PNC Bank 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

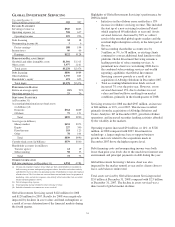

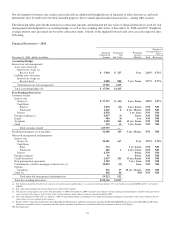

aggregate of the allowance for loan and lease losses and

allowance for unfunded loan commitments and letters of

credit would increase by $128 million. Additionally, other

factors such as the rate of migration in the severity of problem

loans will contribute to the final pool reserve allocations.

We make consumer (including residential mortgage) loan

allocations at a total portfolio level by consumer product line

based on historical loss experience. We compute a four-

quarter average loss rate from net charge-offs for the prior

four quarters as a percentage of the average loans outstanding

in those quarters. We apply this loss rate to loans outstanding

at the end of the current period and make certain qualitative

adjustments to determine the consumer loan allocation.

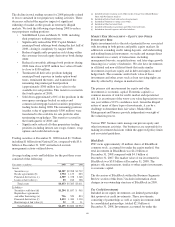

The provision for credit losses totaled $1.517 billion for 2008

compared with $315 million for 2007. Of the total 2008

provision, $990 million was recorded in the fourth quarter,

including $504 million of additional provision recorded at

December 31, 2008 to conform the National City loan

reserving methodology with ours. The differences in

methodology include granularity of loss computations,

statistical and quantitative factors rather than qualitative

assessment, and the extent of current appraisals and risk

assessments.

In addition to the impact of National City, the higher provision

in 2008 compared with the prior year was driven by general

credit quality migration, including residential real estate

development and commercial real estate exposure, an increase

in net charge-offs, and growth in nonperforming loans.

Growth in our total credit exposure also contributed to the

higher provision amounts in both comparisons.

In addition, the provision for credit losses for 2008 and the

evaluation of the allowances for loan and lease losses and

unfunded loan commitments and letters of credit as of

December 31, 2008 reflected loan and total credit exposure

growth, changes in loan portfolio composition, and other

changes in asset quality. The provision includes amounts for

probable losses on loans and credit exposure related to

unfunded loan commitments and letters of credit.

With a deteriorating economy, we expect credit migration will

continue throughout 2009 as credit quality improvements will

lag any economic turnaround.

The allowance as a percent of nonperforming loans was 236%

and as a percent of total loans was 2.23% at December 31,

2008. These percentages excluding the impact of the National

City acquisition were 95% and 1.77%, respectively. We

provide a reconciliation of these percentages excluding the

National City impact to the GAAP-basis percentages in the

Statistical Information (Unaudited) section in Item 8 of this

Report. The comparable percentages at December 31, 2007

were 183% and 1.21%. We expect to continue to increase our

allowance as a percent of total loans as the market and our

credit quality migration dictates.

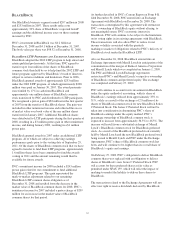

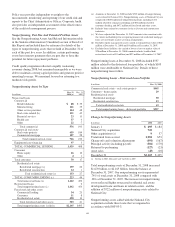

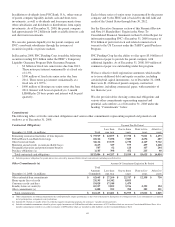

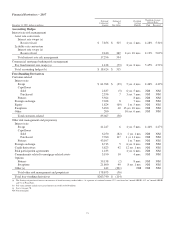

Charge-Offs And Recoveries

Year ended December 31

Dollars in millions Charge-offs Recoveries

Net

Charge-offs

Percent of

Average

Loans

2008

Commercial $301 $53 $248 .80%

Commercial real

estate 165 10 155 1.65

Equipment lease

financing 3 1 2 .08

Consumer 143 15 128 .62

Residential real

estate 6 6 .07

Total $ 618 $ 79 $ 539 .74

2007

Commercial $156 $30 $126 .49%

Commercial real

estate 16 1 15 .20

Consumer 73 14 59 .33

Total $ 245 $ 45 $ 200 .32

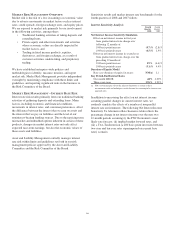

We establish reserves to provide coverage for probable losses

not considered in the specific, pool and consumer reserve

methodologies, such as, but not limited to, the following:

• industry concentrations and conditions,

• credit quality trends,

• recent loss experience in particular sectors of the

portfolio,

• ability and depth of lending management,

• changes in risk selection and underwriting standards,

and

• timing of available information.

The amount of reserves for these qualitative factors is

assigned to loan categories and to business segments primarily

based on the relative specific and pool allocation amounts.

The amount of reserve allocated for qualitative factors

represented 1.76% of the total allowance and .04% of total

loans at December 31, 2008.

C

REDIT

D

EFAULT

S

WAPS

From a credit risk management perspective, we buy and sell

credit loss protection via the use of credit derivatives. When

we buy loss protection by purchasing a credit default swap

(“CDS”), we pay a fee to the seller, or CDS counterparty, in

return for the right to receive a payment if a specified credit

event occurs for a particular obligor or reference entity. We

purchase CDSs to mitigate the risk of economic loss on a

portion of our loan exposures.

We also sell loss protection to mitigate the net premium cost

and the impact of fair value accounting on the CDS in cases

where we buy protection to hedge the loan portfolio and for

trading purposes. These activities represent additional risk

positions rather than hedges of risk.

62