PNC Bank 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Included in total loans at December 31, 2008 were $27.2

billion of distressed loans. These loans include residential real

estate development loans, cross-border leases, subprime

residential mortgage loans, brokered home equity loans and

certain other residential real estate loans. These loans require

special servicing and management oversight given current

market conditions or, in the case of cross-border leases, are

tax and yield challenged. The majority of the distressed loans

were from acquisitions, including $24.6 billion from National

City. An allowance for loan and lease losses of $927 million

was allocated to the distressed loans at December 31, 2008. A

total of $537 million of the distressed loans were classified as

nonperforming at that date. Details of distressed loans follow:

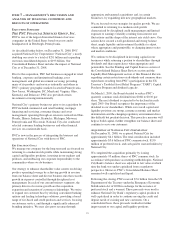

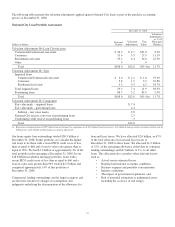

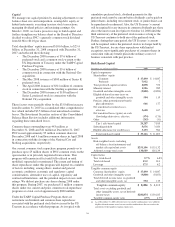

Details of Distressed Loan Portfolio

In millions Dec. 31, 2008

Commercial $28

Commercial real estate

Real estate projects 2,847

Commercial mortgage 510

Total commercial real estate 3,357

Equipment lease financing 858

TOTAL COMMERCIAL LENDING 4,243

Consumer

Home equity

Lines of credit 5,474

Installment 2,877

Total home equity 8,351

Residential real estate

Residential mortgage 10,198

Residential construction 2,603

Total residential real estate 12,801

TOTAL CONSUMER LENDING 21,152

Other 1,761

Total (a) $27,156

(a) Includes impaired loans attributable to National City totaling $10.3 billion, net of

valuation adjustments. The pre-adjusted principal balance was $15.3 billion and

represented the majority of the total $19.3 billion principal balance of total impaired

loans included in the National City Loan Portfolio Assessment table on page 32.

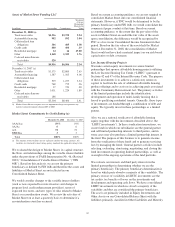

Net unfunded credit commitments are comprised of the

following:

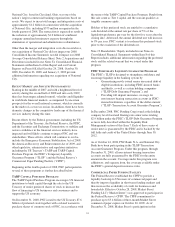

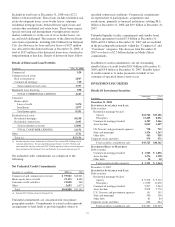

Net Unfunded Credit Commitments

December 31 - in millions 2008 (a) 2007

Commercial and commercial real estate $ 59,982 $42,021

Home equity lines of credit 23,195 8,680

Consumer credit card lines 19,028 969

Other 2,683 1,677

Total $104,888 $53,347

(a) Includes $53.9 billion related to National City.

Unfunded commitments are concentrated in our primary

geographic markets. Commitments to extend credit represent

arrangements to lend funds or provide liquidity subject to

specified contractual conditions. Commercial commitments

are reported net of participations, assignments and

syndications, primarily to financial institutions, totaling $8.6

billion at December 31, 2008 and $8.9 billion at December 31,

2007.

Unfunded liquidity facility commitments and standby bond

purchase agreements totaled $7.0 billion at December 31,

2008 and $9.4 billion at December 31, 2007 and are included

in the preceding table primarily within the “Commercial” and

“Consumer” categories. The decrease from December 31,

2007 was due to a $2.5 billion decline in Market Street

commitments.

In addition to credit commitments, our net outstanding

standby letters of credit totaled $10.3 billion at December 31,

2008 and $4.8 billion at December 31, 2007. Standby letters

of credit commit us to make payments on behalf of our

customers if specified future events occur.

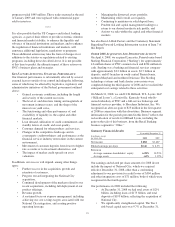

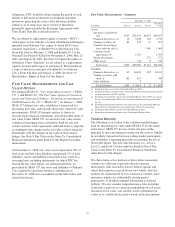

INVESTMENT SECURITIES

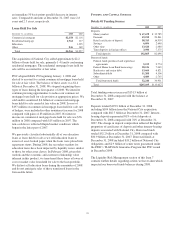

Details Of Investment Securities

In millions

Amortized

Cost

Fair

Value

December 31, 2008

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

Residential mortgage-backed

Agency $22,744 $23,106

Nonagency 13,205 8,831

Commercial mortgage-backed 4,305 3,446

Asset-backed 2,069 1,627

US Treasury and government agencies 738 739

State and municipal 1,326 1,263

Other debt 563 559

Corporate stocks and other 575 571

Total securities available for sale $45,525 $40,142

S

ECURITIES

H

ELD TO

M

ATURITY

Debt securities

Commercial mortgage-backed $ 1,945 $ 1,896

Asset-backed 1,376 1,358

Other debt 10 10

Total securities held to maturity $ 3,331 $ 3,264

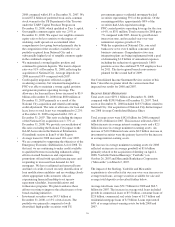

December 31, 2007

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

Residential mortgage-backed

Agency $ 9,218 $ 9,314

Nonagency 11,929 11,638

Commercial mortgage-backed 5,227 5,264

Asset-backed 2,878 2,770

U.S. Treasury and government agencies 151 155

State and municipal 340 336

Other debt 85 84

Corporate stocks and other 662 664

Total securities available for sale $30,490 $30,225

33