PNC Bank 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

6

ACCOUNTING FOR

C

ERTAIN

L

OANS

A

CQUIRED IN A

T

RANSFER

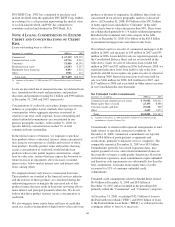

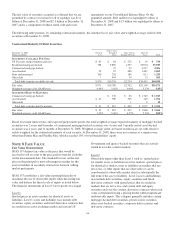

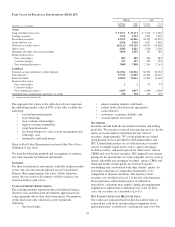

Loans acquired with evidence of credit quality deterioration

since origination and for which it is probable at purchase that

PNC will be unable to collect all contractually required

payments are accounted for under SOP 03-3. Evidence of

credit quality deterioration as of the purchase date includes

statistics such as past due status, current borrower FICO credit

scores, geographic concentration and current loan-to-value

(LTV), some of which are not immediately available as of the

purchase date. We will continue to evaluate this information

and other credit related information as it becomes available.

SOP 03-3 addresses accounting for differences between

contractual cash flows and cash flows expected to be collected

from our initial investment in loans if those differences are

attributable, at least in part, to credit quality. SOP 03-3

requires acquired impaired loans to be recorded at fair value

and prohibits “carrying over” or the creation of valuation

allowances in the initial accounting for loans acquired in a

transfer that are within the scope of this SOP. A total of $2.6

billion of National City allowance for loan losses was not

carried over in purchase accounting. Excluded from the scope

were leases, revolving credit arrangements and certain loans

held for sale.

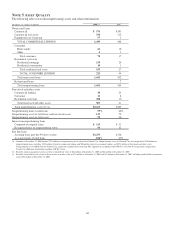

The fair values for loans within the scope of SOP 03-3 are

determined by discounting both principal and interest cash

flows expected to be collected using an observable discount

rate for similar instruments with adjustments that management

believes a market participant would consider in determining

fair value. We estimate the cash flows expected to be collected

at acquisition using internal and third party models that

incorporate management’s best estimate of current key

assumptions, such as default rates, loss severity and payment

speeds.

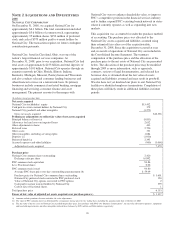

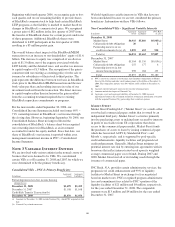

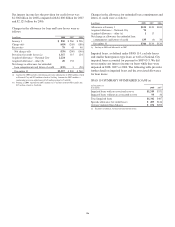

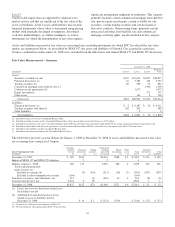

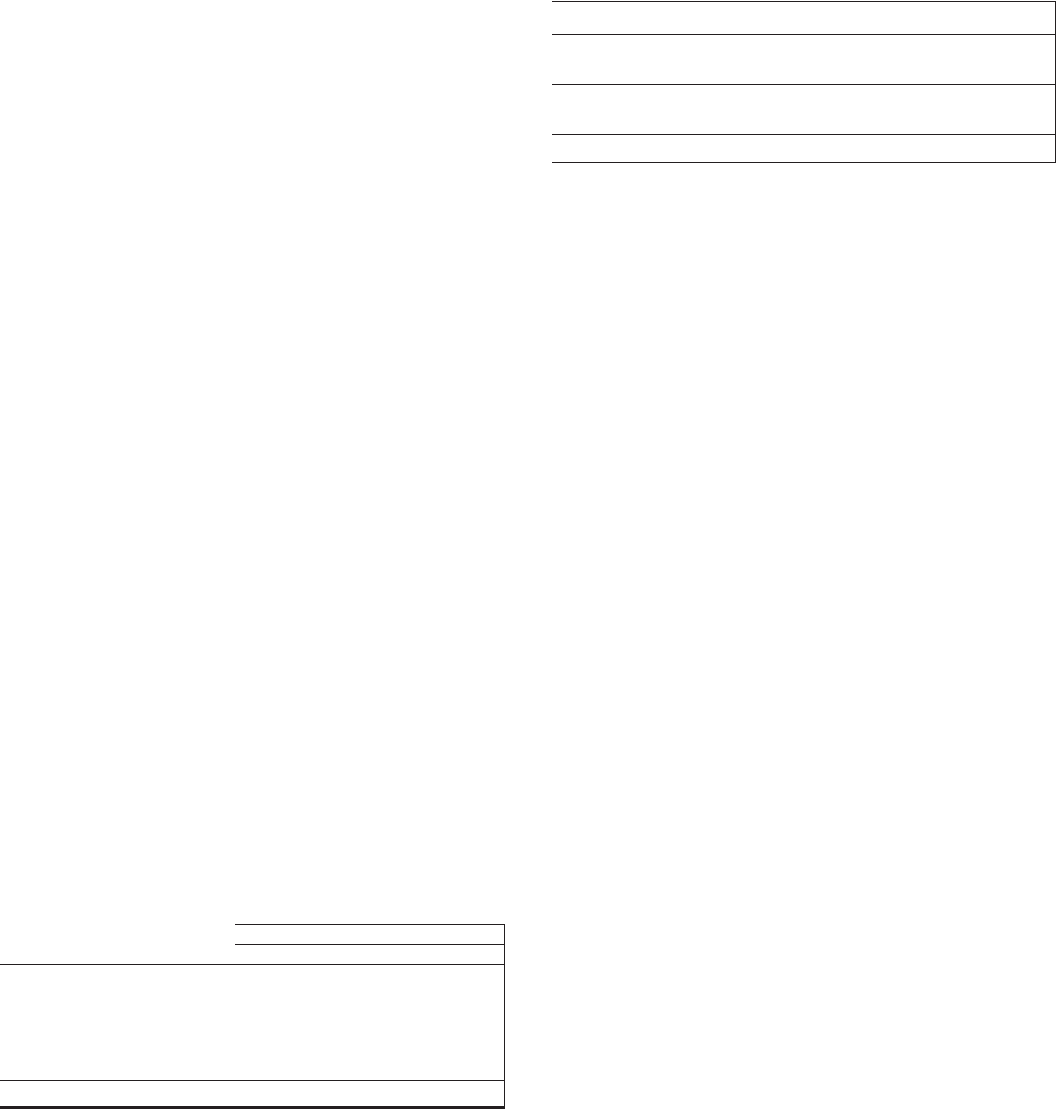

As of December 31, 2008, acquired loans within the scope of

SOP 03-3 had a carrying value of $11.9 billion and an unpaid

principal balance of $19.3 billion as detailed below:

December 31, 2008

In millions Carrying Value Outstanding Balance

Commercial $ 493 $ 1,180

Commercial real estate 1,340 2,831

Consumer 3,924 5,785

Residential real estate 6,154 9,482

Other 10 14

Total $11,921 $19,292

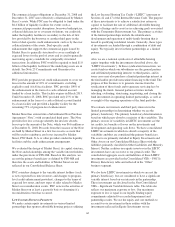

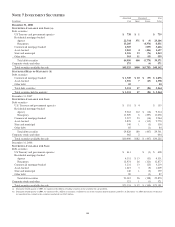

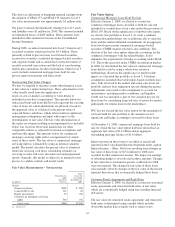

Acquired Loan Information

In millions

December 31,

2008

Contractually required payments including interest $23,845

Less: Nonaccretable difference 8,256

Cash flows expected to be collected 15,589

Less: Accretable yield 3,668

Fair value of loans acquired $11,921

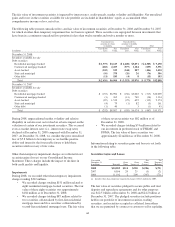

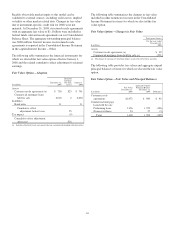

Under SOP 03-3, the excess of cash flows expected at

acquisition over the estimated fair value is referred to as the

accretable yield and is recognized in interest income over the

remaining life of the loan using the constant effective yield

method. The difference between contractually required

payments at acquisition and the cash flows expected to be

collected at acquisition is referred to as the nonaccretable

difference. Changes in the expected cash flows from the date

of acquisition will either impact the accretable yield or result

in a charge to the provision for credit losses in the period in

which the changes become probable. Subsequent decreases to

the expected cash flows will generally result in a charge to the

provision for credit losses resulting in an increase to the

allowance for loan and lease losses, and a reclassification

from accretable yield to nonaccretable difference. Subsequent

increases in cash flows will result in a recovery of any

previously recorded allowance for loan and lease losses, to the

extent applicable, and a reclassification from nonaccretable

difference to accretable yield. There was no allowance for

loan and lease losses related to loans acquired within the

scope of SOP 03-3 as of December 31, 2008. Disposals of

loans, which may include sales of loans, receipt of payments

in full by the borrower, foreclosure, or troubled debt

restructurings result in removal of the loan from the SOP 03-3

portfolio at its carrying amount.

There were no changes in the accretable yield of loans during

2008 as the majority of SOP 03-3 loans were acquired in

connection with the National City acquisition as of

December 31, 2008.

107