PNC Bank 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

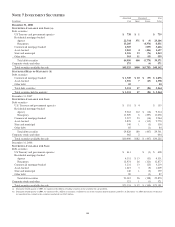

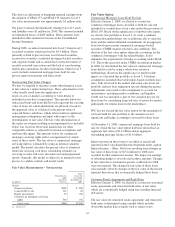

Readily observable market inputs to this model can be

validated to external sources, including yield curves, implied

volatility or other market related data. Changes in fair value

due to instrument-specific credit risk for 2008 were not

material. At December 31, 2008, structured resale agreements

with an aggregate fair value of $1.1 billion were included in

federal funds sold and resale agreements on our Consolidated

Balance Sheet. The aggregate outstanding principal balance

was $980 million. Interest income on structured resale

agreements is reported in the Consolidated Income Statement

in the caption Interest Income – Other.

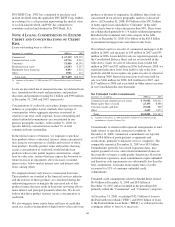

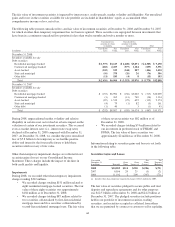

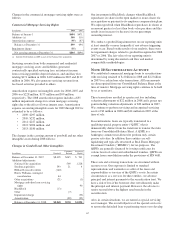

The following table summarizes the financial instruments for

which we elected the fair value option effective January 1,

2008 and the related cumulative-effect adjustment to retained

earnings.

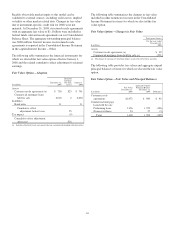

Fair Value Option – Adoption

In millions

December 31,

2007

Retained

Earnings

Net Gain

(Loss)

January 1,

2008

Assets

Customer resale agreements (a) $ 738 $23 $ 761

Commercial mortgage loans

held for sale 2,018 2 2,020

Liabilities

Bank notes 11 11

Cumulative–effect

adjustment, before taxes 25

Tax impact (9)

Cumulative-effect adjustment,

after taxes $16

(a) Includes structured resale agreements that are economically hedged with derivatives.

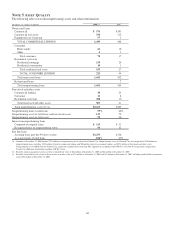

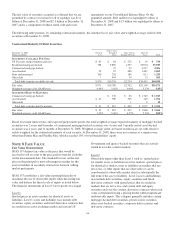

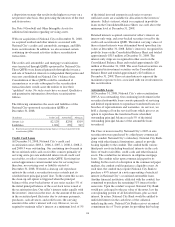

The following table summarizes the changes in fair value

included in other noninterest income in the Consolidated

Income Statement for items for which we elected the fair

value option.

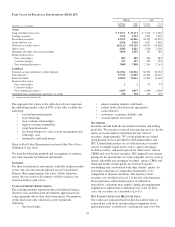

Fair Value Option – Changes in Fair Value

Total gains (losses)

In millions

For the year ended

December 31,

2008

Assets

Customer resale agreements (a) $ 69

Commercial mortgage loans held for sale (a) (251)

(a) The impact on earnings of offsetting hedges is not reflected in these amounts.

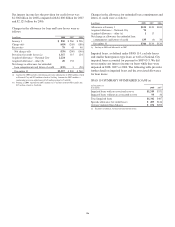

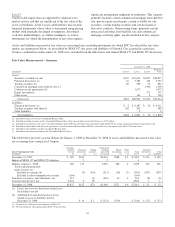

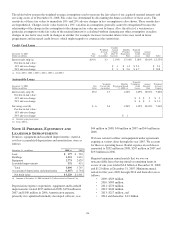

The following table provides fair values and aggregate unpaid

principal balances of items for which we elected the fair value

option.

Fair Value Option – Fair Value and Principal Balances

In millions

Fair Value

December 31,

2008

Aggregate Unpaid

Principal Balance

December 31,

2008 Difference

Customer resale

agreements $1,072 $ 980 $ 92

Commercial mortgage

loans held for sale

Performing loans 1,376 1,572 (196)

Nonaccrual loans 24 27 (3)

Total 1,400 1,599 (199)

113