equity notes.

NCB has incurred credit losses equal to the subordinated

equity notes. NCB currently holds the right to put the

mezzanine notes to the independent third-party at par. As of

December 31, 2008, the value of the mezzanine notes was

$169 million. NCB holds the senior notes and will be

responsible for credit losses in excess of this amount.

The SPE was deemed to be a VIE as its equity was not

sufficient to finance its activities. NCB was determined to be

the primary beneficiary of the SPE as it would absorb the

majority of the expected losses of the SPE through its holding

of all of the asset-backed securities. Accordingly, this SPE

was consolidated and all of the entity’s assets, liabilities, and

equity are intercompany balances and are eliminated in

consolidation. Nonconforming mortgage loans, including

foreclosed properties, pledged as collateral to the SPE remain

on the balance sheet and totaled $719 million at December 31,

2008 reflecting the impact of fair value adjustments recorded

by PNC in conjunction with the acquisition.

P

ERPETUAL

T

RUST

S

ECURITIES

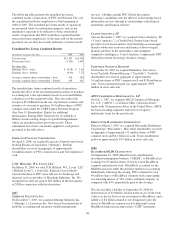

We issue certain hybrid capital vehicles that qualify as capital

for regulatory purposes.

In February 2008, PNC Preferred Funding LLC (the “LLC”),

one of our indirect subsidiaries, sold $375 million of 8.700%

Fixed-to-Floating Rate Non-Cumulative Exchangeable

Perpetual Trust Securities of PNC Preferred Funding Trust III

(“Trust III”) to third parties in a private placement. In

connection with the private placement, Trust III acquired $375

million of Fixed-to-Floating Rate Non-Cumulative Perpetual

Preferred Securities of the LLC (the “LLC Preferred

Securities”). The sale was similar to the March 2007 private

placement by the LLC of $500 million of 6.113%

Fixed-to-Floating Rate Non-Cumulative Exchangeable Trust

Securities (the “Trust II Securities”) of PNC Preferred

Funding Trust II (“Trust II”) in which Trust II acquired $500

million of LLC Preferred Securities and to the December 2006

private placement by PNC REIT Corp. of $500 million of

6.517% Fixed-to-Floating Rate Non-Cumulative

Exchangeable Perpetual Trust Securities (the “Trust I

Securities”) of PNC Preferred Funding Trust I (“Trust I”) in

which Trust I acquired $500 million of LLC Preferred

Securities. PNC REIT Corp. owns 100% of LLC’s common

voting securities. As a result, LLC is an indirect subsidiary of

PNC and is consolidated on our Consolidated Balance Sheet.

Trust I, II and III’s investment in LLC Preferred Securities is

characterized as a minority interest on our Consolidated

Balance Sheet since we are not the primary beneficiary of

Trust I, Trust II and Trust III. This minority interest totaled

approximately $1.3 billion at December 31, 2008.

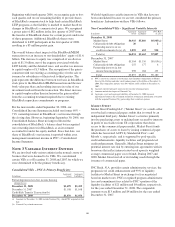

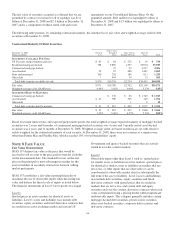

PNC has contractually committed to Trust II and Trust III that

if full dividends are not paid in a dividend period on the Trust

II Securities or the Trust III Securities, as applicable, or the

LLC Preferred Securities held by Trust II or Trust III, as

applicable, PNC will not declare or pay dividends with respect

to, or redeem, purchase or acquire, any of its equity capital

securities during the next succeeding dividend period, other

than: (i) purchases, redemptions or other acquisitions of shares

of capital stock of PNC in connection with any employment

contract, benefit plan or other similar arrangement with or for

the benefit of employees, officers, directors or consultants,

(ii) purchases of shares of common stock of PNC pursuant to a

contractually binding requirement to buy stock existing prior

to the commencement of the extension period, including under

a contractually binding stock repurchase plan, (iii) any

dividend in connection with the implementation of a

shareholders’ rights plan, or the redemption or repurchase of

any rights under any such plan, (iv) as a result of an exchange

or conversion of any class or series of PNC’s capital stock for

any other class or series of PNC’s capital stock, (v) the

purchase of fractional interests in shares of PNC capital stock

pursuant to the conversion or exchange provisions of such

stock or the security being converted or exchanged or (vi) any

stock dividends paid by PNC where the dividend stock is the

same stock as that on which the dividend is being paid.

PNC Bank, N.A. has contractually committed to Trust I that if

full dividends are not paid in a dividend period on the Trust I

Securities, LLC Preferred Securities or any other parity equity

securities issued by the LLC, neither PNC Bank, N.A. nor its

subsidiaries will declare or pay dividends or other

distributions with respect to, or redeem, purchase or acquire or

make a liquidation payment with respect to, any of its equity

capital securities during the next succeeding period (other than

to holders of the LLC Preferred Securities and any parity

equity securities issued by the LLC) except: (i) in the case of

dividends payable to subsidiaries of PNC Bank, N.A., to PNC

Bank, N.A. or another wholly-owned subsidiary of PNC Bank,

N.A. or (ii) in the case of dividends payable to persons that are

not subsidiaries of PNC Bank, N.A., to such persons only if,

(A) in the case of a cash dividend, PNC has first irrevocably

committed to contribute amounts at least equal to such cash

dividend or (B) in the case of in-kind dividends payable by

103