PNC Bank 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 V

ERSUS

2006

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

Summary Results

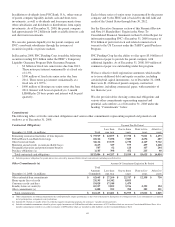

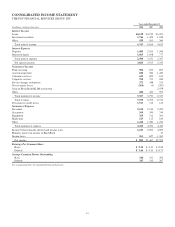

Consolidated net income for 2007 was $1.467 billion or $4.35

per diluted share and for 2006 was $2.595 billion or $8.73 per

diluted share.

Net income for 2006 included the after-tax impact of the

following items:

• The third quarter gain on the BlackRock/MLIM

transaction of $1.3 billion, or $4.36 per diluted share;

• The third quarter securities portfolio rebalancing loss

of $127 million, or $.43 per diluted share;

• BlackRock/MLIM transaction integration costs of

$47 million, or $.16 per diluted share, and

• The third quarter mortgage loan portfolio

repositioning loss of $31 million, or $.10 per diluted

share.

The aggregate impact of these items increased 2006 net

income by $1.1 billion, or $3.67 per diluted share.

Net Interest Income

Net interest income was $2.915 billion for 2007 and $2.245

billion for 2006, an increase of $670 million, or 30%. This

increase was consistent with the $20.3 billion, or 26%,

increase in average interest-earning assets during 2007

compared with 2006. The net interest margin was 3.00% in

2007 and 2.92% for 2006, an increase of 8 basis points.

Provision For Credit Losses

The provision for credit losses totaled $315 million for 2007

and $124 million for 2006. Of the total 2007 provision, $188

million was recorded in the fourth quarter, including

approximately $45 million related to our Yardville

acquisition. The higher provision in 2007 was also impacted

by an increase in our real estate portfolio, including residential

real estate development exposure, and growth in total credit

exposure. Total residential real estate development

outstandings were approximately $2.1 billion at December 31,

2007.

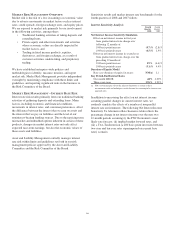

Noninterest Income

Summary

Noninterest income was $3.790 billion for 2007 and $6.327

billion for 2006. Noninterest income for 2007 included the

impact of an $83 million gain recognized in connection with

our transfer of BlackRock shares to satisfy a portion of PNC’s

LTIP obligation and a $210 million net loss representing the

mark-to-market adjustment on our LTIP obligation.

Noninterest income for 2006 included the impact of the

following items:

• The gain on the BlackRock/MLIM transaction, which

totaled $2.078 billion,

• The effects of our third quarter 2006 balance sheet

repositioning activities that resulted in charges

totaling $244 million, and

• PNC consolidated BlackRock in its results for the

first nine months of 2006 but accounted for

BlackRock on the equity method for the fourth

quarter of 2006 and all of 2007. Had our BlackRock

investment been on the equity method for all of 2006,

BlackRock’s noninterest income reported by us

would have been lower by $943 million for that year.

Apart from the impact of these items, noninterest income

increased $367 million, or 10%, in 2007 compared with 2006

largely as a result of the Mercantile acquisition and growth in

several fee income categories.

Additional analysis

Fund servicing fees declined $58 million in 2007, to $835

million, compared with $893 million in the prior year.

Amounts for 2006 included $117 million of distribution fee

revenue at Global Investment Servicing. Effective January 1,

2007, we refined our accounting and reporting of Global

Investment Servicing’s distribution fee revenue and related

expense amounts and present these amounts net on a

prospective basis. Prior to 2007, the distribution amounts were

shown on a gross basis within fund servicing fees and within

other noninterest expense and offset each other entirely with

no impact on earnings.

Apart from the impact of the distribution fee revenue included

in the 2006 amounts, fund servicing fees increased $59

million in 2007 compared with the prior year. Higher revenue

from offshore operations, transfer agency, managed accounts

and alternative investments contributed to the increase in

2007, reflecting net new business and growth from existing

clients.

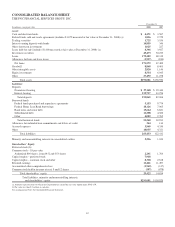

Asset management fees totaled $784 million for 2007 and

$1.420 billion for 2006. Our equity income from BlackRock

has been included in asset management fees beginning with

the fourth quarter of 2006. Asset management fees were

higher in 2006 as the first nine months of 2006 reflected the

impact of BlackRock’s revenue on a consolidated basis.

Assets managed at December 31, 2007 totaled $74 billion

compared with $54 billion at December 31, 2006. This

increase resulted primarily from the Mercantile acquisition.

Consumer services fees increased $81 million, or 13%, to

$692 million in 2007 compared with 2006. The increase

reflected the impact of Mercantile, higher brokerage fees,

higher debit card revenues resulting from higher transaction

volumes, and fees from the credit card business that began in

the latter part of 2006.

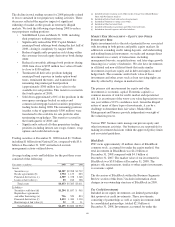

Corporate services revenue was $713 million for 2007, an

increase of $87 million, or 14%, over 2006. Higher revenue

72